ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

118

119

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

President and CEO Jussi Pesonen

Other members of group executive team

1)

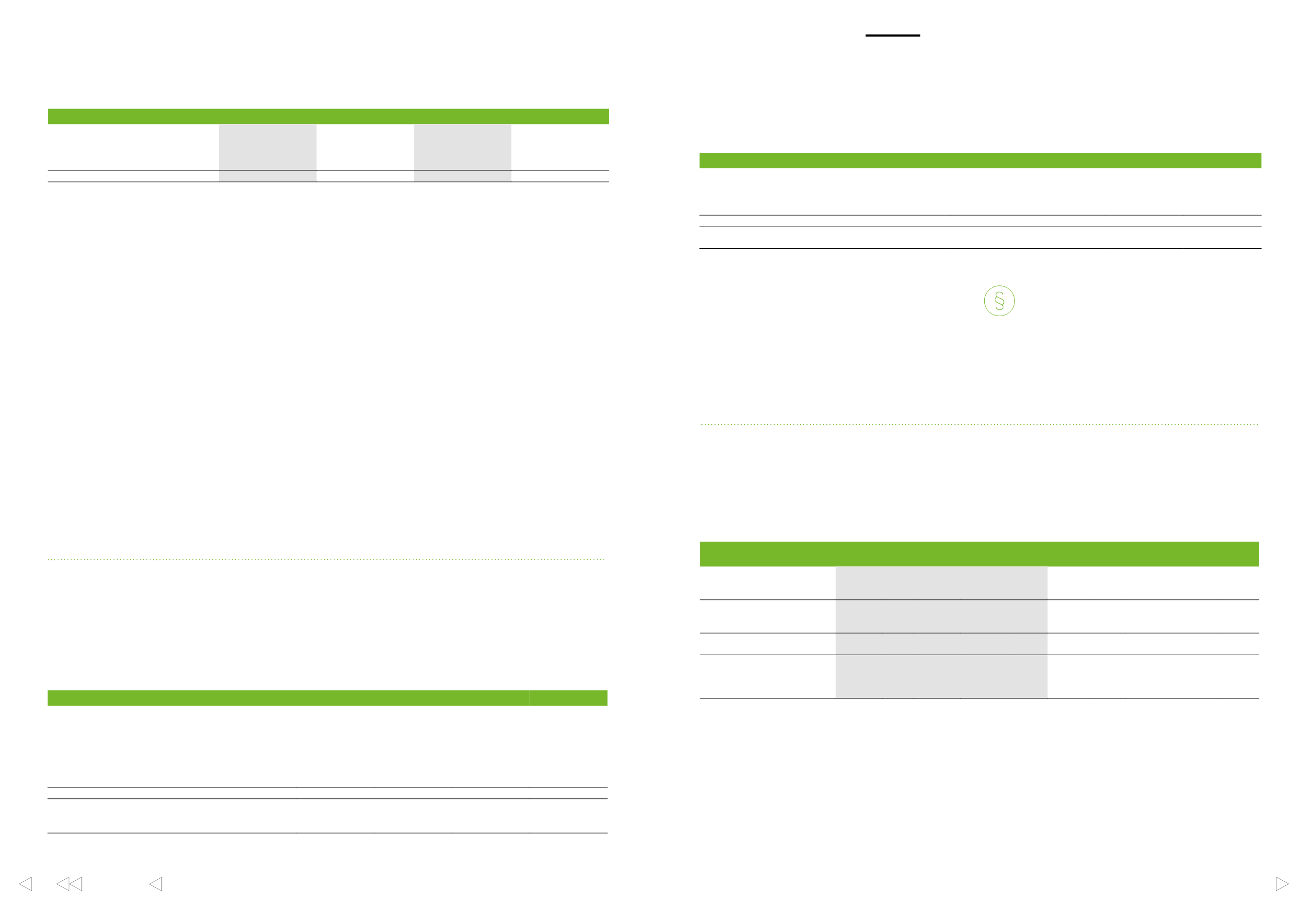

EUR 1,000

2016

2015

2016

2015

Salaries

1,049

1,052

3,564

3,455

Incentives

888

856

1,779

1,733

Share rewards

3,098

824

6,269

1,805

Benefits

30

27

231

238

Total

5,065

2,759

11,843

7,231

1)

11 members in 2016 and 2015.

