ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

134

135

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

Leases

UPM has a sale and leaseback agreement and three finance lease

agreements regarding power plant machinery outstanding at the end

of 2016. The group uses the energy generated by these plants for its

own production. The group also has a finance lease arrangement

over the usage of a waste water treatment plant. In addition, the

group leases certain production assets and buildings under long term

lease arrangements. In 2016, one new finance lease agreement was

made with present value of EUR 2 million.

The group also leases office, manufacturing and warehouse space

through various non-cancellable operating leases. Certain contracts

contain renewal options for various periods of time.

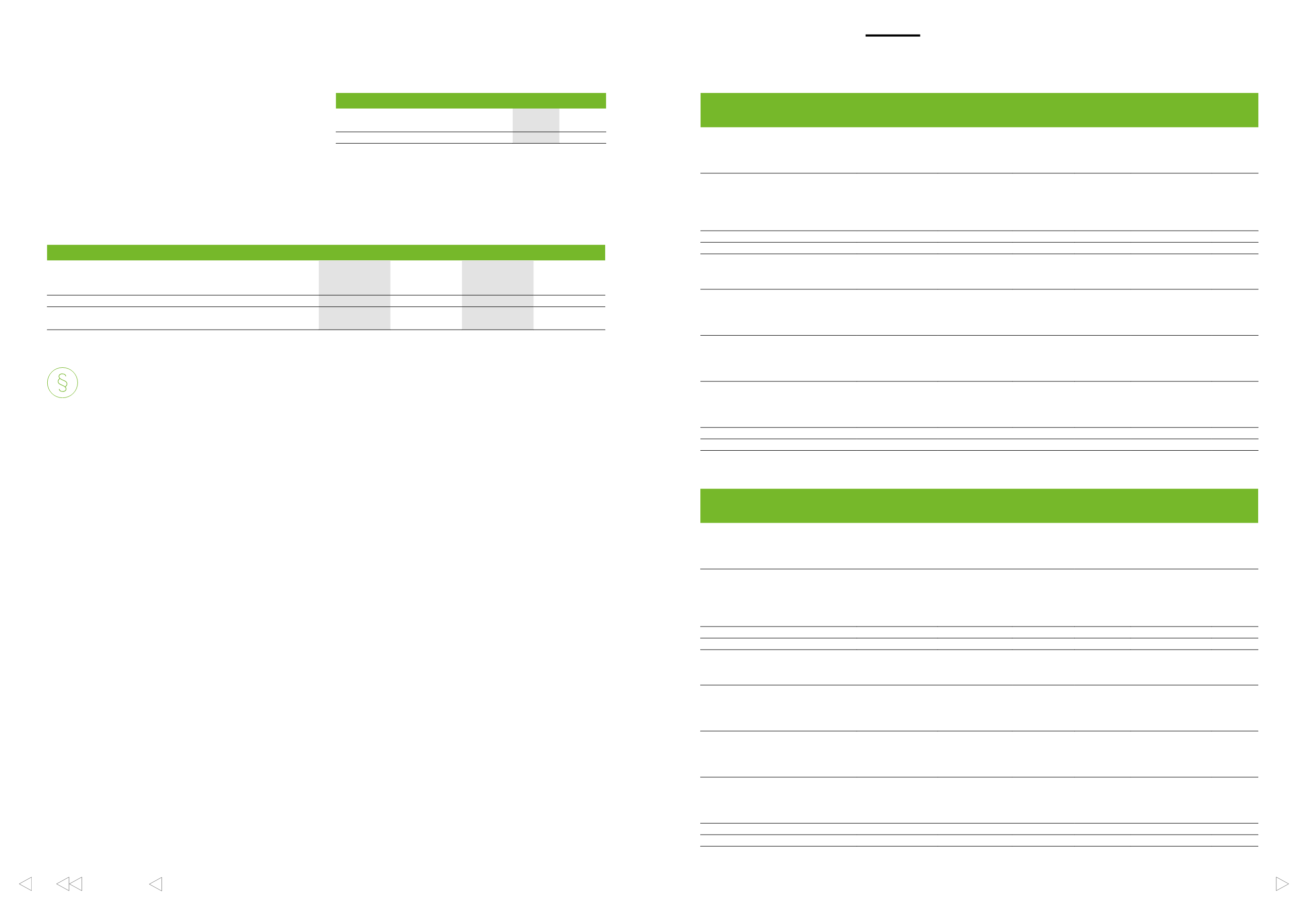

Finance leases

Operating leases

EURm

2016

2015

2016

2015

Within 1 year

94

37

74

65

Between 1 and 5 years

73

152

189

165

Later than 5 years

40

24

185

190

Total

207

213

448

420

Of which interest

–12

–15

–

–

Present value of future minimum lease payments

195

198

–

–

Accounting policies

Leases

Leases of property, plant and equipment where the group, as a

lessee, has substantially all the risks and rewards of ownership are

classified as finance leases. Finance leases are recognised as assets

and liabilities in the balance sheet at the commencement of lease

term at the lower of the fair value of the leased property and the

present value of the minimum lease payments.

