ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

140

141

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

Hedges of net investments in foreign subsidiaries

The fair value changes of forward exchange contracts used in hedging

net investments that reflect the change in spot exchange rates are

recognised in other comprehensive income within translation reserve.

Any gain or loss relating to the interest portion of forward exchange

contracts is recognised immediately in the income statement under

financial items. Gains and losses accumulated in equity are included

in the income statement when the foreign operation is partially disposed

of or sold.

Fair value hedges

The group applies fair value hedge accounting for hedging fixed interest

risk on debt. Changes in the fair value of derivatives that are designated

and qualify as fair value hedges and that are highly effective both

prospectively and retrospectively are recorded in the income statement

under financial items, along with any changes in the fair value of the

hedged asset or liabilities that are attributable to the hedged risk.

The carrying amounts of hedged items and the fair values of hedging

instruments are included in interest-bearing assets or liabilities.

Derivatives that are designated and qualify as fair value hedges mature

at the same time as hedged items. If the hedge no longer meets the

criteria for hedge accounting, the adjustment to the carrying amount

of a hedged item for which the effective interest method is used is

amortised to profit or loss over the expected period to maturity.

Financial counterparty risk

The financial instruments the group has agreed with banks and financial

institutions contain an element of risk of the counterparties being

unability to meet their obligations. According to the Group Treasury

Policy derivative instruments and investments of cash funds may be

made only with counterparties meeting certain creditworthiness criteria.

The group minimises counterparty risk also by using a number of major

banks and financial institutions. Creditworthiness of counterparties is

constantly monitored by Treasury and Risk Management.

No derivatives are subject to offsetting in the group’s financial statements. All derivatives are under ISDA or similar master netting agreement.

