ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

148

149

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

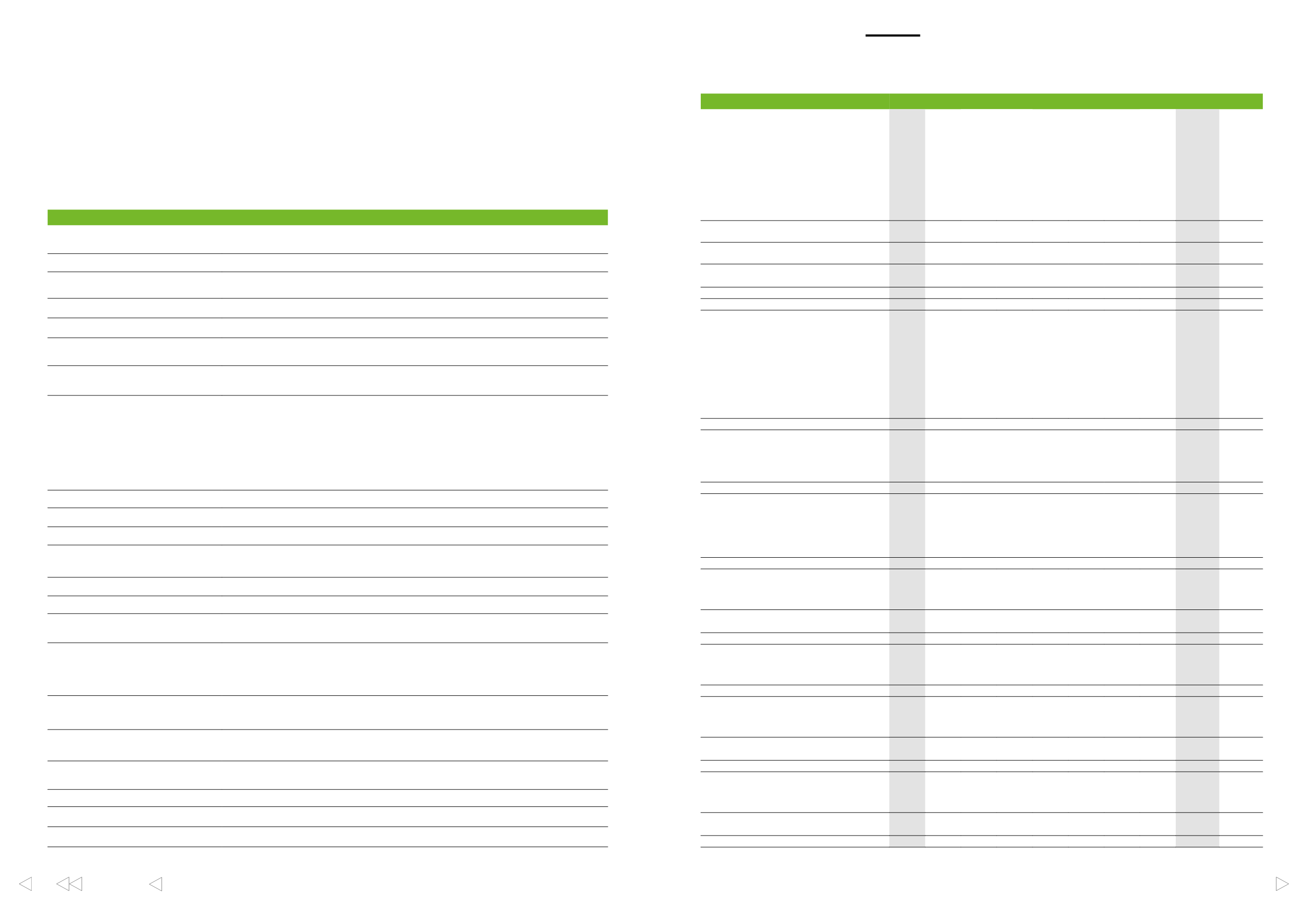

10.2 Alternative performance measures

UPM presents certain performance measures of historical performance,

financial position and cash flows, which in accordance with the

“Alternative Performance Measures” guidance issued by the European

Securities and Markets Authority (ESMA) are not accounting measures

defined or specified in IFRS and are therefore considered as alternative

performance measures. These alternative performance measures are

described below:

ALTERNATIVE PERFORMANCE MEASURE

DEFINITION

Operating profit

Profit before income tax expense, finance expenses and finance income and net gains on sale of energy

shareholdings as presented on the face of the IFRS income statement.

