ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

136

137

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

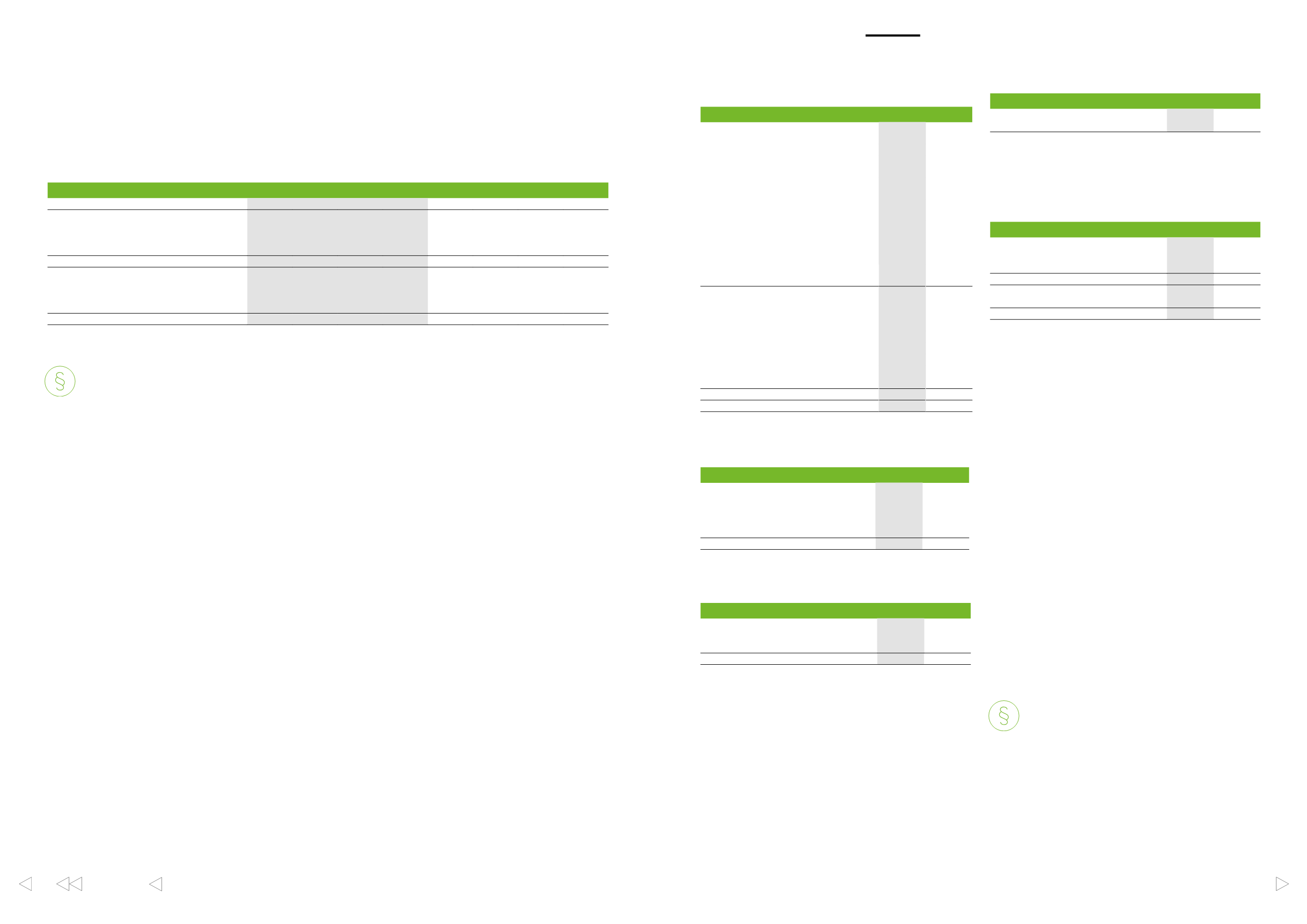

5.4 Financial income and expenses

EURm

2016

2015

Exchange rate and fair value gains and

losses

Derivatives, non-qualifying hedges

–47

85

Fair value gains and losses on derivatives

designated as fair value hedges

–64

–13

Fair value adjustment of debt attributable to

interest rate risk

55

5

Fair value adjustment of firm commitments

attributable to foreign exchange rate risk

–

3

Exchange gains and losses on financial

liabilities measured at amortised costs

13

–105

Exchange gains and losses on loans and

receivables

36

13

Other exchange rate and fair value gains and

losses

–

13

–7

1

Interest and other finance costs, net

Interest expense on financial liabilities

measured at amortised cost

–111

–122

Interest income on derivatives

60

75

Interest income on loans and receivables

4

5

Dividend income from energy shareholdings

2

–

Losses on sale of associates and joint ventures

–4

–

Other financial expenses, net

–

–26

–49

–68

Total

–56

–67

EURm

2016

2015

Cash flow hedges reclassified from hedging

reserve

–38

–107

Cash flow hedges recognised directly in

operating profit

–4

6

Non-qualifying hedges

28

–78

Total

–14

–179

EURm

2016

2015

Sales

9

–100

Other operating income

6

18

Financial income and expenses

3

6

Total

17

–76

5.5 Share capital and reserves

The company has one series of shares and each share carries one

vote. There are no specific terms related to the shares except for the

redemption clause as discussed under

» Shares section

in the Report

of the Board of Directors. At 31 December 2016, the number of the

company’s shares was 533,735,699. The shares do not have any

nominal counter value. The shares are included within the book entry

system for securities.

2016

2015

Number of shares (1,000)

533,736 533,736

Share capital, EURm

890

890

Treasury shares

At 31 December 2016, the company held 230,737 (230,737) of its

own shares, 0.04% (0.04%) of the total number of shares.

Reserve for invested non-restricted equity

Reserve for invested non-restricted equity includes, under the

Companies’ Act, the exercise value of shareholders’ investments

in the company unless otherwise decided by the company.

Translation reserve

This reserve includes the foreign currency differences arising from

the translation of foreign operations, and the effective result of

transactions that hedge the group’s net investments in foreign

operations.

Hedging reserve

This reserve comprises the cumulative net change in the fair value

