ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

164

165

In brief

Strategy

Businesses

Stakeholders

Governance

CONTENTS

Accounts

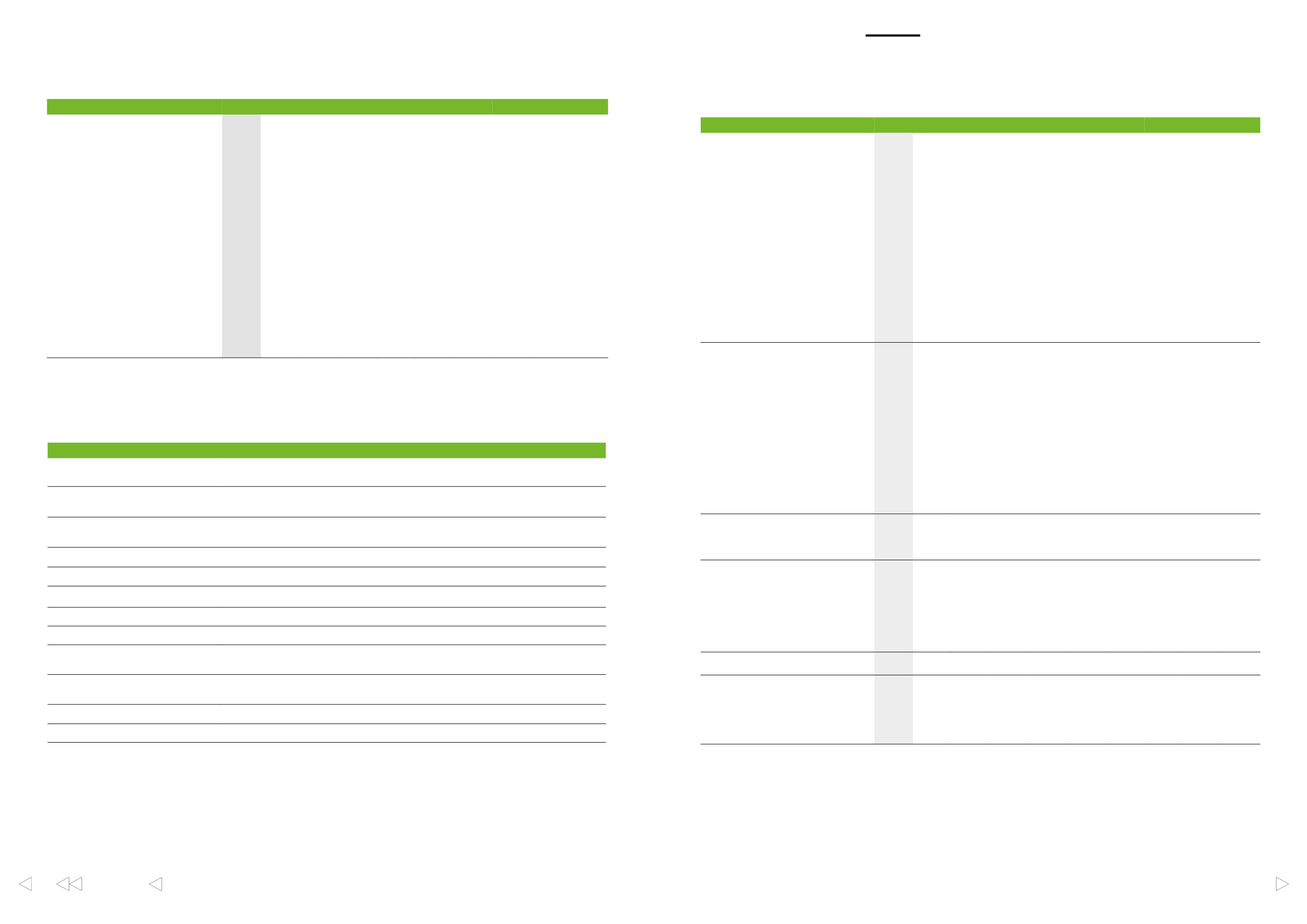

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Earnings per share (EPS), EUR

1.65 1.72 0.96 0.63 –2.14 0.88 1.08 0.33 –0.35 0.16

Comparable EPS, EUR

1.65 1.38 1.20 0.91 0.74 0.93 0.99

0.11 0.42 1.00

Equity per share, EUR

15.43 14.89 14.02 14.08 14.18 14.22 13.64 12.67 11.74 13.21

Dividend per share, EUR

1)

0.95 0.75

0.70 0.60 0.60

0.60

0.55

0.45

0.40 0.75

Dividend to earnings ratio, %

57.6 43.6 72.9 95.2 neg.