Each lease payment is allocated between the liability and finance

charges. The corresponding rental obligations, net of finance

charges, are included in other non-current debt. The interest element

of the finance cost is charged to the income statement over the lease

period so as to produce a constant periodic rate of interest on the

remaining balance of the liability for each period. Property, plant

and equipment acquired under finance leases are depreciated over

the shorter of the asset’s useful life and the lease term.

Leases where the lessor retains substantially all the risks and

rewards of ownership are classified as operating leases. Payments

made as a lessee under operating leases are charged to the income

statement on a straight-line basis over the period of the lease.

EURm

2016

2015

Accumulated costs

154

153

Accumulated depreciation and impairments

–59

–46

Carrying value, at 31 December

95

107

5.3 Financial assets and liabilities

by category

Financial assets and liabilities recognised in the balance sheet include

cash and cash equivalents, loans and other financial receivables,

investments in securities, trade receivables, trade payables, loans and

derivatives.

Classification of financial assets into different measurement

categories depends on the purpose for which the financial assets

were initially acquired and is determined at the acquisition date.

Financial assets and liabilities are offset and the net amount reported

in the balance sheet when there is a legally enforceable right to offset

the recognised amounts and there is an intention to settle on a net

basis or realise the asset and settle the liability simultaneously.

EURm

FAIR VALUE

THROUGH PROFIT

AND LOSS

AVAILABLE-FOR-

SALE FINANCIAL

ASSETS

LOANS AND

RECEIVABLES

DERIVATIVES

USED FOR

HEDGING

FINANCIAL

LIABILITIES AT

AMORTISED COST

TOTAL

Energy shareholdings

–

1,932

–

–

–

1,932

Other non-current financial assets:

Loans and receivables

–

–

19

–

–

19

Derivatives

18

–

–

218

–

236

255

Trade and other receivables

–

–

1,726

–

–

1,726

Other current financial assets:

Loans and receivables

–

–

6

–

–

6

Derivatives

47

–

–

56

–

103

109

Total financial assets

65

1,932

1,751

274

–

4,022

Non-current debt:

Loans

–

–

–

–

1,800

1,800

Derivatives

–

–

–

34

–

34

1,835

Other non-current financial liabilities:

Other liabilities

1)

–

–

–

–

94

94

Derivatives

10

–

–

6

–

16

110

Current debt:

Loans

–

–

–

–

502

502

Derivatives

82

–

–

–

–

82

584

Trade and other payables

–

–

–

–

1,594

1,594

Other current financial liabilities:

Derivatives

20

–

–

96

–

116

116

Total financial liabilities

112

–

–

136

3,990

4,238

EURm

FAIR VALUE

THROUGH PROFIT

AND LOSS

AVAILABLE-FOR-

SALE FINANCIAL

ASSETS

LOANS AND

RECEIVABLES

DERIVATIVES

USED FOR

HEDGING

FINANCIAL

LIABILITIES AT

AMORTISED COST

TOTAL

Energy shareholdings

–

2,085

–

–

–

2,085

Other non-current financial assets:

Loans and receivables

–

–

20

–

–

20

Derivatives

20

–

–

292

–

312

332

Trade and other receivables

–

–

1,743

–

–

1,743

Other current financial assets:

Loans and receivables

–

–

5

–

–

5

Derivatives

49

–

–

79

–

128

133

Total financial assets

69

2,085

1,768

371

–

4,293

Non-current debt:

Loans

–

–

–

–

2,726

2,726

Derivatives

30

–

–

41

–

71

2,797

Other non-current financial liabilities:

Other liabilities

1)

–

–

–

–

103

103

Derivatives

30

–

–

41

–

71

174

Current debt:

Loans

–

–

–

–

248

248

Derivatives

21

–

–

–

–

21

269

Trade and other payables

–

–

–

–

1,463

1,463

Other current financial liabilities:

Derivatives

40

–

–

116

–

156

156

Total financial liabilities

121

–

–

198

4,540

4,859

1)

Consists mainly of non-current advances received and a put liability that is not estimated to mature within 12 months.

Leased assets included in property, plant and equipment

Future minimum lease payments

Financial assets and liabilities by category at the end of 2016

Financial assets and liabilities by category at the end of 2015