11

MULTIFAMILY INVESTMENT SOUTH FLORIDA TEAM

| SOUTH FLORIDA

Cushman & Wakefield

PALM BEACH

MULTIFAMILY MARKET SUMMARY

CONTINUED

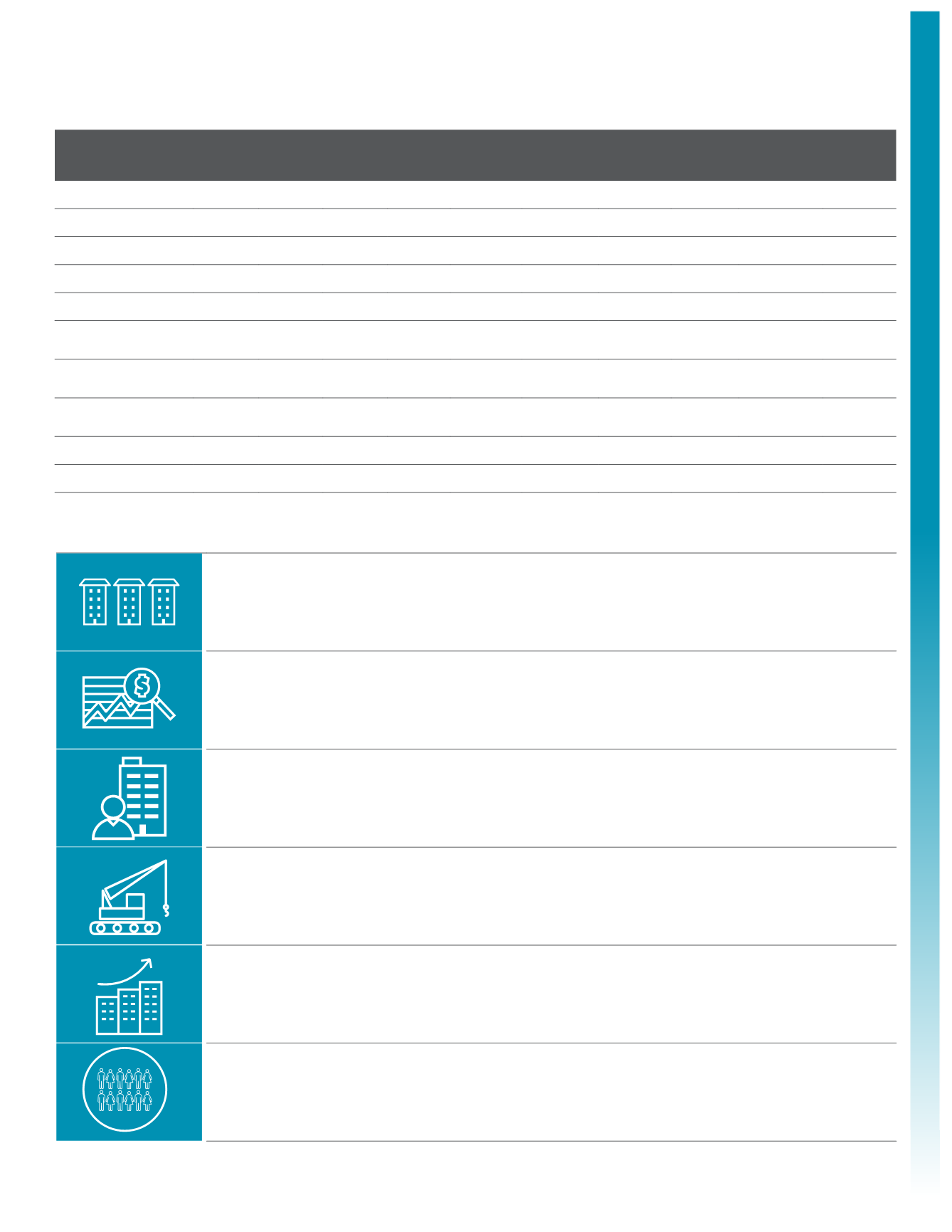

SUBMARKET

UNITS

ASKING

RENT

ASKING

RENT PSF

ASKING

RENT

GROWTH

EFFECTIVE

RENT

EFFECTIVE

RENT PSF

EFFECTIVE

RENT

GROWTH

VACANCY

NET

ABSORPTION

DELIVERED

UNITS

Belle Glade

2,111

$670

$0.85

1.3% $667

$0.84

1.4% 8.6% 5

-

Boca Raton

12,641

$1,772 $1.70

1.3% $1,741

$1.67

0.0% 8.8% 245

-

Boynton Beach

9,910 $1,368 $1.30

1.4% $1,345

$1.28

0.4% 7.4% 107

-

Delray Beach

5,284 $1,622 $1.49

3.0% $1,572

$1.44

0.1% 6.2% -8

-

Greenacres

7,142 $1,077 $1.16

0.5% $1,071

$1.15

0.5% 4.8% -4

118

Outlying Palm Beach

County

193

$666

$1.05

0.1% $664

$1.05

0.2% 4.6% 1

-

Palm Beach Gardens/

Jupiter

7,455 $1,510 $1.40

0.6% $1,508

$1.39

0.7% 5.6% 29

-

Royal Palm Beach/

Wellington

6,087 $1,441 $1.31

-0.1% $1,399

$1.30

-0.1% 6.4% -5

-

West Palm Beach

17,653 $1,209 $1.31

0.3% $1,204

$1.30

0.2% 5.3% 36

-

TOTAL/AVERAGE

68,476 $1,411

$1.39

0.6% $1,387

$1.37

-0.3% 6.3% 406

118

• In the three months of 2017, there were 5 apartment sales totaling $45 million with a median

price of $137,381 per unit or $147 per square foot.

• For a ninth year in a row, average asking and effective rents were at record levels. Year-to-

date, average asking rents grew by 0.6%. This is below the record 8.1% rent increase from

2015.

• Vacancies increased in 2016 to a 6-year high of 6.9%. This was due to new supply out-pacing

net absorption.

• There are 3,634 units forecasted for delivery to market. This represents only 5.3% of the

current inventory in the market.

• Year-to-date net absorption was over 400 units. Net absorption outpaced new supply by

almost 300 units contributing to a slightly lower vacancy rate.

• Last year, median salary income in Palm Beach increased by +/- 4.1%, the second biggest

increase since 2007. Population has grown by 103,000 in the past five years.

*Data as of March-2017, apartment sales of 10 units or more, in excess of $1MM in pricing, excluding

all condo sales