August 2017

MODERN MINING

5

MINING News

Canada’s Roxgold Inc has announced sec-

ond quarter (Q2) production of 27 970

ounces of gold from its Yaramoko under-

ground gold mine located in the Houndé

greenstone region of Burkina Faso.

Yaramoko is a new mine which produced

its first gold in May last year.

During the quarter, Yaramoko mined

66 044 tonnes of ore at 11,69 g/t Au with

2 085 m of development completed. The

plant processed 65 159 tonnes at an aver-

age head grade of 12,78 g/t Au. Plant

availability was 94 % and overall recov-

ery was 99,0 % during the quarter. Similar

grades are anticipated to be mined in Q3

with higher grade material scheduled for

the latter part of the year.

By the end of the quarter, underground

development had reached the 5083 RL,

some 230 m below surface. Waste devel-

opment continues to exceed plan and is

providing a significant amount of flexibility

to the operation going forward. With seven

stoping faces operating at quarter end, the

mine is well positioned to deliver in the

second half of 2017, as well as in 2018 and

beyond.

Roxgold is planning to expand opera-

tions at Yaramoko by developing the

Bagassi South deposit, which is located less

than 2 km from the current (55 Zone) mine.

During the quarter, the company pro-

gressed the Bagassi South feasibility study

on a number of fronts. Highlights from

the work plan of Q2 included: commence-

ment of construction works associated

with the camp expansion to accommodate

construction and additional future opera-

tional personnel; and the completion of a

programme to increase the capacity of the

existing water storage facility to augment

plant water supply.

During the quarter, Roxgold completed

an infill and expansion drilling programme

at Bagassi South. It has since published

an updated Mineral Resource Estimate

(MRE) which details an indicated mineral

resource of approximately 352 000 tonnes

at 16,6 g/t Au for 188 000 ounces and an

inferred resource of approximately 130 000

tonnes at 16,6 g/t Au for 69 000 ounces.

