10 |

Ten Year Network Development Plan 2015

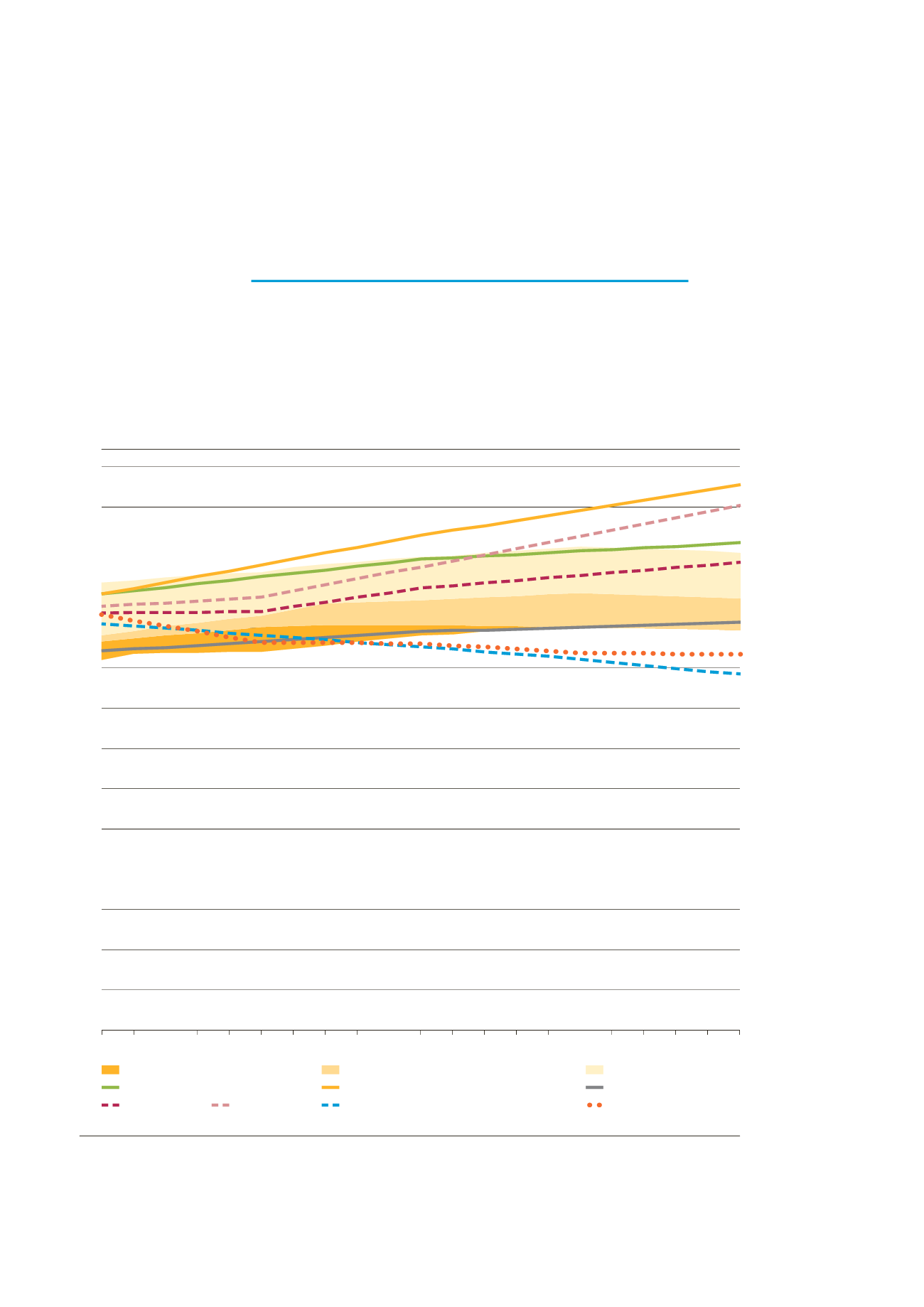

0

2,000

1,000

3,000

4,000

5,000

7,500

6,500

6,000

1,500

500

2,500

3,500

4,500

5,500

TWh/y

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

ENTSOG lower range

ENTSOG range under TSOs scenarios (final+power)

ENTSOG upper range

Eurogas: Base (EU-28 adapted)

IEA NPS

IEA CPS

IEA 450 S

DGENER trends to 2050

Eurogas: Envt. (EU-28 adapted)

Eurogas: Slow Dev. (EU-28 adapted)

Figure 3:

Comparison of gas demand outlooks

such as the socialization of cost or co-financing, and can lead to a higher risk of

stranded assets.

One of the main reasons for this lack of market commitment is the uncertainty in the

long term use of gas in definition of the European energy mix. Only a relative small

share of investment can be triggered for security of supply reason. Market players,

NRAs and infrastructure operators need the guarantee of sufficient use of the infra-

structure in order to support the economically efficient development of projects.

A STABLE DEMAND DRIVEN BY GLOBAL CONTEXT

Since 2010 European gas demand has continuously decreased mainly due to a low-

er use of gas-fired power generation. This results from the combination of European

policies, such as the development of renewable sources (RES) and an inefficient

European Trading System (ETS), as well as the global context of low coal prices and

still ongoing economic downturn.