ACTIVITY SURVEY

2016

page 44

Capital Investment

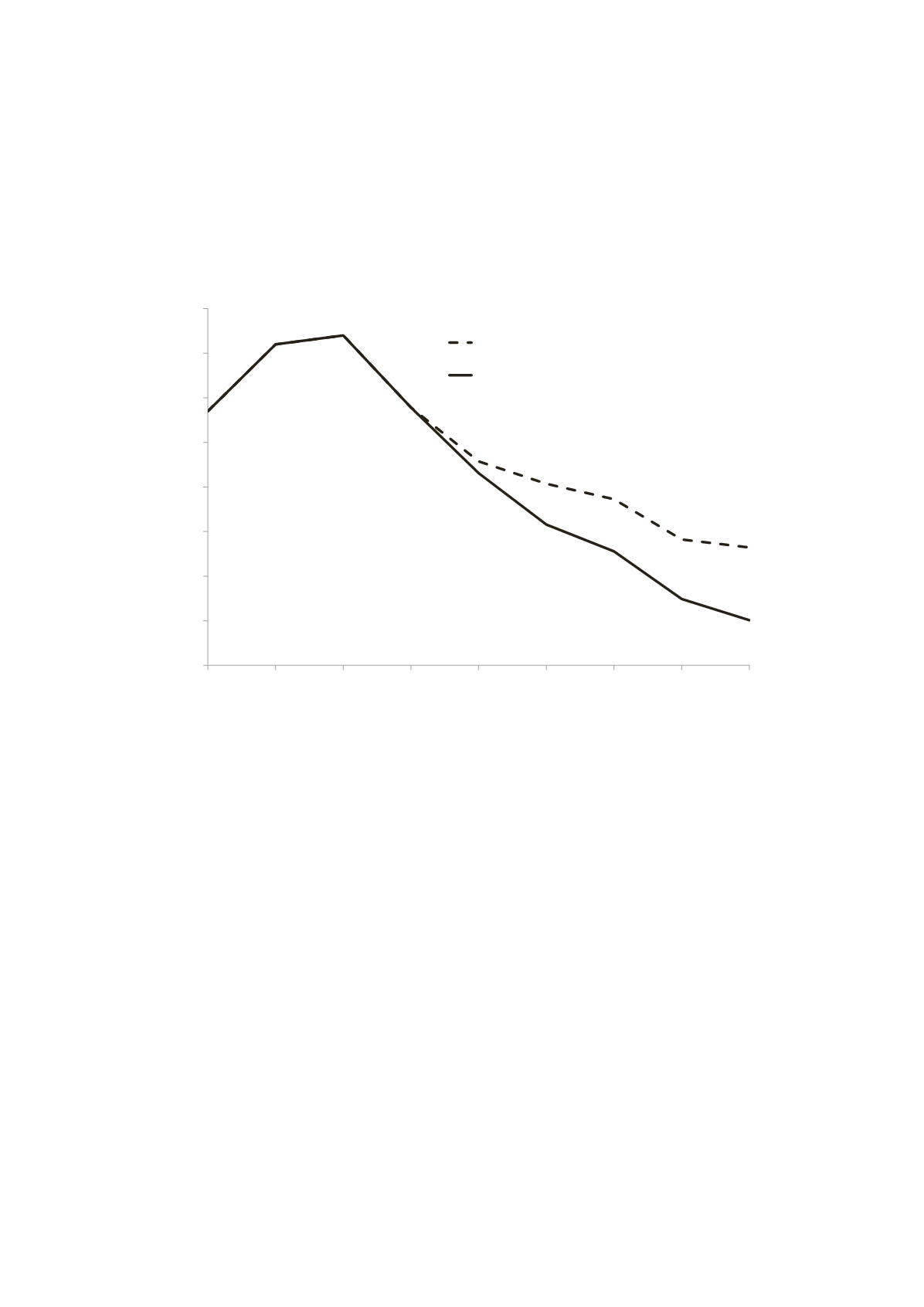

Capital investment in the UKCS is forecast to fall rapidly following years of record expenditure. After peaking at

£14.8 billion in 2014, capital investment declined to £11.6 billion in 2015 and is likely fall to less than £10 billion

this year.

Figure 33: Capital Investment Outlook

0

2

4

6

8

10

12

14

16

2012

2013

2014

2015

2016

2017

2018

2019

2020

Capital Investment (£ Billion - 2015 Money)

Potential Upside from Projects yet to be Sanctioned

Sanctioned Only

Source: Oil & Gas UK

The near-term outlook is dominated by capital committed to ongoing developments that have already been

sanctioned (£38 billion of new capital was approved from 2010 to 2014 and over one fifth of this is still to be

spent), as well as non-discretionary investment required to keep existing assets operational.

However, very little new investment is available in current market conditions. As shown in Figure 34 opposite,

Oil & Gas UK forecasts that less than £1 billion of new capital will be sanctioned in 2016. This reflects a scarcity

of capital globally across the oil and gas industry, primarily due to the price fall, but also the lack of attractive

investment opportunities on the UKCS, which is of serious concern. The basin risks another production collapse at

the start of the next decade if new development opportunities do not begin to be delivered now.

Industry, government and the regulator must look at how they can improve the competitiveness of UKCS

opportunities relative to those in other basins worldwide. Industry must continue to reduce costs and improve

efficiency but this alone will not be enough. The fiscal and regulatory regimes must transform the UKCS into a

highly competitive, low tax, high activity basin, which is attractive to a variety of operators and supports the

supply chain.