4

CONSTRUCTION WORLD

OCTOBER

2016

>

MARKETPLACE

Trading statement

Headline loss per share (HEPS loss) for the

12 months ended 30 June 2016 will be

between 45% and 55% better than the

comparative period. The HEPS loss will be

between 65 and 94 cents per share, compared

to 144,3 cents per share in 2015, while the

headline loss for the year will be between

R260-million and R318-million, compared to

R578-million in 2015.

The basic loss per share (EPS loss) will

be between 75% and 85% better than the

comparative period. The EPS loss will be

between 17 and 29 cents per share, compared

to 114,8 cents per share in 2015, with basic

loss in earnings expected to be between

R69-million and R115-million for the year,

compared to R460-million in 2015.

This result is a material improvement on

the prior year and is underpinned by:

• an improved financial performance from

Aveng Grinaker-LTA on completion of loss-

making and non-contributing contracts,

an improvement in the ratio of contracts

operating at tendered margins, strong

performance in the building business,

the resolution of some major commercial

claims and a further reduction in fixed

operating expenses

• realisation of cost savings initiatives

previously implemented throughout

the Group

• improved financial performance from

Aveng Steel in the second half of the year

Fair value gains on the infrastructure invest-

ments though partially offset by:

• restructuring expenses incurred to further

right-size the Group’s overhead structure

in response to market conditions

• underperformance on certain contracts in

McConnell Dowell

• additional expenses on a problematic

water contract in Aveng Water

• contract cancellations and activity

reductions in Aveng Mining

• Continuing difficult trading conditions

in most of the markets in which the

Group operates.

The basic loss for the year includes the profit

on sale of the South African property portfolio

of R577-million in the first half of the year,

partially offset by the impairment of certain

steel assets recognised in the second half of

the year.

