ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

128

129

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

UPM has undergone several restructurings in recent years including

mill closures and profit improvement programs. Restructuring

provisions recognised include various restructuring activities including

dismantling costs. Termination provisions include severance payments,

unemployment compensations or other arrangements for employees

leaving the company. In Finland termination provisions include also

unemployment arrangements and disability pensions. Unemployment

provisions in Finland are recognised 2–3 years before the granting

and settlement of the compensation.

At 31 December 2016, restructuring provisions and termination

provisions relate mainly to capacity closures in UPM Paper ENA

business area. In 2016, UPM has closed Madison paper mill in the

US. Paper machine 3 at UPM Steyrermühl mill in Austria and paper

machine 2 at UPM Augsburg mill in Germany closures are planned

to take place in 2017. Total provisions made relating to these closures

amounted to EUR 53 million in 2016. At 31 December 2015,

restructuring provisions and termination provisions related mainly to

mill closures of prior years and operational restructuring in Finland

and France.

The group recognises provisions for normal environmental

remediation costs expected to be incurred in a future period upon a

removal of non-current assets and restoring industrial landfills where

a legal or constructive obligation exists.

Other provisions are mainly attributable to onerous contracts and

will be incurred over a period longer than one year.

Provisions for emissions include liability to cover the obligation to

return emission rights. The group possesses emission rights amounting

to EUR 45 million (52 million) as intangible assets.

» Refer Note 2.3

Operating expenses and other operating income, for further

information on emission rights.

Accounting policies

A provision is recognised when a present legal or constructive

obligation exists as a result of a past event and it is probable that

an outflow of resources will be required to settle the obligation and

the amount can be reliably estimated. Provisions are split between

amounts expected to be settled within 12 months of the balance sheet

date (current) and amounts expected to be settled later (non-current).

Restructuring and termination provisions

A restructuring provisions is recognised when a detailed plan for the

implementation of the measures is complete and when the plan has

been communicated to those who are affected. Employee termination

provisions are recognised when the group has communicated the plan

to the employees.

Environmental provisions

Environmental expenditures that relate to an existing condition

caused by past operations that do not contribute to future earnings

are expensed. The recognition of environmental provisions is based

on current interpretations of environmental laws and regulations.

Such provisions are recognised when the group has an obligation to

dismantle and remove a facility or an item of plant and to restore the

site on which it is located. The amount recognised is the present value

of the estimated future expenditure determined in accordance with

local conditions and requirements. A corresponding item of property,

plant and equipment of an amount equivalent to the provision is also

recognised and subsequently depreciated as part of the asset.

Provisions do not include any third-party recoveries.

Emission provisions

Emission obligations are recognised in provisions based on realised

emissions. The provision is measured at the carrying amounts of the

corresponding emission rights held, which are recognised as

intangible assets. In case of deficit in emission rights, the shortage

is valued at the market value at the balance sheet date.

Key estimates and judgements

Environmental provisions

The estimates used in determining the provisions are based on the

expenses incurred for similar activities in the current reporting period

taking into account the effect of inflation, cost-base development and

discounting. Because actual outflows can differ from estimates due to

changes in laws, regulations, public expectations, technology, prices

and conditions, and can take place many years in the future, the

carrying amounts of provisions are regularly reviewed and adjusted

to take into account of any such changes. The discount rate applied

is reviewed annually.

The group aims to operate in compliance with regulations related

to the treatment of waste water, air emissions and landfill sites.

However, unexpected events during production processes and waste

treatment could cause material losses and additional costs in the

group’s operations.

Legal contingencies

Management judgement is required in measurement and recognition

of provisions related to pending litigation. Provisions are recorded

when the group has a present legal or constructive obligation as

a result of past event, an unfavourable outcome is probable and

the amount of loss can be reasonably estimated. Due to inherent

uncertain nature of litigation, the actual losses may differ significantly

from the originally estimated provision.

» Refer Note 9.2

Litigation for

details of legal contingencies.