Comparable EBIT

Operating profit adjusted for items affecting comparability.

Comparable EBITDA

Operating profit before depreciation, amortisation and impairments, change in fair value of forest assets

and wood harvested, share of results of associates and joint ventures and items affecting comparability.

Comparable profit before tax

Profit before income tax expense excluding items affecting comparability.

Comparable profit for the period

Profit for the period excluding items affecting comparability and their tax impact.

Comparable EPS, EUR

Earnings per share calculated in accordance with IFRS excluding items affecting comparability and their

tax impact.

Net debt

Total of current and non-current debt less cash and cash equivalents and interest-bearing current and

non-current financial assets.

Items affecting comparability

Certain non-operational or non-cash valuation transactions with significant income statement impact are

considered as items affecting comparability, if they arise from asset impairments, restructuring measures,

asset sales, fair value changes of forest assets resulting from changes in valuation parameters or estimates

or changes in legislation or legal proceedings. In addition, the changes in fair value of unrealised cash

flow and commodity hedges are classified as items affecting comparability. Numerical threshold for items

to be considered as significant in UPM’s business areas UPM Biorefining, UPM Specialty Papers and UPM

Paper ENA is determined as one cent (EUR 0.01) after tax per share or more. In other business areas, the

impact is considered to be significant if the item exceeds EUR 1 million before tax.

Free cash flow

Cash generated from operations after cash used for investing activities.

Return on equity (ROE), %

Profit for the period as a percentage of average equity.

Comparable ROE, %

Return on equity (ROE) excluding items affecting comparability.

Return on capital employed (ROCE), %

Profit before taxes, interest expenses and other financial expenses as a percentage of average capital

employed.

Comparable ROCE, %

Return on capital employed (ROCE) excluding items affecting comparability.

Capital employed

Group total equity and total debt.

Business area’s comparable ROCE, %

Business area’s operating profit adjusted for items affecting comparability as a percentage of business

area’s average capital employed.

Business area’s capital employed

Business area’s operating assets less its operating liabilities. Operating assets include goodwill, other

intangible assets, property, plant and equipment, forest assets, energy shareholdings, investments in

associates and joint-ventures, inventories and trade receivables. Operating liabilities include trade

payables and advances received.

Capital expenditure

Capitalised investments in property, plant and equipment, intangible assets including goodwill arising

from business combinations, energy shareholdings and other shares, associates and joint ventures.

Capital expenditure excluding acquisitions

and shares

Capital expenditure excluding investments in shares and participations.

Operating cash flow per share, EUR

Operating cash flow divided by adjusted average number of shares during the period excluding treasury

shares.

Gearing ratio, %

Net debt as a percentage of total equity

Net debt to EBITDA

Net debt divided by EBITDA

Equity to assets ratio, %

Equity expressed as a percentage of total assets less advances received.

