2

CONSTRUCTION WORLD

OCTOBER

2016

>

COMMENT

EDITOR & DEPUTY PUBLISHER

Wilhelm du Plessis

constr@crown.co.zaADVERTISING MANAGER

Erna Oosthuizen

ernao@crown.co.zaLAYOUT & DESIGN

Lesley Testa

CIRCULATION

Karen Smith

TOTAL CIRCULATION:

(Second Quarter ’16)

4 766

PUBLISHER

Karen Grant

PUBLISHED MONTHLY BY

Crown Publications cc

P O Box 140

BEDFORDVIEW, 2008

Tel: 27 11-622-4770 • Fax: 27 11-615-6108

The views expressed in this publication are not necessarily those of the editor or the publisher.

PRINTED BY

Tandym Cape

www.constructionworldmagazine.co.za www.facebook.com/construction-worldmagazinesa@ConstWorldSA

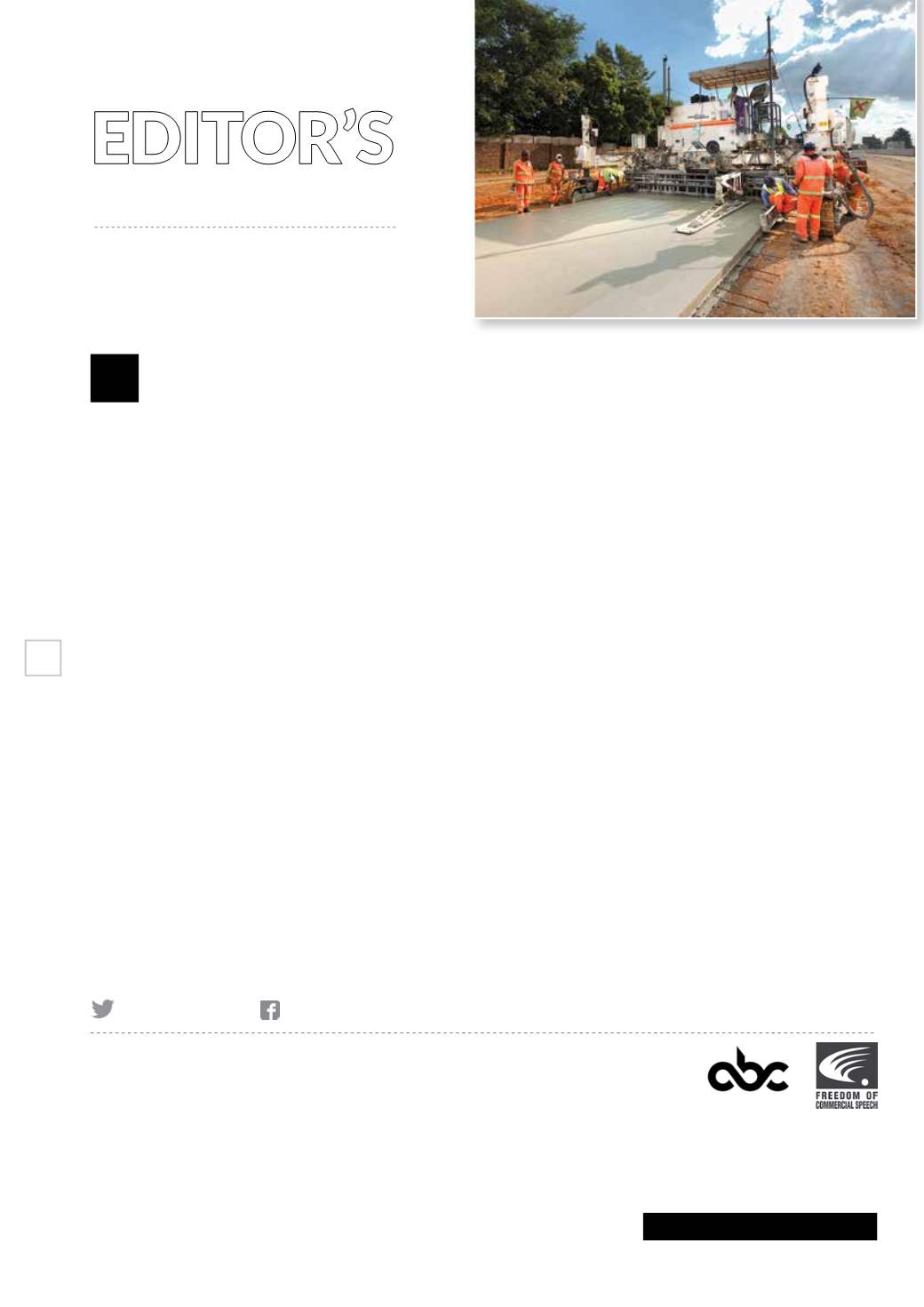

To start with the almost unthinkable: M&R. After

years of stagnation in the infrastructure and

building markets, the company has announced

that its focus will now be on global underground

mining, oil and gas and power and water. It is

not only selling its infrastructure and building

businesses, but will also dispose of its steel and

engineering services.

The reason for this dramatic change in

focus to what the M&R CEO, Henry Laas calls a

‘new strategic future’, is easy to identify. Since

the government’s massive spend on the 2010

Soccer World Cup, spending on huge infra-

structure projects have all but dried up. Laas

points out that M&R is not exiting the country,

but exiting a sector.

M&R’s announcement comes after the

company announced that its diluted headline

earnings per share fell by 10% for the year

The last month has been an interesting

time for the South African construction

industry with the announcement by

Murray & Roberts (M&R) that it is exiting

the infrastructure and building markets in

South Africa and the vastly mixed annual

results from three of SA’s listed companies

(Aveng, Group Five and WBHO).

to June. Further complications have been

the paying by 15 construction companies

(R1,5-billion collectively) for alleged collusion in

infrastructure for theWorld Cup, empowerment

pressures and recurring violent strikes.

Critical to core stability

Three other listed construction companies

recently announced its latest results: Aveng,

Group Five and WBHO.

Aveng’s (SA’s largest construction company

by turnover) results show that only 37% its

pipeline projects for the next two years is made

up of domestic building and engineering work.

This is down from 56% in 2015. Its revenue also

took a plunge: from R578-million in June 2015

to R299-million in June 2016.

It is increasingly relying of work outside

South Africa: 60% of its work now happens in

the Australia and Southeast Asia region (up from

40% last year).

Group Five, by contrast, doubled its oper-

ating profit – albeit entirely from its toll road

concessions in Eastern Europe.

Its CEO, Eric Vemer says that only govern-

ment spend on infrastructure projects can lead

to a recovery of the group’s heavy construction

in South Africa.

Even thoughWBHO’s results show a healthy

jump in profitability, CEO Louwtjie Nel is quick to

point out that this is not because of improving

conditions in the South African market. He

maintains that this is largely due to the fact that

the company now has a bigger share of the

market. In addition, WBHO’s building divisions

in SA and Australia offset lower activity levels in

especially mining which pushed up the headline

earnings per share.

Wilhelm du Plessis

Editor