UPM Annual Report 2015

UPM Annual Report 2015

13

14

contents

UPM aims to increase shareholder value

Drive top performance:

At the business area level, UPM targets top performance in

their respective markets. In 2015, out of our six business areas, UPMBiorefining, UPM

Plywood and UPMEnergy exceeded their long-term return targets, and UPMRaflatac

showed good improvement, getting very close to its target. (page 12). UPM is committed

to continuous improvement in its financial, social and environmental performance.

1

Capture growth opportunities:

To expand the well-performing businesses with

promising long term fundamentals, UPM is implementing focused growth projects.

In 2016, several growth projects are ramping up and focus turns to reaping the benefits

from the investments.

2

Develop business portfolio:

UPM is seeking to develop its business portfolio in

order to uncover and increase its value. Increasing the share of highly profitable busi-

nesses with good fundamentals for growth improves the company’s long-term profit

ability and boosts the value of the shares.

3

Innovation:

UPM’s expertise in renewable and recyclable materials, low-emission

energy and resource efficiency is the key to developing new, sustainable business oppor-

tunities with high added value.

4

Strong operating cash flow

is important for UPM as it enables the realisation of

organic growth projects and new business development, as well as paying attractive

dividends to UPM shareholders.

1

2

3

4

Industry leading balance sheet:

The company aims to maintain a strong balance

sheet to enable portfolio changes that increase UPM’s shareholder value.

1

2

3

4

Responsibility

is an integral part of UPM’s Biofore strategy. Good governance,

industry-leading environmental performance, responsible sourcing practices and

a safe working environment are important sources of competitive advantage. Proactive

corporate responsibility work also enables business impacts and risks to be efficiently

identified and mitigated. UPM’s consistent efforts in this area continued to gain external

recognition in 2015.

1

Dividend policy

Attractive dividend:

UPM aims to pay an attractive dividend, 30-40% of the

company’s annual operating cash flow per share.

UPM aims to increase profitability,

growth outlook and value of

its business portfolio. The target is

to develop the business portfolio

to uncover and increase its value.

With good performance in the

businesses, strong cash flow,

and leading balance sheet in the

industry, UPM can simultaneously

distribute an attractive dividend,

implement focused growth projects

and act on strategic opportunities.

