ECONOMIC REPORT 2015

19

4.1 Capital Investment Cuts and Cost Deflation

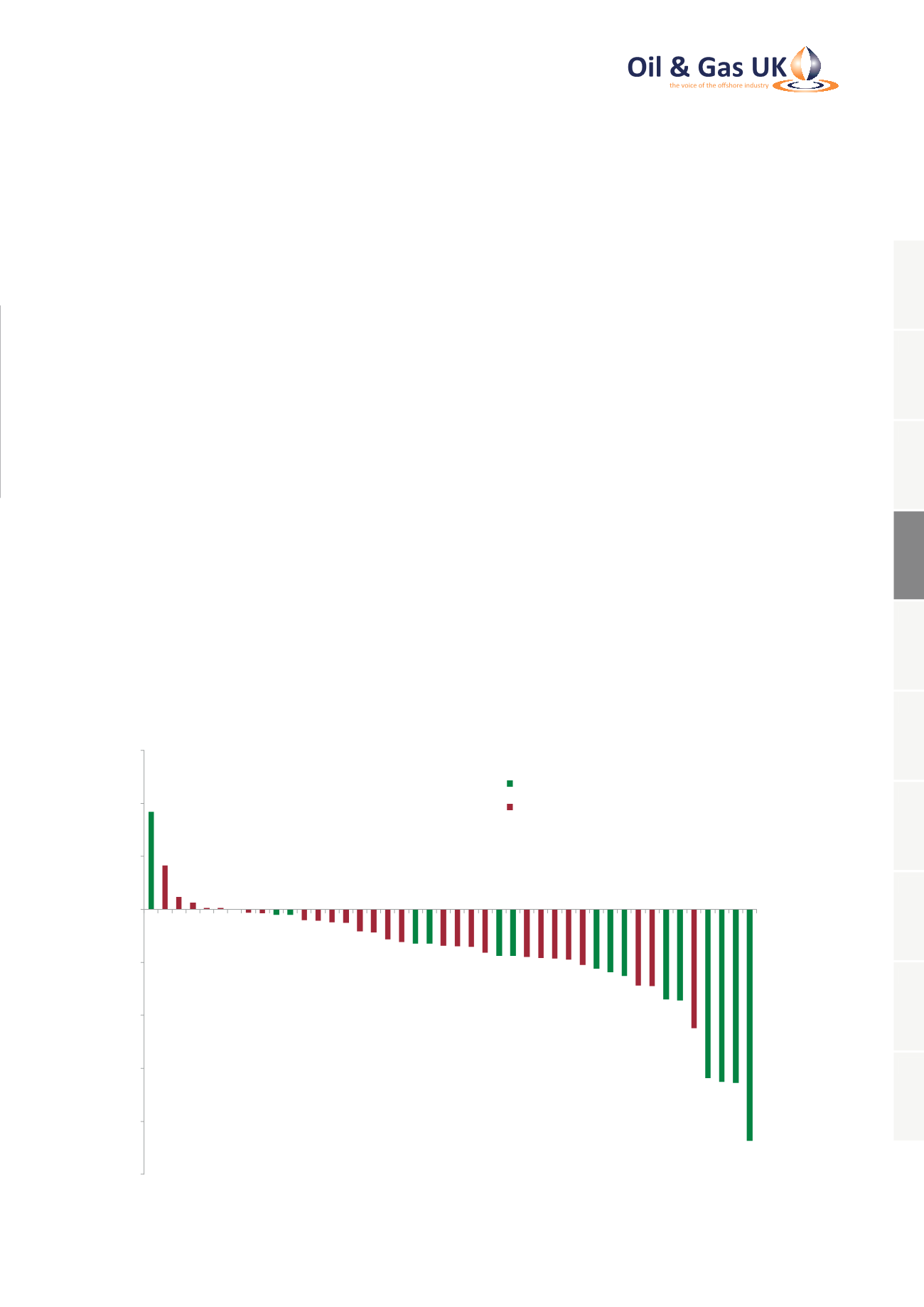

Figure 8 shows the changes in worldwide capital

budgets for oil and gas exploration and production

companies between 2014 and 2015 and illustrates

how budgets are being tightened globally and not just in

the UK.

A Wood Mackenzie survey of 44 organisations

found that each company plans to spend on average

$1.7 billion less in 2015 than they did in 2014,

representing an average fall of just over 25 per cent.

The vast majority of capital that companies still plan

to invest in 2015 is on activity already committed to

before the price fall. Although less than three per cent

of worldwide oil and gas capital is invested in the UK,

the UKCS is particularly struggling to attract discretionary

investment innewexploration, appraisal, or development

activity.

The primary reason for the global reduction in capital

investment is to restore cash flow at a time when

revenues have been negatively impacted by oil prices.

However, it is believed that investors are also postponing

investment in anticipation of further cost deflation in

the near term. For example, rig rates across the world

are falling and those for the North Sea are shown in

Figure 9 overleaf. The day-rate for semi-submersible

rigs fell by around 40 per cent from January 2014 to

-10

-8

-6

-4

-2

0

2

4

6

Change in Global Capex Budget (US$ Billion)

Companies Investing in the UKCS

Companies not Investing in the UKCS

Source:Wood Mackenzie

Figure 8: Capital Budget Changes, 2015 versus 2014

4.

Global Reaction to the Oil Price Fall

1

2

3

4

5

6

7

8

9

10