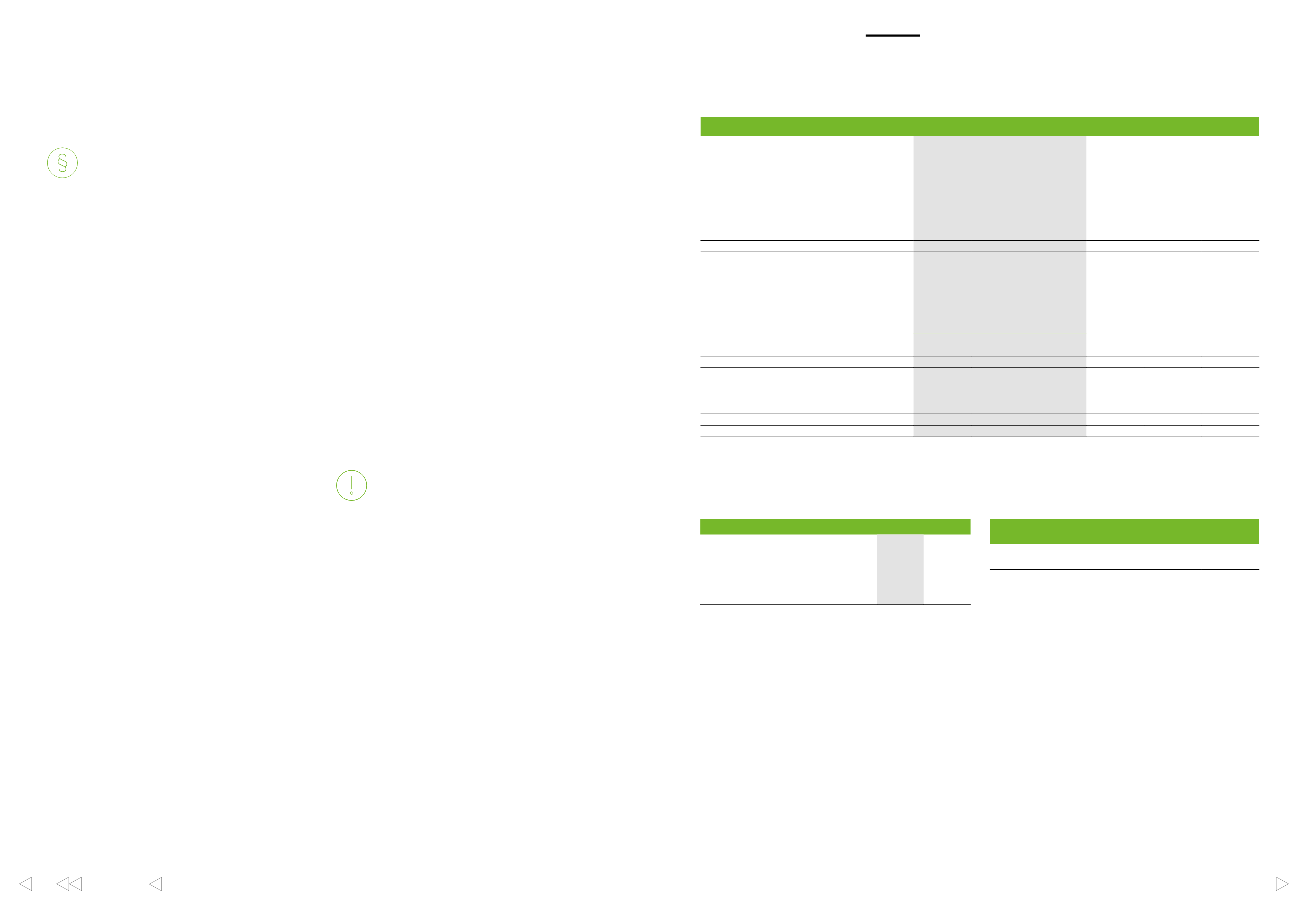

Positive

fair values

Negative

fair values

Net

fair values

Positive

fair values

Negative

fair values

Net

fair values

EURm

2016

2015

Foreign exchange risk

Forward foreign exchange contracts

Cash flow hedges

35

–41

–6

17

–27

–10

Net investment hedge

4

–19

–15

–

–21

–21

Non-qualifying hedges

10

–14

–4

14

–14

–

Currency options

Non-qualifying hedges

–

–

–

–

–

–

Cross currency swaps

Non-qualifying hedges

23

–77

–54

15

–46

–31

Derivatives hedging foreign exchange risk

72

–151

–79

46

–108

–62

Interest rate risk

Interest rate swaps

Cash flow hedges

–

–34

–34

–

–18

–18

Fair value hedges

138

–

138

181

–

181

Non-qualifying hedges

27

–2

25

31

–2

29

Cross currency swaps

Cash flow hedges

–

–

–

–

–23

–23

Fair value hedges

64

–

64

85

–

85

Non-qualifying hedges

1

–

1

1

–

1

Derivatives hedging interest risk

230

–36

194

298

–43

255

Commodity risk

Commodity contracts

Cash flow hedges

32

–42

–10

88

–109

–21

Non-qualifying hedges

5

–19

–14

8

–59

–51

Derivatives hedging commodity risk

37

–61

–24

96

–168

–72

Total

339

–248

91

440

–319

121

EURm

POSITIVE

FAIR VALUES

NEGATIVE

FAIR VALUES

NET

FAIR VALUES

2016

238

–148

90

2015

250

–129

121

6.2 Derivatives and hedge accounting

The group uses financial derivatives to manage currency, interest rate

and commodity price risks.

» Refer Note 6.1

Financial risk

management.

Accounting policies

All derivatives are initially and continuously recognised at fair value in

the balance sheet. The fair value gain or loss is recognised through the

income statement or other comprehensive income depending on whether

the derivative is designated as a hedging instrument, and on the nature

of the item being hedged. Certain derivatives are designated at inception

either hedges of the fair value of a recognised assets or liabilities or

a firm commitment (fair value hedge), hedges of highly probable

forecasted transactions or cash flow variability in functional currency

(cash flow hedge), or hedges of net investments in foreign subsidiaries

with other than the EUR as their functional currency (net investment

hedge). Derivative fair values on the balance sheet are classified as

non-current when the remaining maturity is more than 12 months and

as current when the remaining maturity is less than 12 months.

For hedge accounting purposes, UPM documents the relationship

between the hedging instruments and hedged items, as well as the

risk management objective and strategy for undertaking various

hedge transactions at the inception date. This process includes linking

all derivatives designated as hedges to specific assets and liabilities

or to specific firm commitments or forecast transactions. The group

also documents its assessment, both at the hedge inception and on

an on-going basis, as to whether the hedge is highly effective in

offsetting changes in fair values or cash flows of the hedged items.

Certain derivatives, while considered to be economical hedges for

UPM’s financial risk management purposes, do not qualify for hedge

accounting. Such derivatives are recognised at fair value through the

income statement in other operating income or under financial items.

Cash flow hedges

The effective portion of changes in the fair value of derivatives that

are designated and qualify as cash flow hedges is recognised in other

comprehensive income. Amounts deferred in equity are transferred to

the income statement and classified as income or expense in the same

period as that in which the hedged item affects the income statement

(for example, when the forecast external sale to the group that is hedged

takes place). The period when the hedging reserve is released to sales

after each derivative has matured is approximately one month. The gain

or loss relating to the effective portion of interest rate swaps hedging

variable rate borrowings is recognised in the income statement within

finance costs. When the forecasted transaction that is hedged results

in the recognition of a fixed asset, gains and losses previously deferred

in equity are transferred from equity and included in the initial

measurement of the acquisition cost and depreciated over the useful lives

of the assets.

When a hedging instrument expires or is sold, or when a hedge

no longer meets hedge accounting criteria, any cumulative gain or

loss existing in equity at that time remains in equity and is recognised

when the committed or forecasted transaction is ultimately recognised

in the income statement. However, if a forecasted transaction is no

longer expected to occur, the cumulative gain or loss that was

reported in equity is immediately recognised to the income statement.

EURm

2016

2015

Interest rate forward contracts

1,480

1,906

Interest rate swaps

2,019

2,131

Forward foreign exchange contracts

2,645

2,949

Currency options

36

73

Cross currency swaps

557

669

Commodity contracts

429

400

Cash collaterals pledged for derivative contracts totalled EUR

19 million of which EUR 17 million relate to commodity contracts

and EUR 2 million to interest rate forward contracts.

Net fair values of derivatives

Net fair values of derivatives calculated by counterparty

Notional amounts of derivatives