of the effective portion of cash flow hedging instruments related to

hedged transactions that have not yet occurred. Amounts are

recognised in profit or loss when the associated hedged transactions

affect profit or loss or as part of the acquisition cost of property, plant

and equipment.

Fair value reserve

This reserve represents the cumulative net change in the fair value

of investments in equity securities comprising mainly of the fair value

change of the energy shareholdings. Amounts are recognised in profit

or loss if the asset is sold or impaired.

Share-based payments reserve

The share-based payments reserve is used to recognise the fair value

of the share incentive plans, Performance Share Plan and Deferred

Bonus Plan, over their vesting period.

Accounting policies

Transaction costs directly relating to the issue of new shares are

recognised, net of tax, in equity as a reduction in the proceeds.

Where any group company purchases the parent company’s shares

(treasury shares), the consideration paid, including any directly

attributable incremental costs (net of tax), is deducted from equity

attributable to the owners of the parent company until the shares are

cancelled or reissued. Where such shares are subsequently reissued,

any consideration received, net of any directly attributable

incremental transaction costs and the related income tax effects, is

included in equity attributable to the owners of the parent company.

Fair values under level 2

Observable inputs are used as basis for fair value calculations either

directly (prices) or indirectly (derived from prices). If all significant

inputs required to fair value an instrument are observable, the

instrument is included in level 2. Derivatives, level 2 include OTC

derivatives like forward foreign exchange contracts, foreign currency

options, interest and currency swaps and commodity swaps.

Specific valuation techniques used to value financial instruments at

level 2 include the following methods:

Interest forward rate agreements (FRA) are fair valued based

on quoted market rates on the balance sheet date. Forward foreign

exchange contracts are fair valued based on the contract forward

rates at the balance sheet date. Foreign currency options are fair

valued based on quoted market rates and market volatility rates on

the balance sheet date by using the Black&Scholes option valuation

model. Interest and currency swap instruments are fair valued as

present value of the estimated future cash flows based on observable

yield curves. Commodity swaps are fair valued based on forward

curve quotations received from service providers.

