7

2008 Best Practices Study | Agencies with Revenues Under $1,250,000 | Revenues/Expenses

Agencies with Revenues Under $1,250,000

Appendix

Insurance

Carriers

Technology

Service

Staff Info

Producer

Info

Employee

Overview

Financial

Stability

Revenues/

Expenses

Profile

Expenses

(as % of Net Revenues)

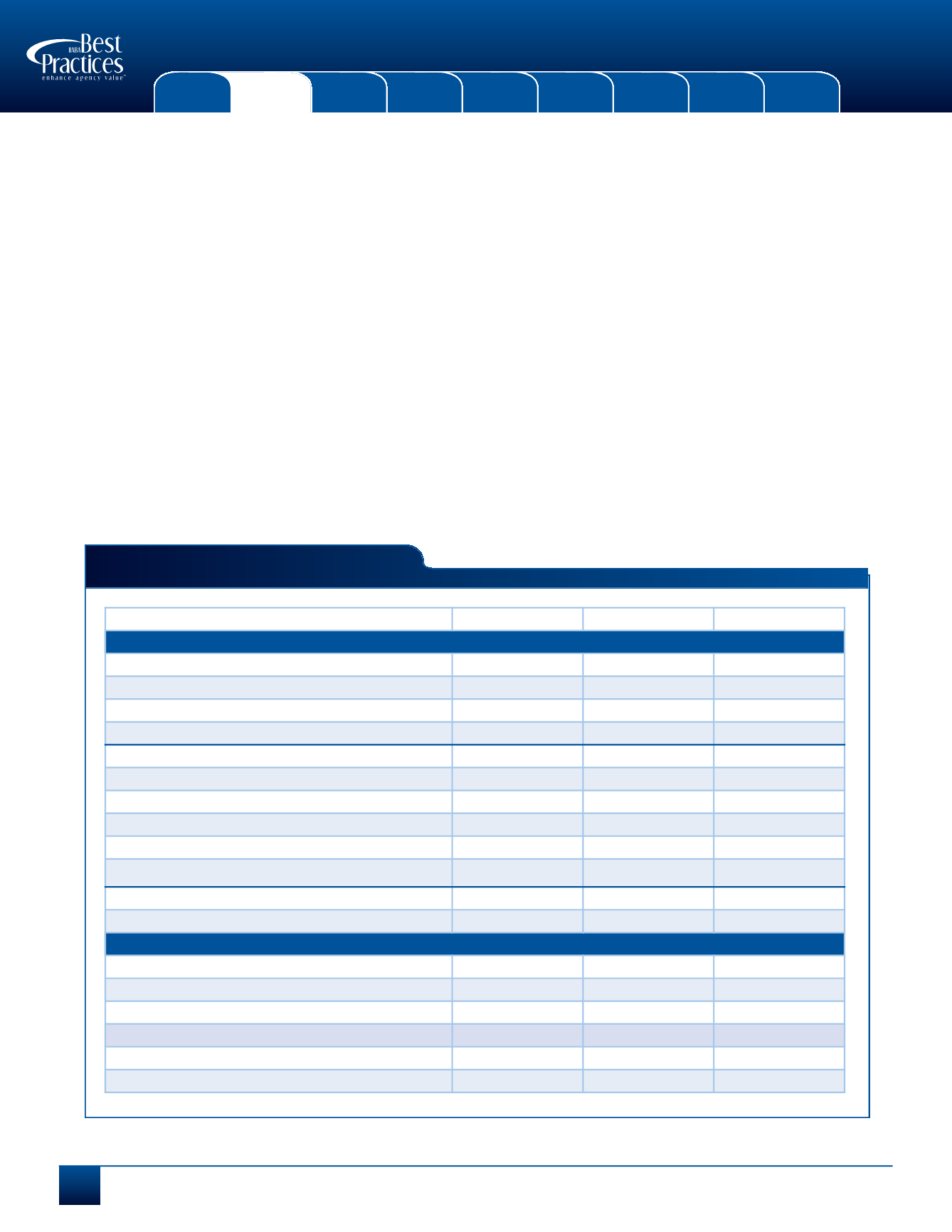

Breakdown of Expenses — What This Means to You

In the past the study has consolidated revenues and expenses into fairly broad categories making some comparisons difficult.

Factors such as corporate structure (e.g., C corporation versus S corporation) further complicated expense comparisons because

of what was or was not reflected on the income statement. The study now provides greater detail for both revenues and

expenses which has resulted in more meaningful benchmarks for better “apples-to-apples” comparisons. The new expense

breakdowns include:

Compensation Expense – Both Payroll and Benefits have been broken down to provide a better understanding of the

participating agencies’ costs – what costs are somewhat fixed (payroll taxes) versus discretionary costs (retirement benefits,

insurance, etc.).

Selling & Operating Expense –These expense categories now include greater detail, including any depreciation and

amortization expense associated with the category. This allows for a more accurate picture of the total expenses incurred as

both cash (e.g. monthly lease payment) and non-cash expenses (e.g. computer depreciation expense) are captured.

Average

+25% Profit

+25% Growth

Compensation Expenses

Payroll

Employee

43.8%

37.3%

41.0%

“Non-Employee” Producers

3.1%

2.8%

2.0%

Temporary Help

0.1%

0.0%

0.0%

Total Payroll

46.9%

40.1%

43.2%

Benefits

Payroll Taxes

3.8%

2.9%

3.5%

Retirement

2.7%

2.7%

3.1%

Insurance

3.4%

1.6%

1.5%

Other

0.0%

0.1%

0.0%

Total Benefits

9.9%

7.3%

8.1%

Total Compensation

56.9%

47.3%

51.3%

Selling Expenses

T&E/Conventions

1.2%

0.9%

0.8%

Auto Expenditures

2.1%

2.5%

1.5%

Auto Depreciation

0.6%

0.3%

1.4%

Total Auto

2.7%

2.8%

2.9%

Advertising/Promotions

2.4%

1.8%

2.1%

Total Selling

6.3%

5.4%

5.7%