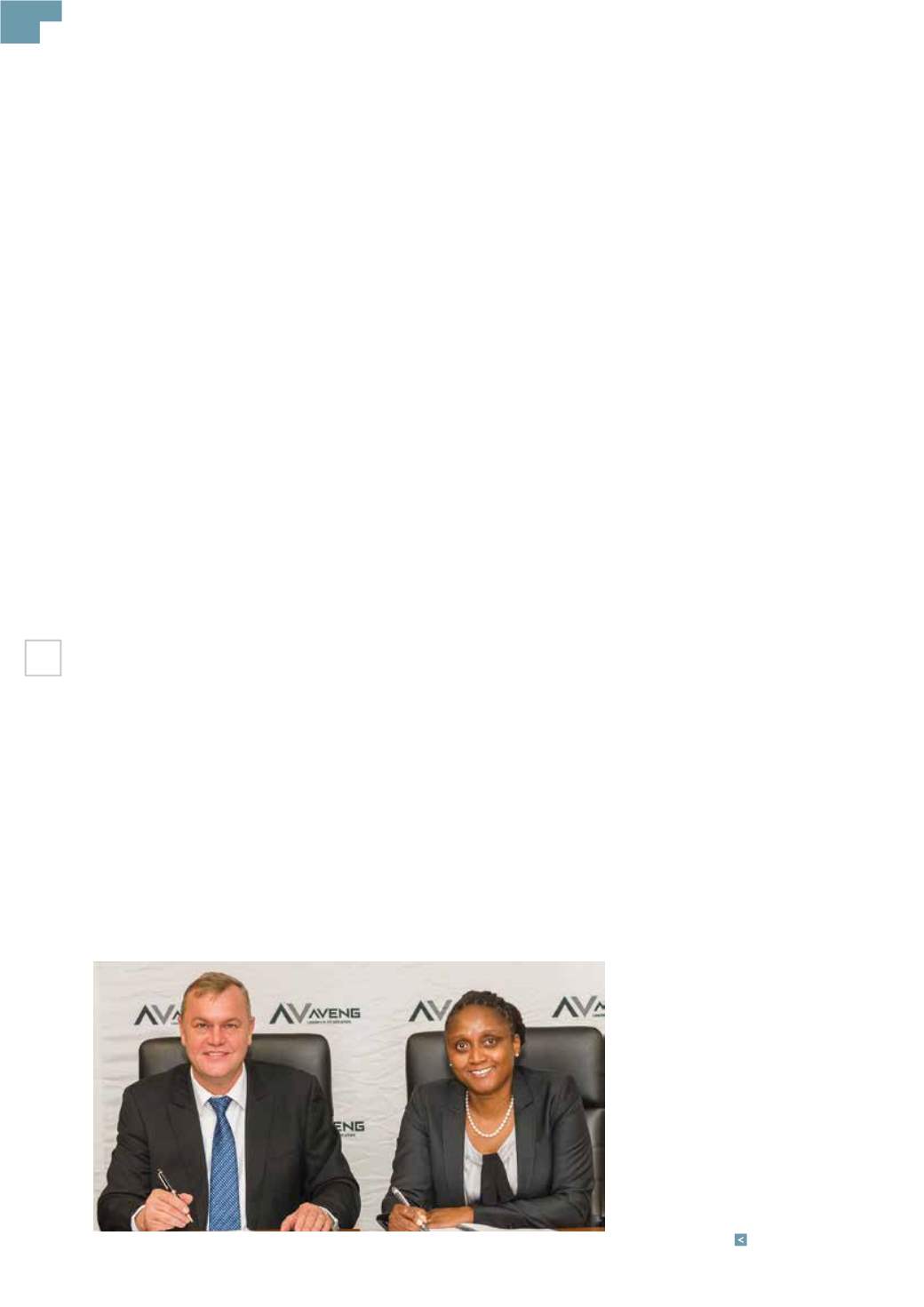

Aveng has entered into a binding agree-

ment with Royal Bafokeng Holdings (RBH)

who will acquire Aveng’s equity interests and

loan in the following investments, for a cash

consideration of R860-million:

• The 138 MW Gouda wind farm, one of the

largest wind farms in the Western Cape on

which 46 wind turbines are erected.

• Imvelo Concession Company, which is the

MAJOR DIVESTMENT

Aveng Limited (Aveng) has announced its trading statement

for the year ended 30 June 2016. Also announced are

agreements for the monetisation of four of its major

infrastructure investments for a cash consideration of

R860-million; and the sale of its Steeledale business to

Kutana, a black women-owned investment group.

holder of a 27-year concession to build,

operate and maintain the Department

of Environmental Affairs’ office campus

in Tshwane.

• N3 Toll Concessions, which entered into a

30-year concession agreement to design,

construct, finance, operate and maintain

the N3 toll road between the Cedara

Interchange in KwaZulu-Natal to the

Heidelberg South interchange in Gauteng.

• The 74 MW Sishen Solar Photovoltaic Plant

located in the municipality of Dibeng in

the Northern Cape.

These sales are subject to the normal and

customary terms and conditions, including

the fulfilment of certain conditions precedent.

The effective date is estimated to be on or

about 31 October 2016.

Kobus Verster, Aveng CEO, said: “These

investments have reached an appropriate

maturity where we can transfer them to

a strong investment company and realise

value for the Group. Aveng Capital Partners

will continue to pursue project development

opportunities for the Group as our investment

and structured financing arm.”

Albertinah Kekana, Royal Bafokeng

Holdings CEO, commented: “This proposed

agreement and its focus on renewable energy,

property and road infrastructure is in line with

our diversification strategy. This proposed

deal represents our long term investment

approach and our commitment to the South

African growth story.”

Proposed disposal of steel and

mesh business

Aveng has reached an agreement with Kutana

to acquire its steel reinforcing and mesh

business (Steeledale) in terms of a phased

exit strategy.

From the effective transaction date,

which is estimated to be on or about

1 November 2016, Kutana will acquire 70% of

the Steeledale business. Aveng can elect to

sell the remaining 30% at any time after three

years. The sale price is determined by way

of a formula applicable at the effective date

and the purchase consideration is expected

to be approximately R252-million, of which

between R93-million and R123-million will

be paid in cash and the remainder paid on a

deferred basis.

This transaction is subject to the

normal and customary terms and condi-

tions, including the fulfilment of certain

conditions precedent.

“I am pleased that both these transac-

tions have been implemented in line with

our strategy and previous announcements.

In addition to realising value, we have also

established partnerships with two excep-

tional empowered companies and I look

forward to forging positive relationships,”

concluded Verster.

Kobus Verster, Aveng CEO and Albertinah Kekana, CEO of Royal Bafokeng Holdings.