IN BRIEF

STRATEGY

BUSINESSES

GOVERNANCE

STAKEHOLDERS

ACCOUNTS

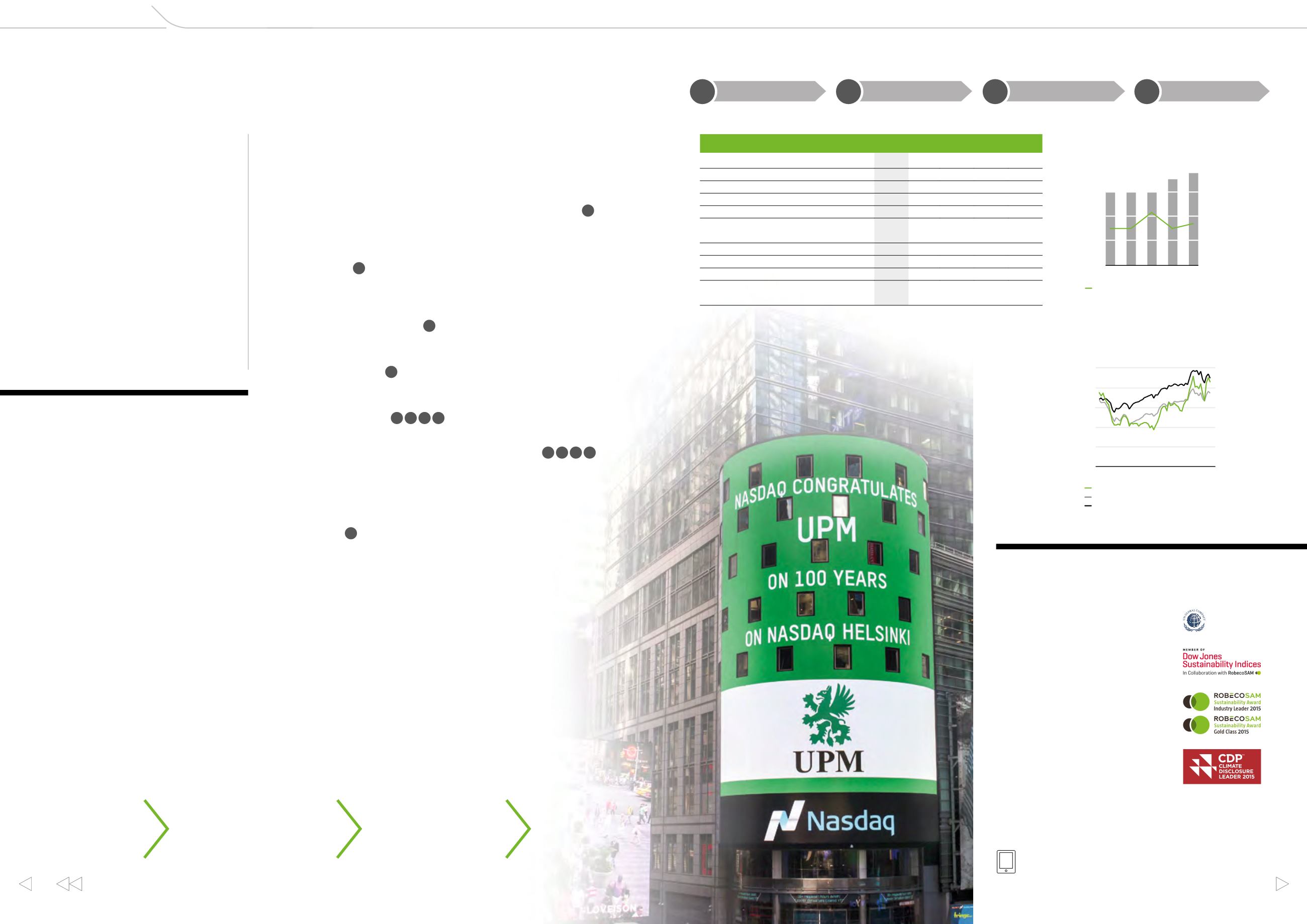

UPM as an investment

UPM share price 2011–2015

compared with indices

EUR

UPM share price

NASDAQ OMX Helsinki (rebased)

DJ STOXX 600 (rebased)

2011 2012 2013 2014 2015

0

4

8

12

16

20

5-year share performance and valuation multiples

2015

2014

2013 2012 2011

Share price at 31 Dec, EUR

17.23

13.62

12.28 8.81 8.51

Earnings per share, excluding special items, EUR

1.75

1.17

0.91 0.74 0.93

Dividend per share, EUR

0.75

*

)

0.70

0.60 0.60 0.60

Operating cash flow per share, EUR

2.22

2.33

1.39 1.98 1.99

Effective dividend yield, %

4.4

5.1

4.9 6.8 7.1

P/E ratio

10.0

14.2

19.5 neg.

9.7

P/BV ratio

1)

1.16

0.97

0.87 0.62 0.60

EV/EBITDA ratio

2)

8.4

7.5

8.3 6.0 5.8

Market capitalisation, EUR million

9,192

7,266

6,497 4,633 4,466

*)

2015: Board’s proposal

1)

P/BV ratio = Share price at 31.12./Equity per share

2)

EV/EBITDA ratio = (Market capitalisation + Net debt)/EBITDA

UPM invited into UN Global Compact LEAD

as the first forest industry company and

the first Finnish Company as of 1 Jan 2016

Industry leader in the Dow Jones European

and World Sustainability Indices for

2015–2016

RobecoSAM’s annual Sustainability

Yearbook 2015 with Industry Leader and

Golden Class distinctions

CDP Nordic Disclosure Leadership Index

the 7th time in a row

Number 25 in the 2016 Global 100 Most

Sustainable Corporations in the World

(Global 100)

Recognition by FAO for exemplary forestry

in Uruguay

Read more:

www.upm.com/responsibilityUPM’s Biofore strategy receives

external recognition

Vision and values

Portfolio strategy

Business targets

Capital allocation

Code of Conduct

Responsibility targets

Top performance

Competitive advantage

Value creation

Shared value with stakeholders

License to operate

Business area strategies

Commercial excellence

Growth projects

Profitability improvement programmes

Innovation

GROUP

IMPLEMENTATION IN BUSINESSES

OUTCOMES

Over the past years, UPMhas transformed from an integrated paper

company into a Biofore company with six separate business areas,

each striving for top performance in their respective markets. UPM

has turned former internal resources such as chemical pulp and

energy into customer-focused and market-driven businesses, created

new business in advanced biofuels and grown in its other well-per-

forming businesses. The company’s profitability has improved, share-

holder returns have increased and the balance sheet has been

strengthened (see page 4).

Global Compact

LEAD

Each business area is responsible for executing its own strategy and

achieving targets. Group direction and support from global functions

enable the businesses to capture benefits fromUPM’s brand, scale and

integration, while navigating the complex operating environment.

UPM’s structure of six separate businesses enables optimal capital

allocation decisions at the group level, as well as developing the busi-

ness portfolio further.

With the Biofore strategy (on page 5), we are committed to continue

the transformation. A strong focus on performance and competitive-

ness, combined with an industry leading balance sheet, demonstrate

our ability to execute it.

Driving performance and transformation

15

14

13

12

11

0.80

0.60

0.40

0.20

0.00

% of operating cash flow per share

Cash flow-based dividend

EUR per share

%

*)

Board’s proposal for 2015

80

60

40

20

0

0.75

*

)

1

performance

2

growth

3

PORTFOLIO

4

innovation