In 2016, costs under the Finnish statutory pension scheme for the

President and CEO amounted to EUR 370,000 (353,000) and

payments under the voluntary pension plan were EUR 1,000,000

(1,000,000).

In 2016, costs under the Finnish and German statutory pension

schemes for Group Executive Team (GET) members (excluding the

President and CEO) amounted to EUR 881,000 (900,000) and costs

under the voluntary pension plan were EUR 818,000 (651,000).

The total remuneration of the President and CEO and the members

of the Group Executive Team consists of base salary and benefits,

short-term incentives and long-term share-based incentives.

The short-term incentive plan for the President and CEO and the

members of the Group Executive Team has been linked with

achievement of the predetermined financial targets of the group or

business areas and individual targets. The incentives amount to a

total maximum of 100% of annual base salary to the business area

executives and to a total maximum of 70% of annual base salary to

the other members of the Group Executive Team. For the President

and CEO the maximum annual incentive amounts to 150% of the

annual base salary.

The expenses recognised in income statement in respect of share-

based payments for the Group Executive Team were EUR 9.2 million

(5.4 million).

In accordance with his service contract, the retirement age of the

President and CEO Jussi Pesonen, is 60. For the President and CEO,

the target pension is 60% of the average indexed earnings from the

last ten years of employment calculated according to the Finnish

statutory pension scheme. The costs of lowering the retirement age to

60 is covered by supplementing the statutory pension with a voluntary

defined benefit pension plan. Should the President and CEO leave the

company before reaching the age of 60, an immediate vesting right

corresponding to 100% of earned pension (pro rata) will be applied.

The retirement age of the other members of the Group Executive Team

is 63. The expenses of the President and CEO’s defined benefit pension

plan in 2016 were EUR 0.5 million (0.6 million), and the plan assets

amounted to EUR 2.6 million (1.6 million) and obligation to EUR 1.8

million (0.9 million). Other Group Executive Team members are under

defined contribution plans.

In case the notice of termination is given to the President and CEO,

a severance pay of 24 months' base salary will be paid in addition to

the salary for six months' notice period. Should the President and CEO

give a notice of termination to the company, no severance pay will be

paid in addition to the salary for the notice period. For other members

of the Group Executive Team, the period for additional severance pay

is 12 months, in addition to the six months’ salary for the notice period,

unless notice is given for reasons that are solely attributable to the

executive.

If there is a change in the control over the company, the President

and CEO may terminate his service contract within three months and

each member of the Group Executive Team may terminate his/her

service contract within one month from the date of the event that

triggered the change of control and shall receive compensation

equivalent to 24 months' base salary.

PERFORMANCE SHARE PLANS

PSP 2013-2015

PSP 2014-2016

PSP 2015-2017

PSP 2016-2018

No. of participants at 31 December 2016

33

24

24

24

Actual achievement

90.4%

100%

–

–

Max no. of shares to be delivered

1)

to the President and CEO

197,976

116,785

125,000

112,500

to other members of GET

397,760

352,689

380,000

360,000

to other key individuals

402,280

280,284

295,000

263,000

Total max no. of shares to be delivered

998,016

749,758

800,000

735,500

Share delivery (year)

2016

2017

2018

2019

Earning criteria (weighting)

Operating cash

flow (60%) and

EPS (40%)

Total shareholder

return (100%)

Total shareholder

return (100%)

Total shareholder

return (100%)

1)

For PSP 2013–2015 and PSP 2014–2016, the gross amount of the actual no. of shares earned.

3.3 Share-based payments

UPM offers reward and recognition with an emphasis of high

performance. All UPM’s employees belong to a unified annual Short

Term Incentive (STI) scheme. In addition, UPM has two long-term

incentive plans: the Performance Share Plan (PSP) for senior executives

and the Deferred Bonus Plan (DBP) for other key employees.

Performance Share Plan

The Performance Share Plan (PSP) is targeted at Group Executive Team

members and other selected members of the management. Under the

ongoing plans the UPM shares are awarded based on the total shareholder

return during a three-year earning period. The earned shares are delivered

after the earning period has ended. Total shareholder return takes into

account share price appreciation and paid dividends.

