ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

110

111

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

1.5 New standards and amendments adopted

The following amendments to existing standards that are relevant to group have been adopted on January 2016:

2.

Business performance

STANDARD

NATURE OF CHANGE

IMPACT

DATE OF ADOPTION

Amendment to IAS 7

Statement of Cash Flows

The amendment requires to explain changes

in liabilities arising from financing activities.

The group has early adopted the amendments

made to IAS 7 and revised its net debt

disclosures to comply with new requirements.

1 January 2016

Amendment to IAS 1

Presentation of financial

statements

Part of IASB “Disclosure initiative” to improve

presentation and disclosures in financial

reports. The amendment provides prepares

with more flexibility in presenting the

information in financial reports.

The group has reviewed the content and

structure of the financial statements in order to

provide users with a clearer understanding of

what drives financial performance. Immaterial

disclosures that may undermine the usefulness

of the financial reports have been removed

and the notes to the financial statements have

been reorganised into sections to assist users

in understanding the group performance.

1 January 2016

Annual improvements to IFRSs

2012–2014 cycle

The amendments primarily remove

inconsistencies, provide additional guidance

and clarify wording of standards.

The adoption of improvements did not have

any impact on the group’s financial

statements.

1 January 2016

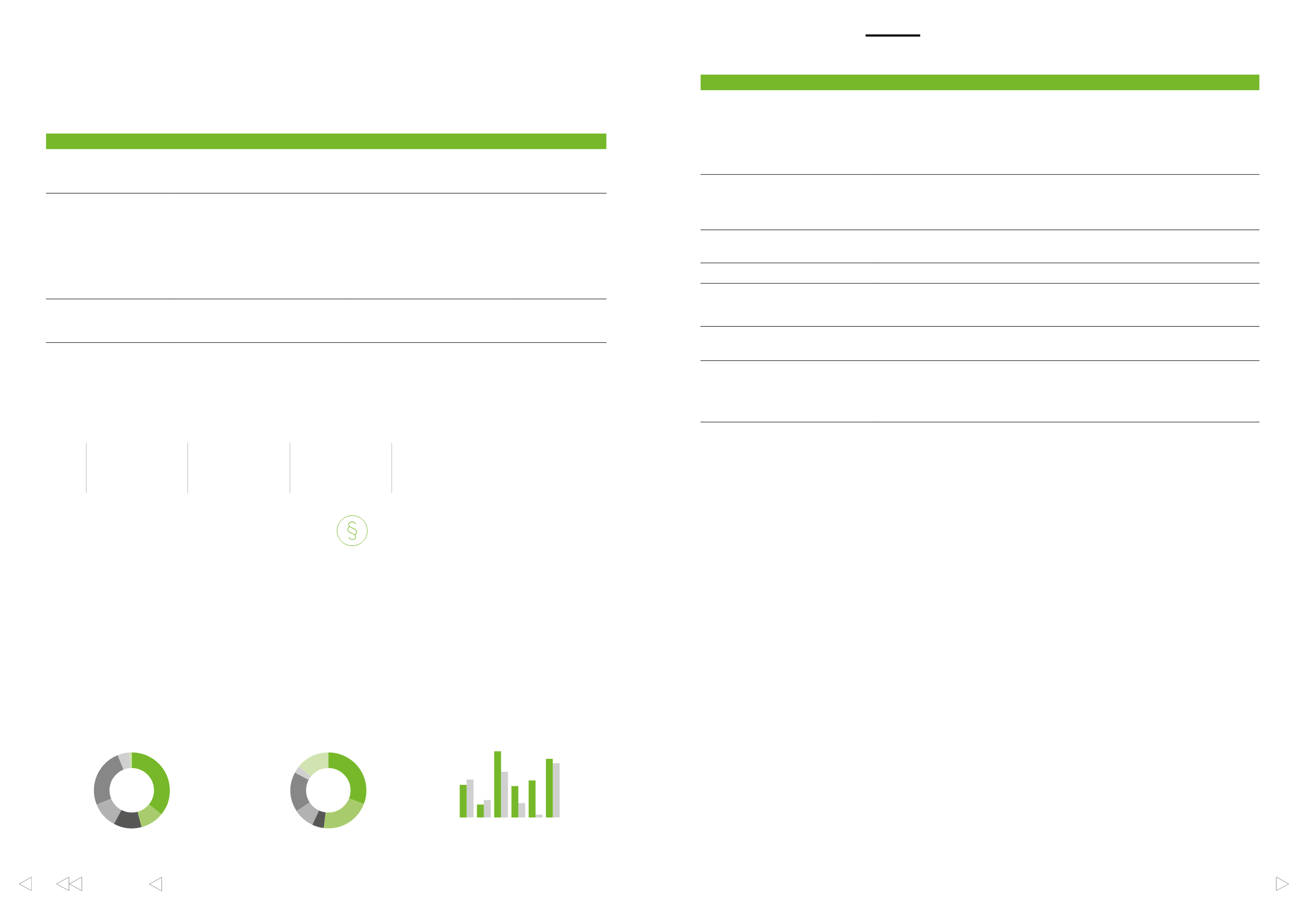

2.1 Business areas

UPM business portfolio consist of six competitive businesses with

strong market positions. UPM reports financial information for the

following business areas (segments): UPM Biorefining, UPM Energy,

UPM Raflatac, UPM Specialty Papers, UPM Paper ENA, UPM Plywood

and Other operations. UPM has production plants in 12 countries. The

group’s most important markets are Europe, North America and Asia.

