12 |

Ten Year Network Development Plan 2015

0

4,000

5,000

2,000

6,000

3,000

1,000

7,000

8,000

9,000

TWh/y

0

500

300

100

200

700

600

400

800

900

bcma

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

Maximum (Low infra. Sc)

Maximum (High infra. Sc)

Intermediate (Low infra. Sc)

Minimum (Low infra. Sc)

Green

Grey

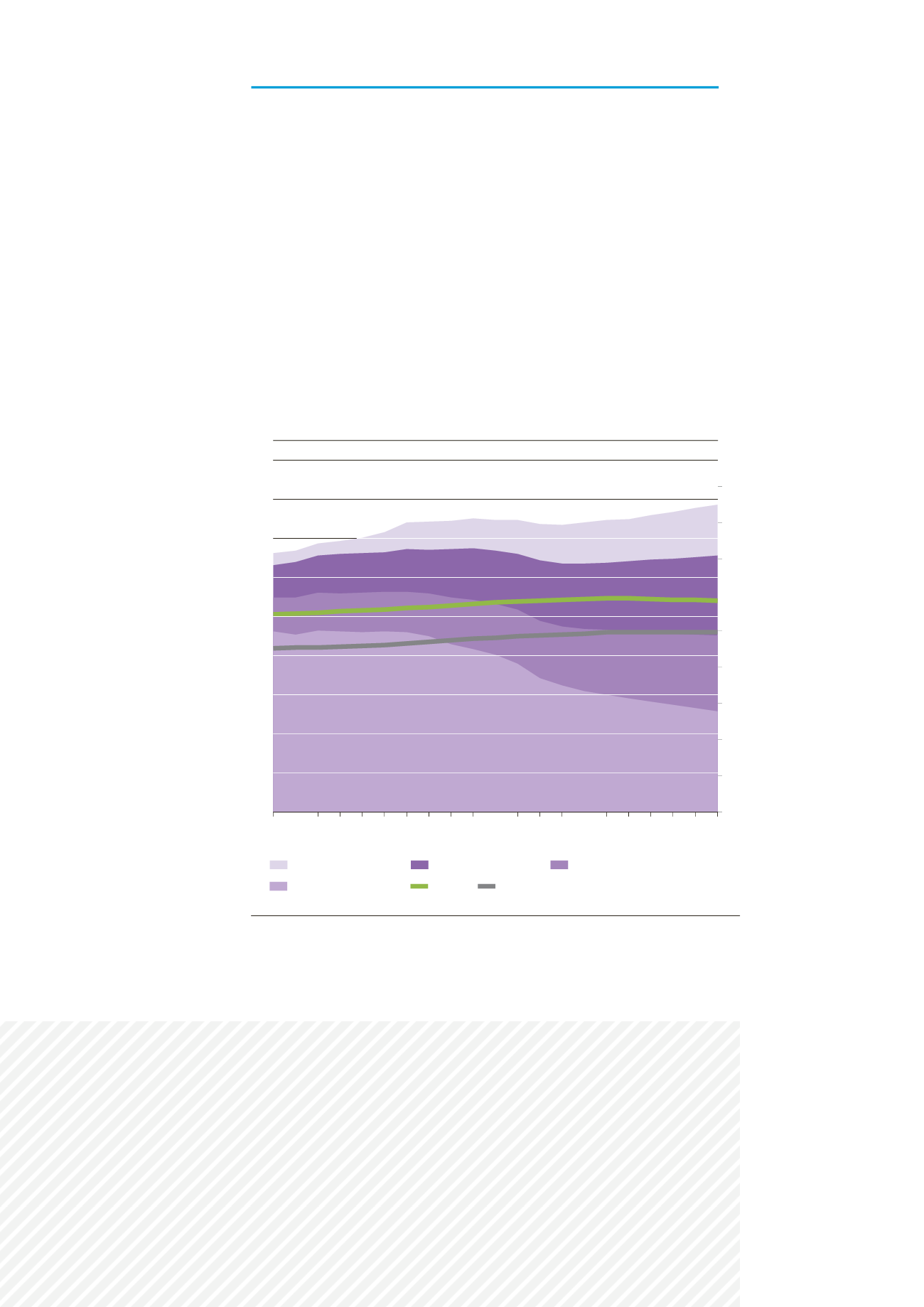

Figure 5:

Comparison of gas demand and gas supply scenarios

EUROPE NEEDS TO ENLARGE ITS SUPPLY PORTFOLIO

When gas demand does not show a clear evolution, the requirements for gas imports

are driven by the decreasing indigenous production. Under the current perspective

the induced need for additional imports is likely to be met by Russian gas and LNG,

especially under the Green scenario. In such a situation Europe would be in a

challenging position resulting in a reduced market power.

Other sources are likely to stay at the current level (pipe gas from Algeria and Libya)

or would only have a limited influence (Caspian gas) in absence of stronger market

signals. Norway is a very particular case as there is a potential to deliver significant

volumes from the Barents Sea gas fields from the mid 2020s. Nevertheless, the

investments connecting this production to the existing European gas network is not

yet decided and is in competition with potential LNG developments as a result of the

lack of long term attractiveness of the continent. Other producers (e. g. North Africa

and Middle-East) are facing the same challenges. Appropriate signals from Europe

would enable the delivery of new supply to Europe improving both its energy security

and its competitiveness while supporting high environmental standards.