ECONOMIC REPORT 2015

11

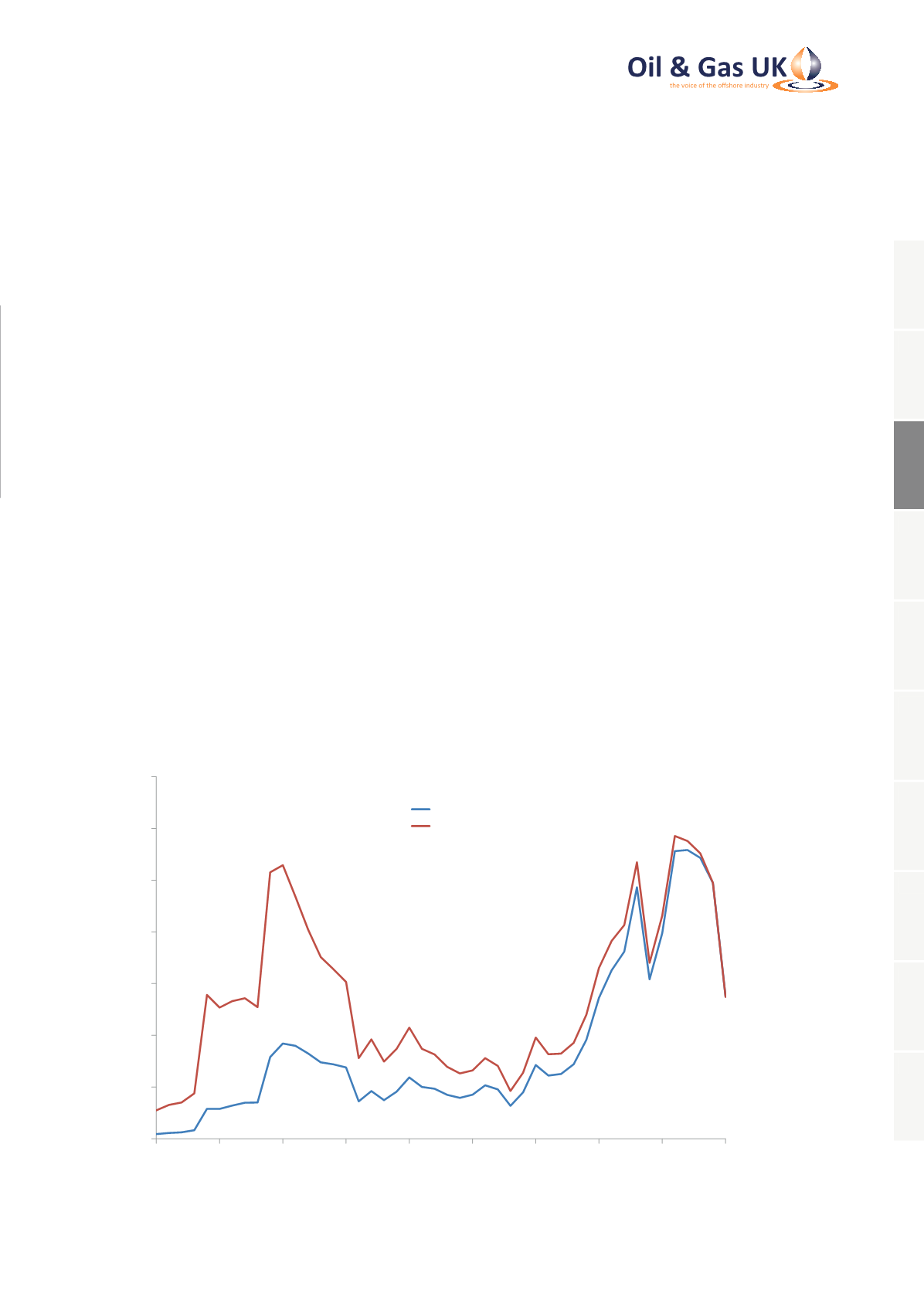

3.1 Oil Markets and Price Trends

Prevailing Oil Market Conditions

The low price volatility that prevailed in the oil and

energy markets between 2011 and 2014 was finally

shattered by the collapse in oil prices in the second half

of 2014. From a peak of $110 per barrel (bbl) in June

2014, dated Brent slid progressively to just $48/bbl

in January 2015 amid a growing over-supply in world

oil markets.

The over-supply has persisted so far in 2015. Brent has

traded in a range of $45-65/bbl since January, averaging

$58/bbl in the first half of 2015, despite a mild recovery

in the second quarter. While the collapse in prices in

2014-15 marked a return of oil price volatility, it may

be noted that the average Brent price in the first half

of 2015 matches the average over the last 40 years

(1975 to 2014), expressed in 2014 dollars. For reference,

Brent oil last sat in the $50/bbl range (in real terms)

more than a decade ago in 2004.

Lower prices have led to a dynamic adjustment of

supply, demand, stockholding and investment flows.

This process is now well under way and will continue

beyond the end of 2015, given the excess supply and

inventories that have built up in the market. A new

equilibrium price range may eventually be found but

market indications increasingly suggest that prices may

persist within the current range of $45-65/bbl well

beyond the end of 2015.

0

20

40

60

80

100

120

140

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015*

Brent Oil Prices ($/bbl)

Brent Price (Nominal)

Brent Price (Real)

Source: Argus Media, BP

*2015 predicted average

Figure 1: Nominal and Real Brent Prices

3. Prices and Markets

1

2

3

4

5

6

7

8

9

10