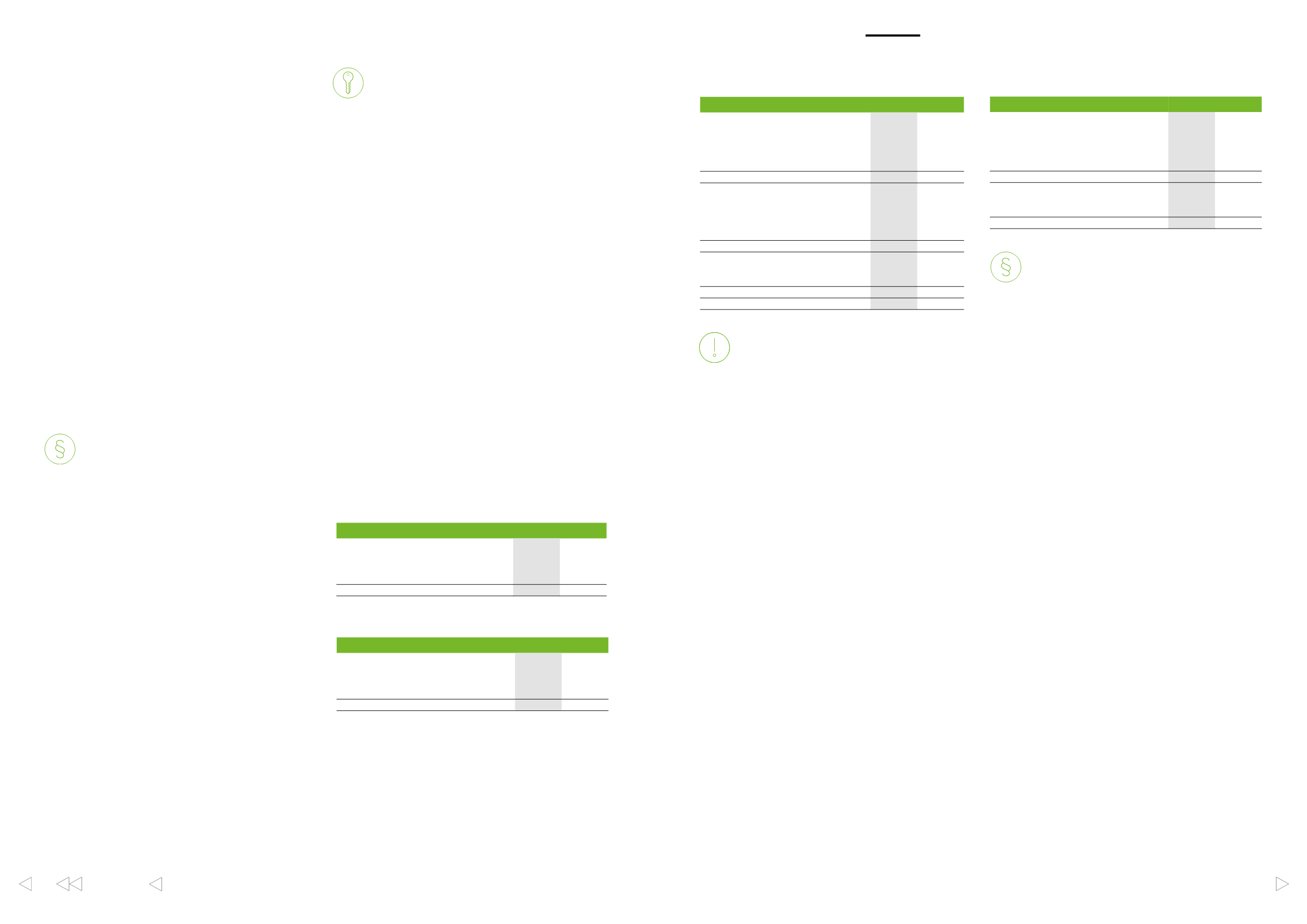

EURm

2016

2015

Inventories

1,346

1,376

Trade receivables

1,360

1,436

Trade payables

–994

–917

Advances received

–19

–20

Total

1,694

1,875

EURm

2016

2015

Raw materials and consumables

625

646

Work in progress

54

54

Finished products and goods

645

642

Advance payments

23

34

Total

1,346

1,376

EURm

2016

2015

Trade receivables

Undue

1,211

1,193

Past due up to 30 days

114

159

Past due 31–90 days

17

45

Past due over 90 days

18

39

Total trade receivables

1,360

1,436

Prepayments and accrued income

Personnel expenses

5

9

Interest income

1

3

Energy and other excise taxes

60

66

Other items

69

56

Total prepayments and accrued income

134

134

Other receivables

VAT and other indirect taxes receivable

170

131

Other

62

42

Total other receivables

231

173

Total

1,726

1,743

4.6 Working capital

The group defines operating working capital as inventories, trade

receivables and trade payables which are presented separately

below. UPM is focusing on working capital efficiency and targeting

a sustainable and permanent reduction in operating working capital.

Operational credit risk

Operational credit risk is defined as the risk where UPM is not able to

collect the payments for its receivables. The group has a credit policy

in place and the exposure to credit risk is monitored on an ongoing

basis. Outstanding trade receivables, days of sales outstanding (DSO)

and overdue trade receivables are followed on monthly basis.

Potential concentrations of credit risk with respect to trade and other

receivables are limited due to the large number and the geographic

dispersion of customers. Customer credit limits are established and

monitored, and ongoing evaluations of their financial condition is

performed. Most of the receivables are covered by trade credit

insurances. In certain market areas, including Asia and Northern

Africa, measures to reduce credit risks include letters of credit,

prepayments and bank guarantees. Maximum exposure to credit risk,

without taking into account any credit enhancements, is the carrying

amount of trade and other receivables.

UPM does not have significant concentration of customer credit

risk. The ten largest customers accounted for approximately 18%

(20%) of the trade receivables as at 31 December 2016 – i.e.,

approximately EUR 239 million (285 million).

In 2016, trade receivables amounting to EUR 10 million (18 million)

were impaired and the loss was recorded under other costs and

expenses. Impairment is recognised when there is objective evidence

that the group is not able to collect the amounts due. There are no

indications that the debtors will not meet their payment obligations

with regard to trade receivables that are not overdue or impaired at