Salaries, fees and other benefits to the President and CEO and the Group Executive Team

3.4 Retirement benefit obligations

The group operates various pension schemes in accordance with local

conditions and practices in the countries of operations. Retirement

benefits are employee benefits that are payable usually after the

termination of employment, such as pensions and post-employment

2016

2015

EURm

FINLAND UK GERMANY

OTHER

COUNTRIES TOTAL

FINLAND UK GERMANY

OTHER

COUNTRIES TOTAL

Present value of funded

obligations

327 563

34

39

963

314 504

29

41

888

Fair value of plan assets

–396 –426

–3

–33 –858

–406 –409

–2

–34 –851

Deficit (+)/surplus (-)

–70 137

31

6

104

–92

95

27

7

37

Present value of unfunded

obligations

–

–

520

90

610

–

–

490

92 582

Net defined benefit liability (+)/

asset (-)

–70 137

552

96

714

–92

95

517

99

619

Net retirement benefit asset in the

balance sheet

–70

–

–

–1

–71

–92

–

–

–1

–93

Net retirement benefit liability in

the balance sheet

1)

– 137

552

95 784

–

95

517

100

712

1)

Net retirement benefit liability in the balance sheet includes other long-term employee benefits of EUR 33 million (35 million) in 2016.

DEFERRED BONUS PLANS

DBP 2013

DBP 2014

DBP 2015

DBP 2016

No. of participants (at grant)

560

395

350

340

No. of participants (at 31 December 2016)

505

367

339

335

Max no. of shares to be delivered (at grant)

1,640,000

950,000

800,000

770,000

Estimated no. of shares to be delivered at 31 December 2016

1)

255,451

317,125

386,432

323,017

Share delivery (year)

2016

2017

2018

2019

Earning criteria (weighting)

Group/Business

area EBITDA

Group/Business

area EBITDA

Group/Business

area EBITDA

Group/Business

area EBITDA

1)

For DBP 2013 and DBP 2014, the gross amount of the actual no. of shares earned.

The indicated actuals and estimates of the share rewards under the

Performance Share Plan and the Deferred Bonus Plan represent the

gross amount of the rewards of which the applicable taxes will be

deducted before the shares are delivered to the participants. The

amount of estimated payroll tax accruals accounted for as share-

based payment liabilities at 31 December 2016 were EUR 22.7

million (14.7 million).

Deferred Bonus Plan

The Deferred Bonus Plan (DBP) is targeted at other selected key

employees of the group and it consists of annually commencing plans.

Deferred Bonus Plan share incentives are based on achievement of

group and /or business area EBITDA targets. Each plan consists of

a one-year earning period and a two-year restriction period. Prior to

share delivery, the share rewards earned are adjusted with dividends

and other capital distributions, if any, paid to all shareholders during

the restriction period.

Accounting policies

The group’s long-term share incentive plans are recognised as equity-

settled or cash-settled share-based payment transactions depending

on the settlement. Shares are valued using the market rate on the

grant date. The settlement is a combination of shares and cash.

The group may obtain the necessary shares by using its treasury

shares or may purchase shares from the market. PSP and DBP share

deliveries are executed by using already existing shares and the

plans, therefore, have no dilutive effect.

medical care. The pension plans are generally funded through

payments to insurance companies or to trustee-administered funds or

foundations and classified as defined contribution plans or defined

benefit plans.

Defined benefit assets and liabilities recognised in the balance

sheet are presented below:

About 90% of the group’s defined benefit arrangements exist in

Finland, in the UK and in Germany. The group has defined benefit

obligations also in Austria, Holland, France, Canada and in the US.

Approximately a quarter of UPM´s employees are active members of

defined benefit arrangement plans.

Finland

In Finland employers are obliged to insure their employees for

statutory benefits, as determined in Employee’s Pension Act (TyEL).

TyEL provides the employee with insurance protection for old age,

disability and death. The benefits can be insured with an insurance

company or the employer can establish a fund or a foundation to

manage the statutory benefits.

Approximately 90% of group´s Finnish employees are insured with

an insurance company and these arrangements qualify as defined

contribution plans. Approximately 10 % of employees are insured

with TyEL foundation (Kymin eläkesäätiö). The TyEL foundation is

administered by the representatives of both the employer and the

employees. The foundation has named an authorised representative to

take care of its regular operations. The plan is supervised by Financial

Supervisory Authority. The foundation is classified as a defined

benefit plan for the benefits that must be funded nationally and is the