92 |

Gas Regional Investment Plan of the South Region 2017

-200

1,800

GWh/d

1,400

1,200

1,000

800

600

400

200

0

1,600

01.01.16

23.01.16

14.02.16

07.03.16

29.03.16

20.04.16

12.05.16

03.06.16

25.06.16

17.07.16

08.08.16

30.08.16

21.09.16

13.10.16

04.11.16

26.11.16

18.12.16

09.01.17

31.01.17

22.02.17

Total demand

Algeria

VIP Pirineos

VIP Iberico

LNG Send-Out

UGS

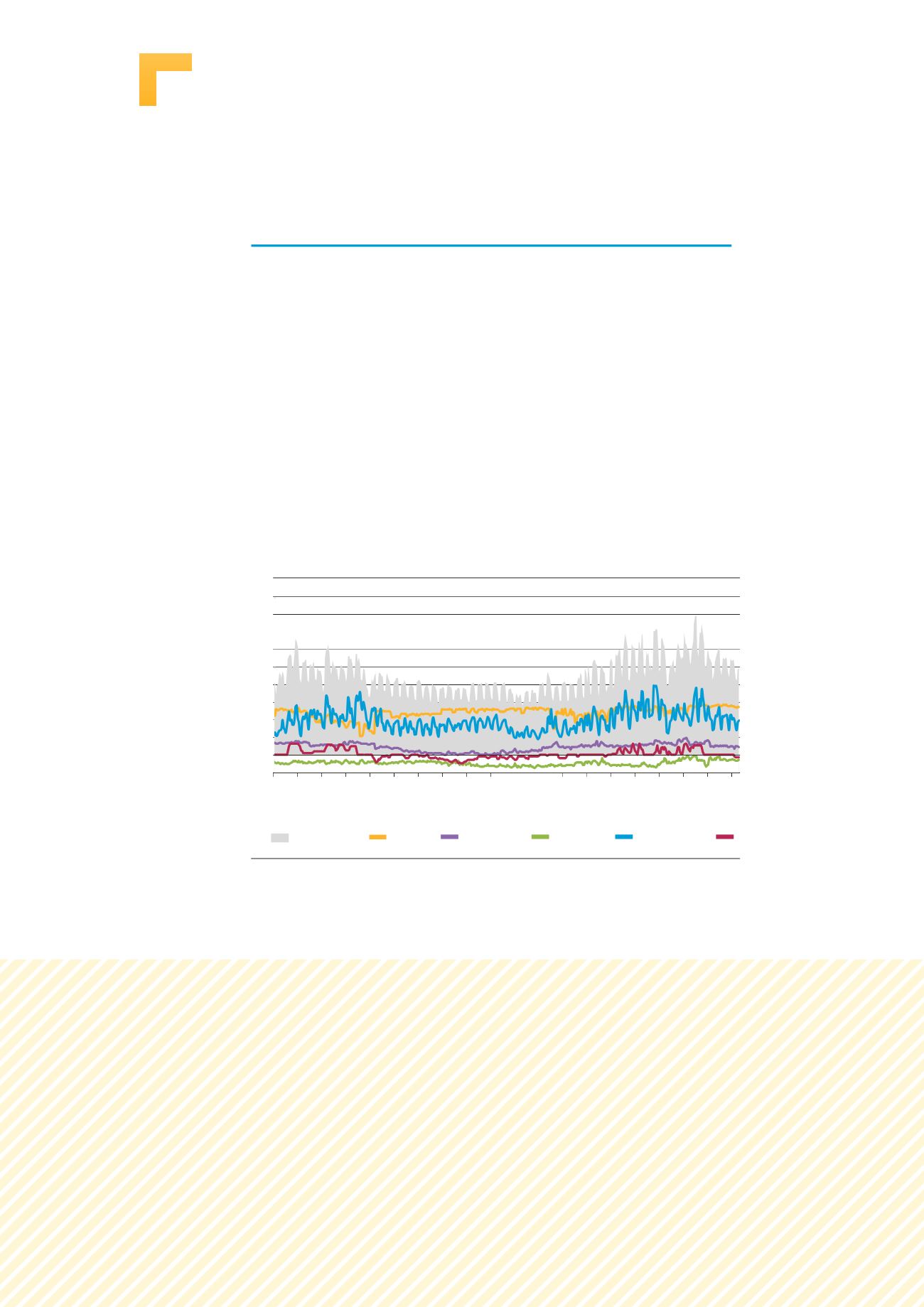

Entry / Exit flows to the Spanish gas system

Figure 7.2:

LNG and pipeline gas entry/exit flows to the Spanish gas system compared to total

gas demand in Spain (Source: ENTSOG TP)

7.2 Assessment of the Gas

System in the South Region

UGS and LNG terminals use: the main role of these facilities

Analysing the behavior of LNG regasification terminals, IPs and UGS’s in the South

Region, the different way of covering gas demand in the three countries can be

observed. The Iberian Peninsula relies primarily on LNG and Algerian gas, due to its

proximity to Algeria and higher LNG import capacity. France, being well intercon-

nected, has broader access to different supply sources and higher UGS withdrawal/

injection capacity.

Focusing on the Spanish gas system, LNG stock varies according to the level of

regasification and LNG cargos arriving to Spanish LNG terminals. In addition,

fluctuations in the IPs are covered with a higher LNG regasification. Variations of

Algerian pipeline imports have impact on the level of LNG regasification and IPs with

European countries, due to its higher capacity. Seasonal modulation of underground

storages plays a secondary role in the Spanish gas system resulting from its lower

capacity compared to LNG terminals or IPs and strategic stocks.