The updated MRE will be incorporated

into the feasibility study for the Bagassi

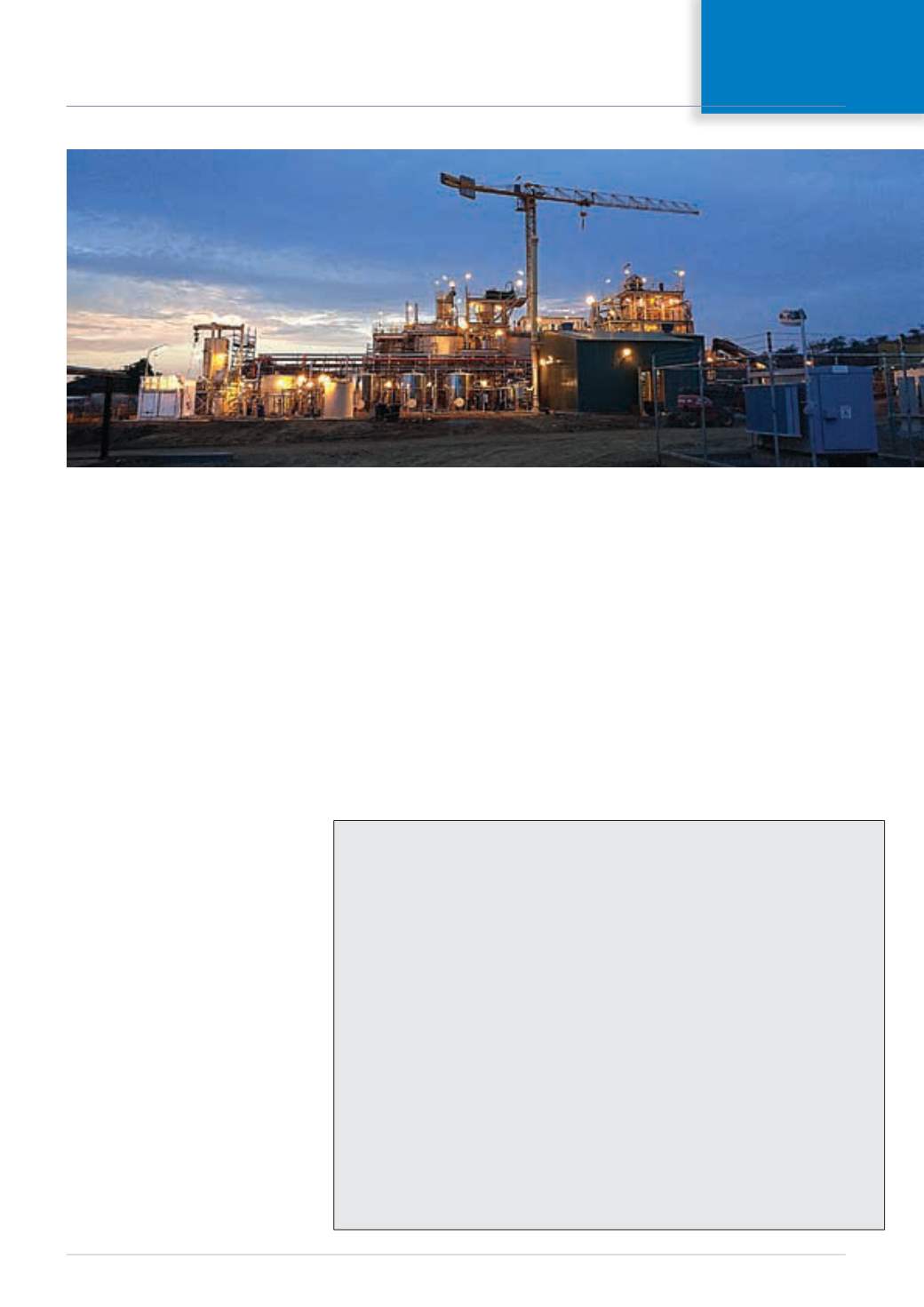

The processing plant at Roxgold’s Yaramoko gold mine in Burkina Faso (photo: Roxgold).

Solid quarterly performance by Yaramoko

South expansion project which is due to

be completed in Q4.

“Another solid quarter of production

above expectations at Yaramoko has put

us on track to meet the upper end of our

annual production guidance,” commented

John Dorward, President and CEO of

Roxgold. “With first half production of over

63 500 ounces, we are well placed to meet

guidance of 105 000 to 115 000 ounces

for the full year. In addition, the feasibility

study for our Bagassi South expansion proj-

ect is on track for delivery in Q4 and we are

excited by its prospects to build upon the

recently upgraded resource estimate.”

Namibian tantalite mine to increase production

Kennedy Ventures, an AIM-quoted invest-

ment company, which – through its stake

in African Tantalum (Aftan) – has an interest

in the Namibia Tantalite Investments (NTI)

mine (historically referred to as the‘Tantalite

Valley Mine’) in Namibia, has raised £3,75

million through a share placing.

Larry Johnson, CEO of Kennedy Ven

tures, commented: “I am very pleased with

the support we have received from our

existing and new shareholders which will

allow Aftan to accelerate plans to increase

production as well as increase our tanta-

lum resource and life of mine and complete

a lithium JORC resource report. Having

worked in the tantalum business for over

35 years, I am confident in my view that

NTI represents one of the finest grade

mines globally and this has played a part

in helping us secure and execute a long-

term supply agreement with a global North

American leading tantalum consumer and

end user of tantalum ore.

“NTI is one of the highest-grade mines

in the world and, following upgrades in H1

2017, we are now capable of meeting the

customer’s grade specifications. The fund

raise will enable Aftan to implement fur-

ther plant upgrades with the expectation

of ramping up to 30 tonnes per quarter and

beyond long term.”

The upgrades will include the purchase

of a variety of equipment to increase

plant capability such as a new Tornado

crusher, a fines recovery plant and con-

veyor belts. Aftan also intends enhancing

the operational effectiveness of the mine

by purchasing winches, water and air pip-

ing, explosives, a dump truck and a mining

chute and platform.