Reconciliation of key figures to IFRS

EURm, OR AS INDICATED

Q4/16 Q3/16 Q2/16 Q1/16 Q4/15 Q3/15 Q2/15 Q1/15 Q1-Q4/16 Q1-Q4/15

Items affecting comparability

Impairment charges

–24

–

1 –12

–

–1

1

–

–35

–

Restructuring charges

–31

–

–

–18

–2

4

–6

–1

–48

–5

Change in fair value of unrealised cash flow and

commodity hedges

2

3

–3

25 –22

2

8

–6

27

–18

Capital gains and losses on sale of non-current

assets

2

47

–

–

–

3

3

–

49

6

Fair value changes of forest assets resulting from

changes in estimates

–

–

–

–

–

265

–

–

–

265

Other non-operational items

–

–

–

–

–3

–

–19

–

–

–22

Total items affecting comparability in operating

profit

–51

50

–2

–4 –27 273 –13

–7

–7

226

Total items affecting comparability in financial

items

–

–2

–

–

–

–

–

–

–2

–

Changes in tax rates

4

–

–

–

–

–

–

–

4

–

Taxes relating to items affecting comparability

14 –14

–

6

5 –54

3

2

7

–44

Items affecting comparability in taxes

18 –14

–

6

5 –54

3

2

11

–44

Items affecting comparability, total

–33

34

–2

2 –22 219 –10

–5

1

182

Comparable EBITDA

Operating profit

232 364 262 277 220 513 206 203

1,135

1,142

Depreciation, amortisation and impairment

charges excluding items affecting comparability

120 118 134 138 132 131 130 131

510

524

Change in fair value of forest assets and wood

harvested excluding items affecting

comparability

–53

–7 –11 –16 –16 –24 –31 –16

–88

–87

Share of results of associates and joint ventures

–1

–2

–2

–

–

–2

–1

–

–5

–3

Items affecting comparability in operating profit

51 –50

2

4

27 –273

13

7

7

–226

Comparable EBITDA

349 423 385 403 363 345 317 325 1,560 1,350

% of sales

14.1 17.3 15.8 16.5 14.1 13.6 12.4 13.1

15.9

13.3

Comparable EBIT

Operating profit

232 364 262 277 220 513 206 203

1,135

1,142

Items affecting comparability in operating profit

51 –50

2

4

27 –273

13

7

7

–226

Comparable EBIT

283 314 264 281 247 240 219 210

1,143

916

% of sales

11.4 12.8 10.8 11.5

9.6

9.5

8.6

8.4

11.6

9.0

Comparable profit before tax

Profit before tax

231 336 250 263 214 498 182 181 1,080 1,075

Items affecting comparability in operating profit

51 –50

2

4

27 –273

13

7

7

–226

Items affecting comparability in financial items

–

2

–

–

–

–

–

–

2

–

Comparable profit before tax

282 288 252 267 241 225 195 188 1,089

849

Comparable ROCE, %

Comparable profit before tax

282 288 252 267 241 225 195 188 1,089

849

Interest expenses and other financial expenses

17

13

15

10

13

12

20

12

55

57

300 301 266 277 254 237 215 200

1,144

906

Capital employed, average

10,560 10,433 11,701 11,005 11,079 11,080 11,059 11,025 10,833 10,977

Comparable ROCE, %

11.4 11.5 10.0 10.1

9.2

8.6

7.8

7.3

10.6

8.3

Comparable profit for the period

Profit for the period

187 268 198 227 193 408 160 155

880

916

Items affecting comparability, total

33 –34

2

–2

22 –219

10

5

–1

–182

Comparable profit for the period

220 234 200 225 215 189 170 160

879

734

Comparable EPS, EUR

Comparable profit for the period

220 234 200 225 215 189 170 160

879

734

Profit attributable to non-controlling interest

–

–

–1

–

–

–

–

–

–1

–

220 234 199 225 215 189 170 160

878

734

Average number of shares basic (1,000)

533,505 533,505 533,505 533,505 533,505 533,505 533,505 533,505

533,505 533,505

Comparable EPS, EUR

0.41 0.44 0.37 0.42 0.41 0.35 0.32 0.30

1.65

1.38

Comparable ROE, %

Comparable profit for the period

220 234 200 225 215 189 170 160

879

734

Profit attributable to non-controlling interest

–

–

–1

–

–

–

–

–

–1

–

220 234 199 225 215 189 170 160

878

734

Total equity, average

8,054 7,767 7,819 7,959 7,944 7,788 7,718 7,642 8,091

7,712

Comparable ROE, %

10.9 12.1 10.2 11.3 10.8

9.7

8.8

8.4

10.9

9.5

Quarterly key figures are unaudited