ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

154

155

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

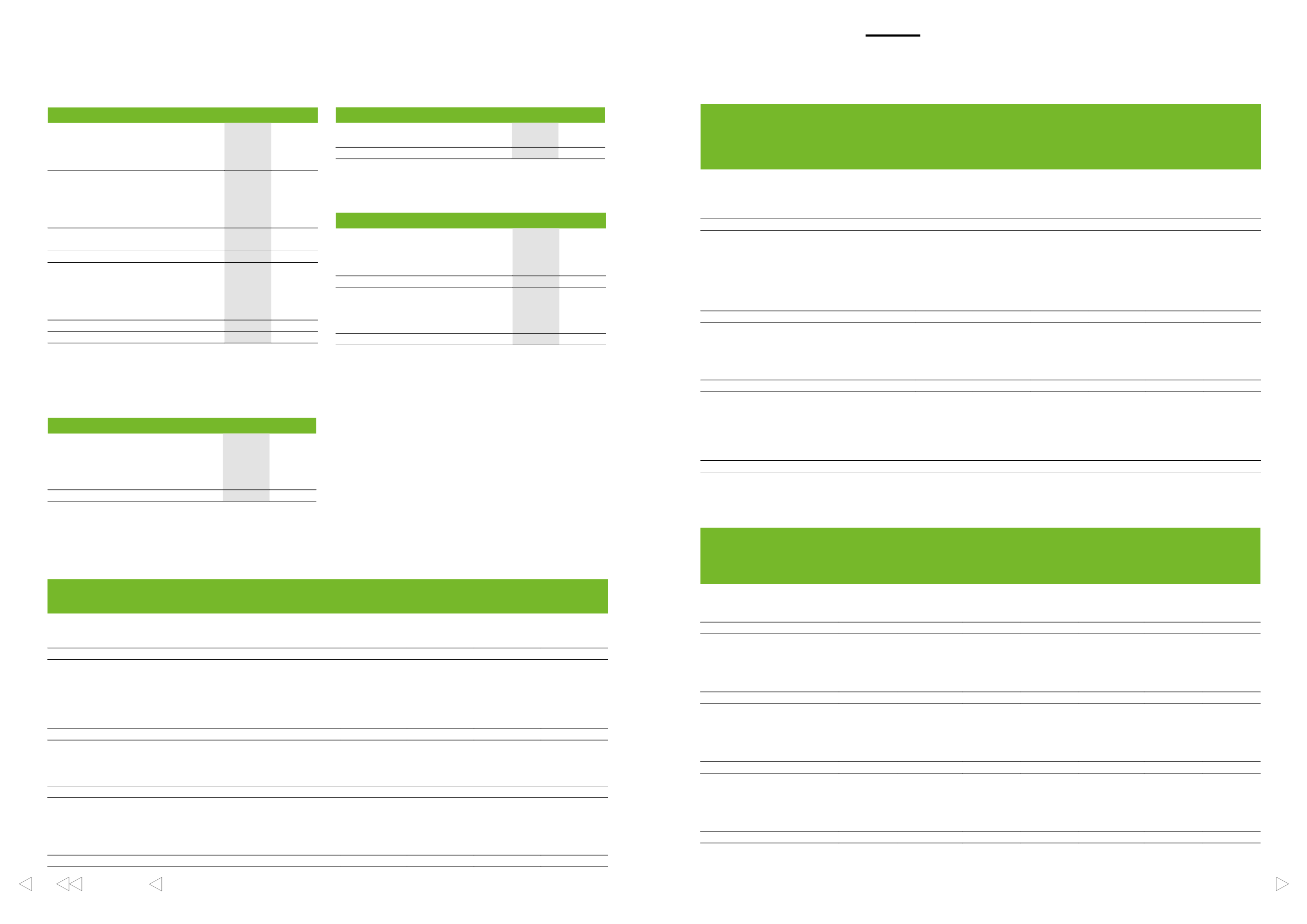

10. Intangible assets

EURm

INTANGIBLE

RIGHTS

OTHER

INTANGIBLE

ASSETS

ADVANCE

PAYMENTS

TOTAL

2016

Accumulated costs

13

282

5

300

Accumulated amortisation and impairments

–8

–257

–

–265

Carrying value, at 31 December

5

25

5

35

Carrying value, at 1 January

5

178

4

187

Additions

6

4

3

13

Disposals

–3

–141

–

–144

Amortisation

–3

–17

–

–19

Impairment

–

–2

–

–2

Reclassifications

–

2

–2

–

Carrying value, at 31 December

5

25

5

35

2015

Accumulated costs

19

523

4

546

Accumulated amortisation and impairments

–14

–345

–

–359

Carrying value, at 31 December

5

178

4

187

Carrying value, at 1 January

5

198

3

206

Additions

7

4

3

14

Disposals

–5

–1

–1

–7

Amortisation

–2

–24

–

–26

Reclassifications

–

1

–1

–

Carrying value, at 31 December

5

178

4

187

9.