to be updated

UPM Biorefining 36%

Other operations 1%

UPM Plywood 5%

UPM Paper ENA

25%

UPM Energy 10%

UPM Raflatac 12%

UPM Specialty

Papers 11%

Comparable EBIT 2016

EUR 1,143 million

to be updated

UPM Biorefining 31%

Other operations 14%

UPM Plywood

3%

UPM Paper

ENA 17%

UPM Energy 21%

UPM Raflatac 5%

UPM Specialty

Papers 9%

Capital employed 31 Dec 2016

EUR 10,657 million

BUSINESS AREA

DESCRIPTION AND PRODUCTS

UPM Biorefining

UPM Biorefining consists of UPM Pulp, UPM Biofuels and UPM Timber business units. UPM has three pulp

mills in Finland, one pulp mill and plantation operations in Uruguay, four saw mills in Finland and one

biorefinery in Finland. UPM Pulp serves the global market with a comprehensive assortment of

sustainably produced eucalyptus, birch and softwood pulp grades for a variety of tissue, specialty paper,

board, printing and writing paper and other applications. UPM Biofuels produces innovative, advanced

biofuels for transport. UPM Timber manufactures certified sawn timber from Nordic pine and spruce to

joinery, packaging, distribution and construction industries.

UPM Energy

UPM Energy produces low emission electricity to the Nordic market. UPM Energy is the second largest

electricity producer in Finland. UPM Energy operations include electricity generation, and operations in

both physical electricity and financial portfolio management. UPM Energy assets consists of hydro power

assets in Finland and shareholdings in energy companies.

UPM Raflatac

UPM Raflatac is one of the world’s leading producers of self-adhesive label materials. UPM Raflatac

supplies high-quality film and paper label stock for consumer product and industrial labelling.

UPM Paper ENA

UPM Paper ENA (Europe & North America) is the world’s leading producer of graphic papers.

UPM Plywood

UPM Plywood manufactures high-quality plywood and veneer products mainly for construction and

transport industries and the new thermo-formable wood material for the form pressing industry.

Production facilities are located in Finland, Estonia and Russia.

UPM Specialty Papers

1)

UPM Specialty Papers produces fine papers to Asian markets and label and packaging materials to

global markets. Responsibly produced high performance papers are manufactured in China and Finland.

Other operations

Other operations include wood sourcing and forestry, UPM Biocomposites, UPM Biochemicals business

units and group services. Wood sourcing operations source wood raw material for sustainable and

recyclable UPM products. UPM Biocomposites combines cellulose fibres and polymers into new high-

performance products and materials. UPM Biochemicals wood-based biochemicals offer truly

sustainable, competitive and high-quality solutions for various industries and applications.

1)

In 2016, UPM Paper Asia business area has been renamed UPM Specialty Papers. The new name highlights the business area’s strategic focus on specialty papers

and global operations.

Key performance indicators and financial targets

UPM presents comparable performance measures to reflect the

underlying business performance and to enhance comparability from

period to period. However the comparable performance measures

used by management should not be considered in isolation as a

substitute for measures of performance in accordance with IFRS.

Business area information including description of items affecting

comparability is presented below.

Accounting policies

UPM business areas are reported consistently with the internal

reporting provided to UPM’s President and CEO who is responsible

for allocating resources and assessing performance of the business

areas. Internal reporting is prepared under the same basis as the

consolidated accounts, except for a joint operation, Madison Paper

Industries (MPI) which is consolidated as a subsidiary in the UPM

Paper ENA reporting. Costs, revenues, assets and liabilities are

allocated to business areas on a consistent basis. The sales

transactions between business areas are based on market prices,

and they are eliminated on consolidation.

UPM Energy

UPM Raflatac

UPM Specialty Papers

UPM Paper ENA

UPM Plywood

UPM Biorefining

■

2016

■

2015

%

Comparable ROCE

30

24

18

12

6

0

UPM targets top performance at the business area level in their

respective markets. Financial target setting, follow up and allocation

of resources in the group’s performance management process is

mainly based on the business areas’ comparable EBIT and

comparable ROCE.

Sales

EUR

9,812m

(EUR 10,138m)

Comparable EBIT

EUR

1,143m

(EUR 916m)

Comparable ROE

10.9%

(9.5%)