ECONOMIC REPORT 2015

16

for about half the gas entering the NTS (67 bcm). NBP

prices are closely correlated with hub prices in adjacent

hub markets on the near-continent, notably Zeebrugge

and the Dutch TTF (Title Transfer Facility) market, and

reflect prevailing supply and demand conditions across

north-west Europe.

Although NBP prices respond to many of the same

influences as oil prices, the divergent behaviour of NBP

and oil price since 2014 to 2015 is worthy of note. UKCS

gas producers faced a major fall in NBP prices in the

first half of 2014, whereas the fall for oil producers was

concentrated in the last few months of the year.

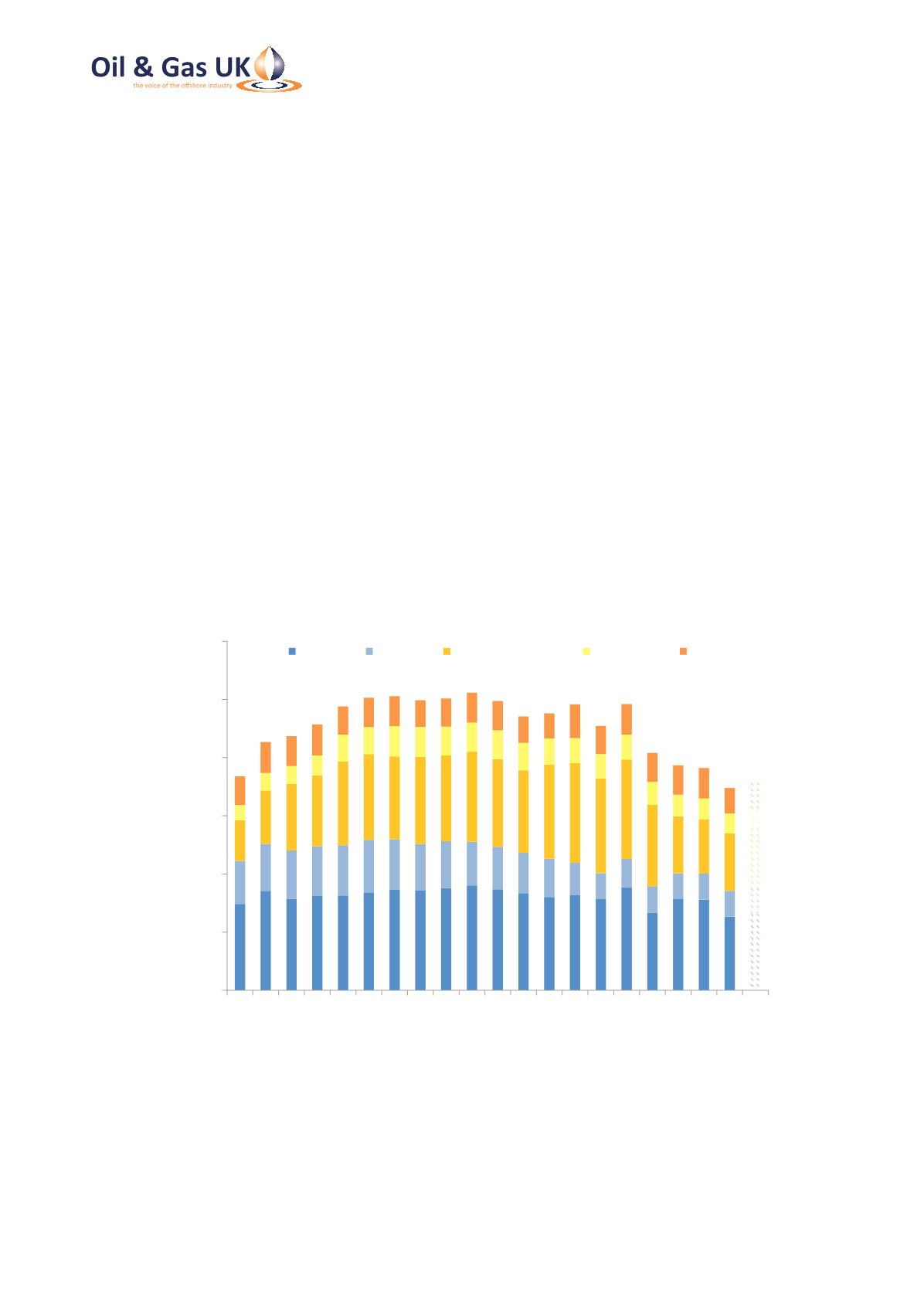

Gas demand in Europe in 2014 fell 10.1 per cent to

452 bcm due to an exceptionally warm winter in

2013-14, the economic weakness of much of the

Eurozone, price-induced demand restraint and further

contraction of gas use for electricity generation in

favour of coal and renewables.

In the UK, total gas demand in 2014 was 70.2 bcm, the

lowest since 1994. Even if corrected to take account of

thewarmer-than-normal temperatures in 2014, demand

would only be estimated at 75 bcm. Unlike most other

EU countries, the UK recorded a slight increase in gas

use for electricity generation, from 18.7 bcm to 19.8

bcm, as gas picked up market share after the permanent

closure of old coal-fired plants. Based on provisional

data for the first six months of this year and normal

temperatures, UK gas demand in 2015 is expected to

rise modestly to 72.5 bcm (plus 3.2 per cent).

0

20

40

60

80

100

120

1995

2000

2005

2010

2015

Gas Balance (bcm)

Domestic

Industrial

Electricity Generation Other Energy

Services

Source: DECC, Oil & Gas UK projection

Figure 6: UK Gas Demand by Sector