ECONOMIC REPORT 2015

17

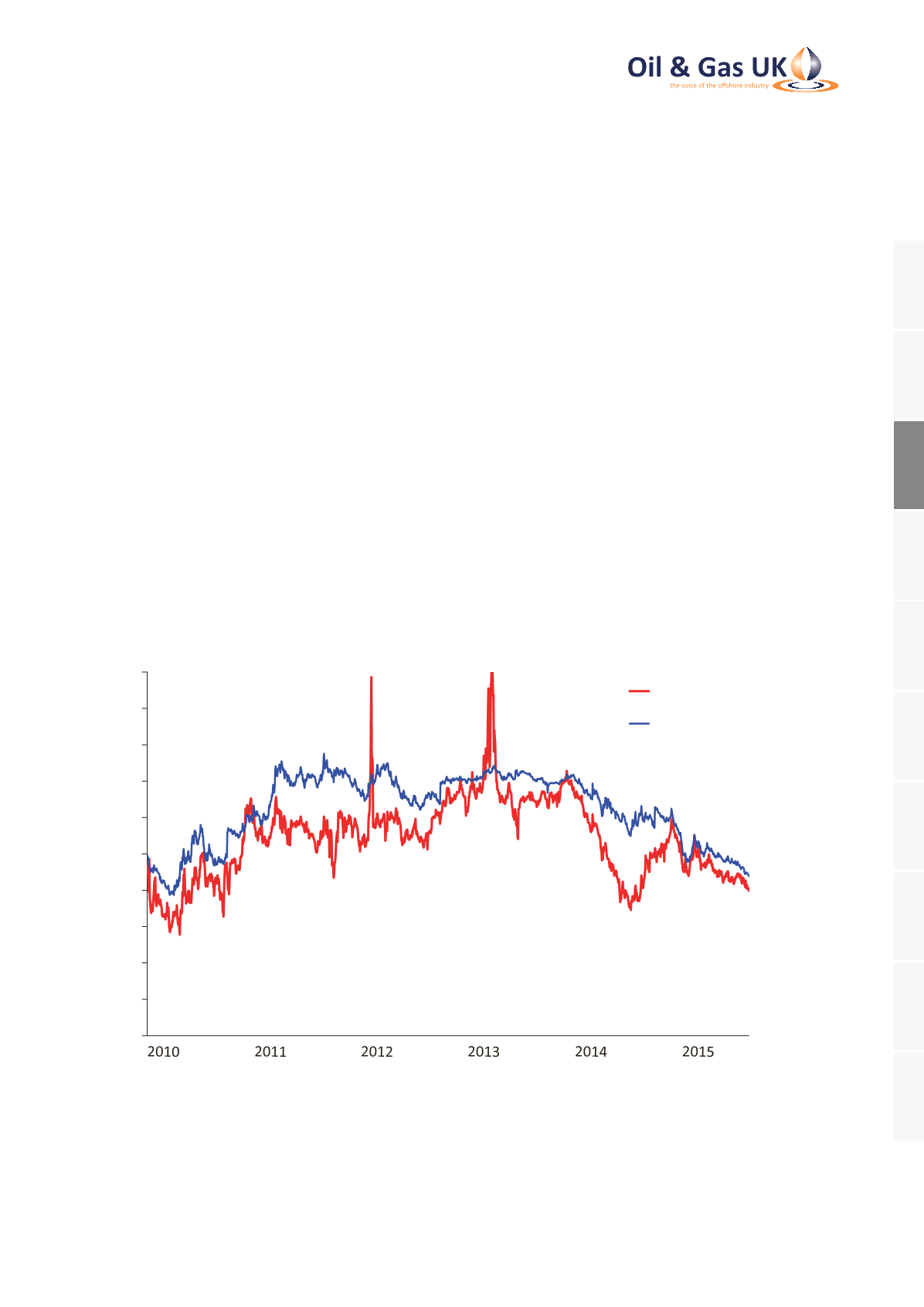

Average month-ahead NBP prices fell to a four-year low

of 51 p/th ($8.40/m BTU) in 2014, in response to acute

demand-side weakness rather than the collapse in oil

price. The influence of lower oil prices can be seen in the

progressive erosion of prices for delivery in the winter

of 2015-16 from 60 p/th in mid-2014 to 45 p/th at the

time of writing.

Prompt NBP prices in the summer of 2015 have so far

avoided the collapse seen in 2014, and the full-year

average is expected to be in the range of 42-49 p/th.

The slide in forward winter prices, despite the recent

severe restrictions on production from the large Dutch

Groningen field, indicates that there is adequate supply

in European gas markets even at times of peak winter

demand. Excess supply is conventionally kept in check

by export restraint by the holders of uncontracted

pipeline gas. This role of regulating supply and defending

NBP/TTF hub prices may be more difficult to perform

once new sources of LNG enter the market in late 2015

and 2016, unless European demand unexpectedly

reverses its policy-induced downward trend.

0

10

20

30

40

50

60

70

80

90

100

Gas Price (p/th)

Day Ahead

Front Winter

Source: ICIS Heren

Figure 7: Daily National Balancing Point Prices,

January 2010 to August 2015

1

2

3

4

5

6

7

8

9

10