6

MODERN MINING

October 2015

MINING News

London-listed gold miner Acacia, which

operates three mines in Tanzania, has

reported a lower than expected output

of approximately 164 000 ounces for the

quarter ended 30 September 2015. It

attributes this to several short-term fac-

tors negatively impacting output at the

Bulyanhulu and Buzwagi mines over the

period. The North Mara mine performed in

line with expectations.

As a result of the lower levels of pro-

duction, cash cost per ounce sold and

all-in sustaining cost per ounce sold (AISC)

for the quarter will be above US$800 per

ounce and US$1 200 per ounce respec-

tively. Acacia predicts, however, a stronger

fourth quarter performance, with produc-

tion increases at all three mines.

With the increase in fourth quarter pro-

duction, the company expects to deliver

full year production at around the level

achieved in 2014 (718 851 ounces), com-

pared to the initial guidance range of

750 000-800 000 ounces.

Commenting on the update, Brad

Gordon, CEO of Acacia, said: “I am person-

ally very disappointed in the operational

performance in the third quarter, which

saw a succession of small issues impact

Buzwagi and the ramp up at Bulyanhulu.

We have addressed each of these to ensure

they do not impact future performance.

Importantly, key underlying metrics at

Bulyanhulu, such as underground devel-

opment rates, mining widths and stope

availability are on track to sustain a step-

up in production in Q4 2015.”

At Bulyanhulu, the anticipated pro-

duction ramp up did not materialise

during the quarter, leading to production

of approximately 62 000 ounces, with run-

of-mine production of 55 000 ounces and

reclaimed tailings production of 7 000

ounces. The reduced output was primarily

due to delays in opening new high grade

long-hole stopes, which led to lower ore

tonnes mined than planned and reduced

head grade together with lower plant

recoveries. A specialist contractor has been

brought in to undertake the stope opening

Acacia production lower than expected in September quarter

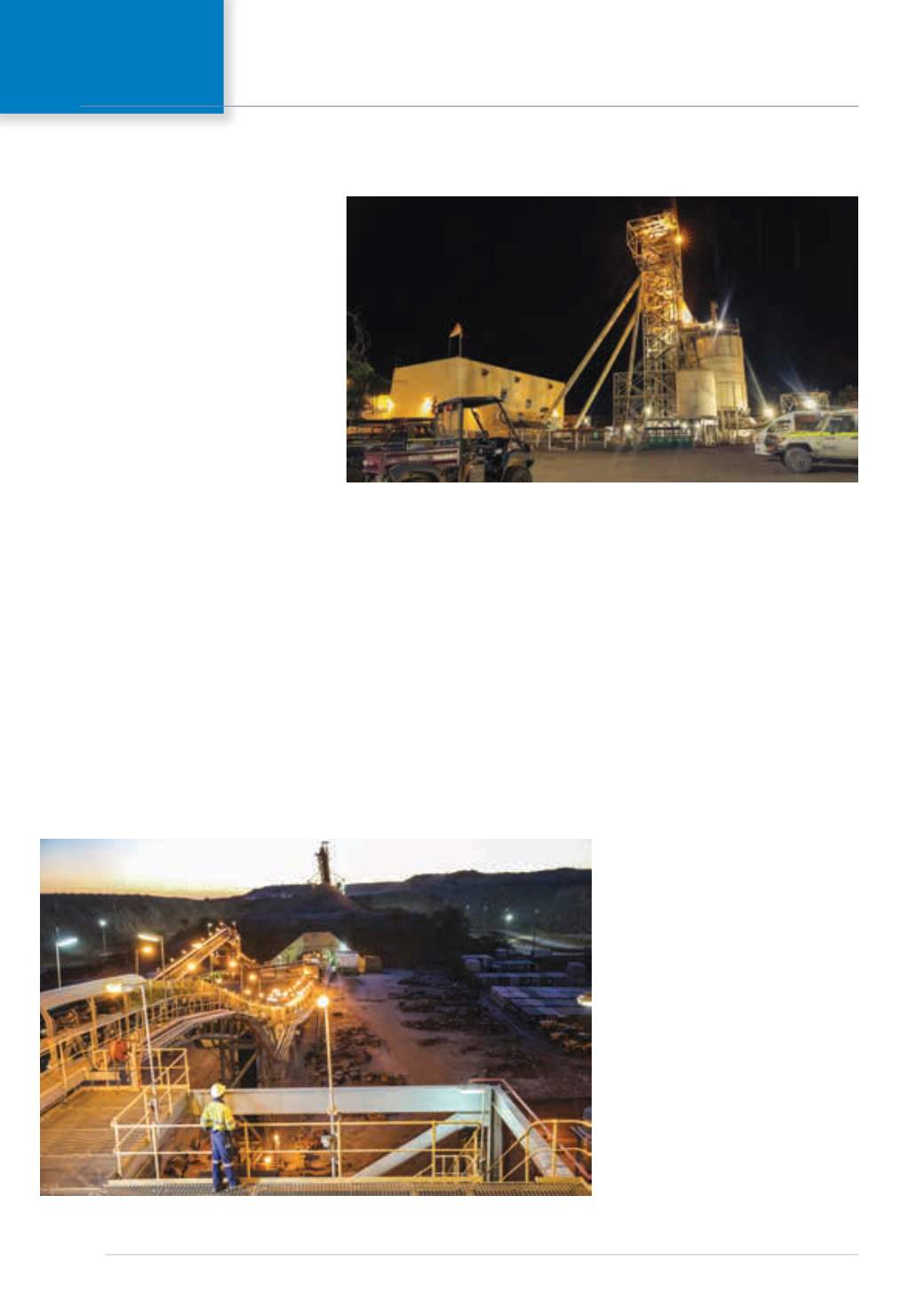

Bulyanhulu – which was commissioned in 2001 – is an underground mine with shaft access, which is

transitioning to long-hole and drift and fill as its principal mining methods (photo: Acacia).

Acacia’s Buzwagi mine is a low grade bulk deposit with a single large open pit. The process plant is designed with

a throughput capacity of 12 000 tonnes of ore per day (photo: Acacia).

process, which will ensure that sufficient

long-hole stopes are available as the mine

moves into Q4 2015.

Recoveries have been impacted by the

lower grade together with instability in the

plant caused by power interruptions and

contamination of the elution circuit, which

have both now largely been resolved.

Furthermore, in order to better manage

long term recoveries and processing costs,

the mine is looking at options to separate

the run of mine and the reclaimed tailings

streams within the CIL circuit.

At Buzwagi, production of approxi-

mately 34 000 ounces for the quarter was

impacted by the mining of lower than

planned grades together with reduced

mill throughput as a result of extended

crusher downtime in September and an

unplanned SAG mill re-line. Mining during

the quarter was primarily focused on lower

grade splay areas within the open pit;

however, negative grade reconciliations

from a higher grade zone, combined with

limited flexibility resulting from slower

than planned waste movement, led to

mining below reserve grade for the quar-

ter. The mine focused on additional waste

movement in late September which will

continue into early Q4 2015.

At North Mara, production of approxi-

mately 68 000 ounces was in line with plan.

As expected, mined grade from the under-

ground operation increased. This was due

to the proportion of stoping ore of total

underground ore production increasing

over the quarter, and Acacia expects this

trend to continue into the fourth quarter.