ECONOMIC REPORT 2015

12

US Oil Production Expected to Peak in 2015

Analysis of the oil price collapse has naturally focused

on the US ‘shale revolution’ and the change in OPEC

market strategy against the background of a marked

slowdown in world oil demand growth in 2014.

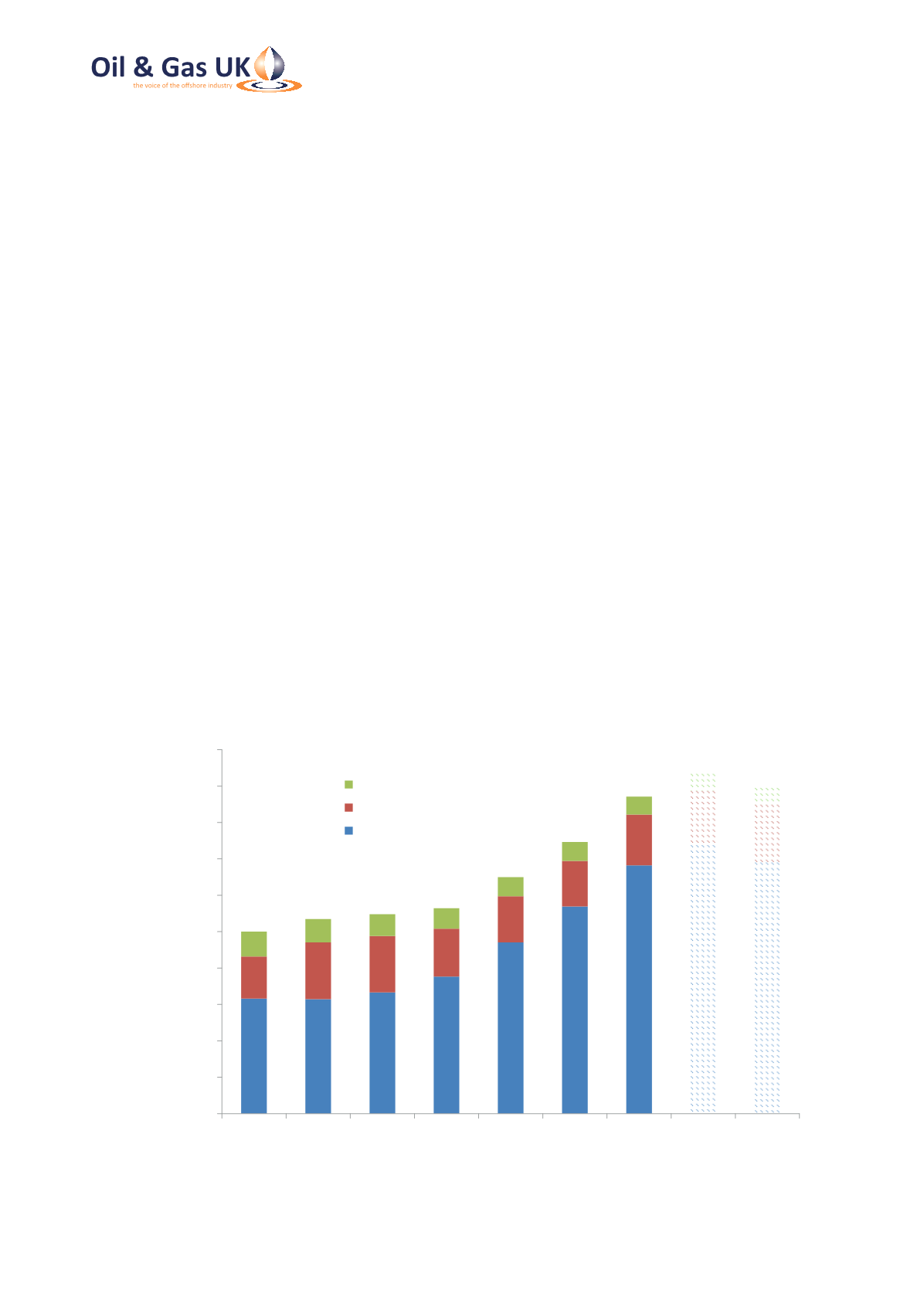

Between 2010 and 2014, US crude oil production rose

from 5.5 million barrels per day (mb/d) to 9.5 mb/d as

tight oil output from shale formations grew steadily.

The effect of this investment-led increase in US output

was to reduce US import demand and to intensify

competition among crude oil suppliers in international

markets, especially those in the Atlantic Basin forced to

look for new buyers in Asia.

Since crude prices began to fall in mid-2014, the key

question in oil markets has been the extent and speed

of response from US tight oil production. The monthly

data from the US Energy Information Administration

(EIA) is beginning to provide some answers but market

opinion remains divided over the sustainability of US

tight oil output at an oil price of $40-60/bbl for WTI

(West Texas Intermediate).

US oil-directed drilling declined by 60 per cent between

October 2014 and mid-2015. However, total US tight oil

production continued to rise until April 2015, sustained

by existing financial hedging of cash flows, renewed cost

reduction in drilling and well completion, and a focus on

more productive plays. From April, output in the prolific

Bakken and Eagle Ford regions started to decline but the

larger Permian region had yet to record any reversal.

The EIA is now forecasting a modest decline in total US

crude production in 2016 for the first time since 2008,

coupled with an average Brent price of $54/bbl in 2015

and $59/bbl in 2016.

OPEC Holds Firm to New Market Strategy

OPEC’s decision in November 2014 to maintain its

production and restore its market share marked a

decisive moment in its recent history. The change of

market strategy to put pressure on high-cost sources

of non-OPEC supply was confirmed in June 2015 when

OPEC maintained its official ceiling of 30 mb/d and

continued to produce at more than 31 mb/d, almost

2 mb/d more than the underlying demand for its

crude oil needed to balance the short-term market.

0

1

2

3

4

5

6

7

8

9

10

2008 2009 2010 2011 2012 2013 2014 2015 2016

Total Production (Billion boe)

Alaska

Gulf of Mexico

Lower 48 Onshore

Source: EIA (Short Term Energy Outlook August 2015)

Figure 2: US Crude Oil Production