Income taxes

EURm

2016

2015

Tax expense for the period

82

61

Tax expense for the previous periods

–1

–

Total

81

61

7.

Financial income and expenses

EURm

2016

2015

Income on non-current assets

Dividend income from group companies

80

182

Dividend income from other companies

1

–

Interest income from group companies

3

6

84

188

Other interest and financial income

Other interest income from group companies

19

3

Other financial income from group companies

35

29

Other financial income from other companies

13

–

68

32

Value adjustments

–6

105

Interest and other financial expenses

Interest expenses to group companies

–22

–34

Interest expenses to other companies

–29

–26

Other financial expenses to other companies

–90

–97

–141

–157

Total

6

168

8.

Closing entries

EURm

2016

2015

Change in accumulated depreciation

difference

11

44

Group contributions received

–1

–4

Group contributions granted

32

6

Losses from mergers

1

–

Total

42

46

EURm

2016

2015

Deferred tax assets

Provisions

34

12

Share-based payments

3

2

Other temporary differences

–

1

Total

37

15

Deferred tax liabilities

Accumulated depreciation difference

–91

–122

Revaluations of the land areas

–73

–117

Total

–164

–239

1)

The parent company has not recognised deferred tax assets and liabilities in

the balance sheet. Deferred tax assets and liabilities were calculated based on

temporary differences between the carrying and taxable values of assets and

liabilities.

Deferred tax assets and liabilities

1)

11. Tangible assets

EURm

LAND AND

WATER

AREAS BUILDINGS

MACHINERY

AND

EQUIPMENT

OTHER

TANGIBLE

ASSETS

ADVANCE

PAYMENTS

AND CON

STRUCTION

IN

PROGRESS

TOTAL

2016

Accumulated costs

449

604

2,026

138

36

3,254

Accumulated depreciation and impairments

–

–345

–1,396

–112

–

–1,852

Revaluations

364

–

–

–

–

364

Carrying value, at 31 December

813

259

630

27

36

1,766

Carrying value, at 1 January

891

443

868

37

23

2,262

Additions

8

25

117

2

61

213

Disposals

–29

–186

–270

–8

–7

–499

Depreciations

–

–27

–120

–6

–

–152

Impairment

–

–

1

–

–

1

Reclassifications

–

3

35

2

–41

–

Changes in revaluations

–57

–

–

–

–

–57

Carrying value, at 31 December

813

259

630

27

36

1,766

2015

Accumulated costs

470

1,242

5,027

198

23

6,960

Accumulated depreciation and impairments

–

–799

–4,159

–161

−

–5,119

Revaluations

421

–

–

–

–

421

Carrying value, at 31 December

891

443

868

37

23

2,262

Carrying value, at 1 January

934

441

720

38

209

2,342

Additions

8

12

64

3

78

165

Disposals

–15

–

–

−

−

–15

Depreciations

−

–33

–155

–6

−

–194

Reclassifications

–

23

239

2

–264

–

Changes in revaluations

–36

–

–

–

–

–36

Carrying value, at 31 December

891

443

868

37

23

2,262

12. Other non-current assets

EURm

HOLDINGS

IN GROUP

COMPANIES

HOLDINGS IN

PARTICIPATING

INTEREST

COMPANIES

OTHER

SHARES AND

HOLDINGS

RECEIVABLES

FROM

GROUP

COMPANIES

RECEIVABLES

FROM

PARTICIPATING

INTEREST

COMPANIES

OTHER

NON-

CURRENT

RECEIVABLES

TOTAL

2016

Accumulated costs

5,780

5

4

255

5

7

6,056

Accumulated value adjustments

–1,414

–

–

–

–

–

–1,414

Carrying value, at 31 December

4,365

5

4

255

5

7

4,642

Carrying value, at 1 January

3,984

93

614

723

6

7

5,427

Additions

829

1

–

3

–

–

832

Disposals

–442

–88

–446

–470

–1

–

–1,448

Changes in revaluations

–

–

–164

–

–

–

–164

Value adjustments

1)

–5

–

–1

–

–

–

–6

Carrying value, at 31 December

4,365

5

4

255

5

7

4,642

2015

Accumulated costs

5,393

93

450

723

6

7

6,672

Accumulated value adjustments

–1,409

–

–

–

–

−

–1,409

Revaluations

–

–

164

–

–

–

164

Carrying value, at 31 December

3,984

93

614

723

6

7

5,427

Carrying value, at 1 January

4,648

99

582

666

6

30

6,031

Additions

37

–

32

69

–

–

138

Disposals

–806

–6

–

–12

–

−21

–845

Reclassifications

–

–

–

–

–

–2

–2

Value adjustments

105

–

–

–

–

–

105

Carrying value, at 31 December

3,984

93

614

723

6

7

5,427

1)

Value adjustments are recognised under financial items.