31 December 2016.

EURm

2016

2015

Accrued expenses and deferred income

Personnel expenses

212

203

Interest expenses

30

35

Indirect taxes

5

4

Customer rebates and other items

205

188

Total accrued expenses and deferred income

451

430

Advances received

19

20

Trade payables

994

917

Other current liabilities

130

96

Total

1,594

1,463

Operating working capital

Inventories

Trade and other receivables

Trade and other payables

Accounting policies

Inventories

Inventories are stated at the lower of cost and net realisable value.

Cost is determined by the method most appropriate to the particular

nature of inventory, the first-in, first-out (FIFO) or weighted average

cost. The cost of finished goods and work in progress comprises raw

materials, direct labour, other direct costs and related production

overheads (based on normal operating capacity) but excludes

borrowing costs. Net realisable value is the estimated selling price

in the ordinary course of business, less the costs of completion and

selling expenses. If the net realisable value is lower than cost,

a valuation allowance is established for inventory obsolescence.

Trade receivables

Trade receivables arising from selling goods and services in the

normal course of business are recognised initially at fair value and

subsequently measured at amortised cost, less a provision for

impairment. Provision for impairment is charged to the income

statement when there is objective evidence that the group will not

be able to collect all amounts due according to the original terms of

receivables. In determining the recoverability of trade receivables the

group considers any change to the credit quality of trade receivables.

Significant financial difficulties of the debtor, probability that the

debtor will enter bankruptcy, or default or delinquency in payments

more than 90 days overdue are considered indicators that the trade

receivable may be irrecoverable. Subsequent recoveries of amounts

previously written off are credited to the income statement. The

carrying amount of trade receivables approximates to their fair value

due to the short-term nature of the receivables.

Trade payables

Trade payables arise from purchase of inventories, fixed assets and

goods and services in the ordinary course of business from UPM’s

suppliers. Trade and other payables are classified as current liabilities

if they are due to be settled within the normal operating cycle of the

business or within 12 months from the balance sheet date. Trade

payables are recognised initially at fair value and subsequently

at amortised cost using the effective interest method. The carrying

amount of trade payables approximates to their fair value due to the

short-term nature of the payables.