ECONOMIC REPORT 2015

15

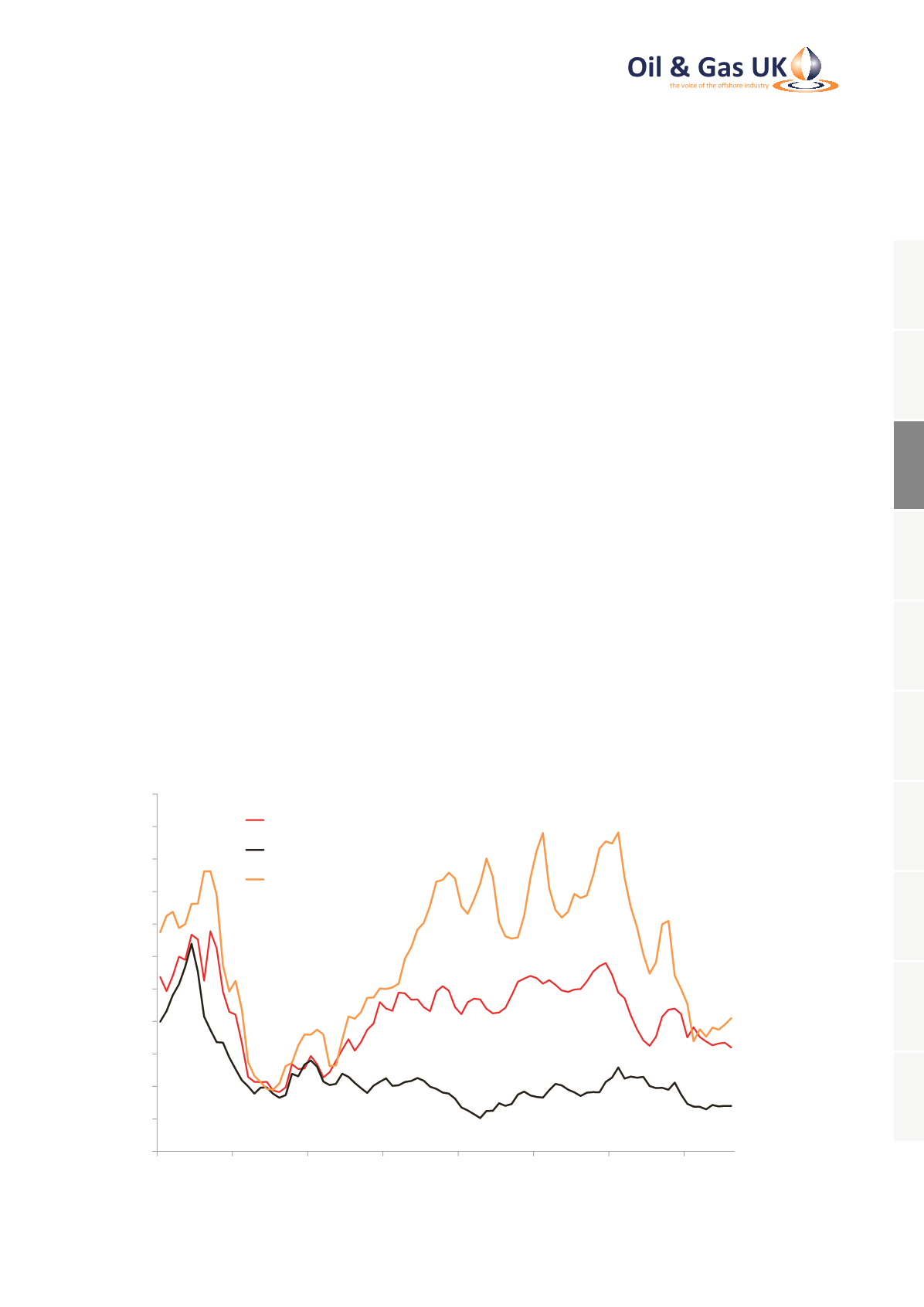

3.2 Gas Markets and Prices

Regional gas price convergence

Gas markets around the world are increasingly

inter-connected by liquefied natural gas (LNG) flows but

still remain largely regional in nature. There is therefore

no single world benchmark gas price of the kind

represented by North Sea Brent in oil markets. Pricing

of gas and LNG outside of North America is also marked

by a difference between term contract prices, many of

which remain linked to oil prices, and spot or hub prices

for uncontracted supply. Oil-indexation of contract

prices has diminished in Europe since 2009 as contract

terms have been progressively renegotiated but the link

still persists in Asian gas and LNG markets.

In 2014, there was a decline in traded gas and LNG

prices in all major regions and a convergence of Asian

and European markets, as illustrated in Figure 5.

However, we did not see the complete convergence of

all regional gas prices, as we did in 2009 in the depths

of the worldwide recession. The difference lies in the

contribution of the ‘shale gas revolution’ in lowering

the cost structure of North American supply and in

underpinning investment in new LNG export facilities

on the US Gulf coast. The first LNG exports from the

US are expected towards the end of 2015 when the

first train of Cheniere’s Sabine Pass liquefaction plant

is commissioned.

The sharp weakening of European hub prices and Asian

spot LNG prices preceded the collapse in oil prices,

but the decline was later reinforced by oil market

over-supply and low oil prices. By the beginning of this

year, the Asian spot price premium over NBP had almost

disappeared entirely after more than three years of

tightness in LNG markets. US gas prices, represented by

Henry Hub front month futures, also weakened from a

winter peak in the first quarter of 2014 and settled back

below $3/m BTU in 2015. The US economy continues

to enjoy a gas cost advantage over European and Asian

markets, which is reflected in much lower wholesale

electricity prices, but the advantage narrowed in 2014

to a level last seen in 2010.

UK NBP Wholesale Prices Reflect European

Demand Weakness

Almost all gas production from the UKCS is sold at

prices explicitly related to prices at the NBP, the virtual

hub based on the National Transmission System (NTS)

owned and operated by National Grid. In 2014, UK gas

production of 34.8 billion cubic metres (bcm) accounted

0

2

4

6

8

10

12

14

16

18

20

22

2008

2009

2010

2011

2012

2013

2014

2015

Gas Price ($/Million BTU)

NBP Month Ahead

Henry Hub Front Month

Far East Spot LNG

Source: ICIS Heren, NYMEX

Figure 5: Regional Gas and Liquefied Natural Gas Prices,

January 2008 to August 2015

1

2

3

4

5

6

7

8

9

10