An embedded derivative that is by nature a foreign currency forward

contract is valuated at market forward exchange rates and is included

in level 2. Embedded derivatives are monitored by the group and the

fair value changes are reported in other operating income in the

income statement.

Fair values under level 3

Financial assets or liabilities of which fair values are not based on

observable market data (that is, unobservable inputs) are classified

under level 3. This category include UPM’s energy shareholdings and

forest assets. Fair valuations are performed at least quarterly by

respective business areas or functions. Fair valuations are reviewed by

the group finance management and overseen by the Audit Committee.

» Refer Note 4.3

Energy shareholdings and

Note 4.2

Forest assets.

EURm

2016

2015

Level 1 Level 2 Level 3

Total

Level 1 Level 2 Level 3

Total

Financial assets

Derivatives, non-qualifying hedges

2

63

–

65

6

63

–

69

Derivatives used for hedging

32

241

–

273

88

283

–

371

Energy shareholdings

–

–

1,932

1,932

–

–

2,085

2,085

Total

34

304

1,932

2,270

94

346

2,085

2,525

Financial liabilities

Derivatives, non-qualifying hedges

19

93

–

112

59

62

–

121

Derivatives used for hedging

42

94

–

136

109

89

–

198

Total

61

187

–

248

168

151

–

319

There have been no transfers between levels in 2016 and 2015.

EURm

2016

2015

Fair value reserve

1,438

1,582

Hedging reserves

–31

–104

Share-based payments reserve

9

8

Total other reserves

1,416

1,486

Reserve for invested non-restricted equity

1,273

1,273

Translation reserve

433

449

Total reserves

3,122

3,208

Accounting policies

Fair value through profit or loss

This category includes derivatives that don’t qualify hedge

accounting. They are measured at fair value and any gains or losses

from subsequent measurement are recognised in the income

statement.

Available-for-sale financial assets

This category includes mainly UPM’s energy shareholdings. These

assets are measured at fair value through other comprehensive

income.

Loans and receivables

This category comprises loan receivables with fixed or determinable

payments that are not quoted in an active market, as well as trade

and other receivables. They are included in non-current assets unless

they mature within 12 months of the balance sheet date. Loan

receivables that have a fixed maturity are measured at amortised cost

using the effective interest method. Loan receivables without fixed

maturity date are measured at amortised cost. Loan receivables are

impaired if the carrying amount is greater than the estimated

recoverable amount.

Derivatives used for hedging

All derivatives are initially and continuously recognised at fair value in

the balance sheet. Gains and losses on remeasurement of derivatives

used for hedging purposes are recognised in accordance with the

accounting principles described in

» Note 6.2

Derivatives and hedge

accounting.

Financial liabilities measured at amortised cost

This category includes debt, trade payables and other financial

liabilities.

» Refer Note 5.2

Net debt, for further information.

The different levels of fair value hierarchy used in fair value estimation

are defined as follows:

Fair values under level 1

Quoted prices (unadjusted) traded in active markets for identical

assets or liabilities. Derivatives include futures and commodity

forwards traded in exchange.

The carrying amounts of financial assets and financial liabilities

except for non-current loans approximate their fair value. The fair

value of non-current loans amounted to EUR 1,804 million (2,755

million) at the end of 2016. For quoted bonds, the fair values are

based on the quoted market value as of 31 December. At the end of

2016, all bonds were quoted. For other non-current borrowings fair

values are estimated using the expected contractual future payments

discounted at market interest rates and are categorised within level 2

of the fair value hierarchy.

»

Refer Note 5.2

Net debt, for further information on net debt and

bonds.

Fair value measurement hierarchy for financial assets and liabilities

Share capital

Reserves

Net gains and losses on derivatives included

in the operating profit

Foreign exchange gains and losses in the income statement

excluding non-qualifying hedges