68.2 50.9 136.4 neg.

468.8

Dividend to operating cash flow, %

30

34

30

43

30

30

29

19

33

44

Effective dividend yield, %

4.1

4.4

5.1

4.9

6.8

7.1

4.2

5.4

4.4

5.4

P/E ratio

14.1 10.0 14.2 19.5 neg.

9.7 12.2 25.2 neg.

86.4

Operating cash flow per share, EUR

3.16 2.22 2.33 1.39 1.98 1.99 1.89 2.42 1.21 1.66

Dividend distribution, EURm

1)

507

400

373

317

317

315

286

234

208

384

Share price at 31 Dec., EUR

23.34 17.23 13.62 12.28 8.81 8.51 13.22 8.32 9.00 13.82

Lowest quotation, EUR

13.71 13.19 10.07 7.30 7.82 7.34 7.37 4.33 8.15 13.01

Highest quotation, EUR

23.41 19.26 13.99 13.02 10.98 15.73 13.57 9.78 13.87 20.59

Average quotation for the period, EUR

17.51 16.37 12.26 9.42 9.21 11.17 10.43 7.06 11.32 17.30

Market capitalisation, EURm

12,452 9,192 7,266 6,497 4,633 4,466 6,874 4,326 4,680 7,084

Shares traded, EURm

2)

6,749 7,469 6,233 5,308 5,534 8,835 8,243 5,691 10,549 16,472

Shares traded (1,000)

385,355 456,168 508,318 563,382 600,968 790,967 790,490 805,904 932,136 952,300

Shares traded, % of all shares

72.2 85.5 95.6 106.7 114.4 151.5 152.0 155.0 180.1 182.1

Number of shares, average (1,000)

533,505 533,505 531,574 527,818 525,434 521,965 519,970 519,955 517,545 522,867

Number of shares at the end of period (1,000)

533,736 533,736 533,736 529,302 526,124 524,973 519,970 519,970 519,970 512,569

of which treasury shares (1,000)

231

231

231

231

231

211

–

–

16

–

1)

Proposal

2)

Trading on the Nasdaq Helsinki Main Market. Treasury shares bought by the company are included in shares traded.

SHARE RELATED INDICATORS

DEFINITION

Earnings per share (EPS), EUR

Profit for the period attributable to owners of the parent company divided by adjusted average number

of shares during the period excluding treasury shares.

Comparable EPS, EUR

Earnings per share calculated in accordance with IFRS excluding items affecting comparability and their

tax impact.

Equity per share, EUR

Equity attributable to the owners of the parent company in relation to the adjusted number of shares

at the end of period.

Dividend per share, EUR

Dividend distribution divided by adjusted number of shares at the end of period.

Dividend to earnings ratio, %

Dividend per share as a percentage of earnings per share.

Dividend to operating cash flow, %

Dividend per share as a percentage of operating cash flow per share.

Effective dividend yield, %

Adjusted dividend per share as a percentage of adjusted share price at 31.12.

P/E ratio

Adjusted share price in relation to the earnings per share.

Operating cash flow per share, EUR

Operating cash flow divided by adjusted average number of shares during the period excluding treasury

shares.

Market capitalisation

Total number of shares (excluding those held as treasury shares) multiplied by the share price at the end

of period.

Adjusted share price at the end of period

Share price at the end of period in relation to share issue coefficient.

Adjusted average share price

Total value of shares traded in relation to adjusted number of shares traded during the period.

Adjusted share-related indicators

Financial information 2007–2016

EURm, OR AS INDICATED

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Income statement

Sales

9,812 10,138 9,868 10,054 10,492 10,068 8,924 7,719 9,461 10,035

Comparable EBITDA

1)

1,560 1,350 1,306 1,161 1,325 1,383 1,343 1,062 1,206 1,546

% of sales

15.9 13.3 13.2 11.5 12.6 13.7 15.0 13.8 12.7 15.4

Operating profit

1,135 1,142

674

548 1,318

459

755

135

24

483

% of sales

11.6 11.3

6.8

5.5 –12.6

4.6

8.5

1.7

0.3

4.8

Comparable EBIT

1,143

916

866

683

556

682

731

270

513

835

% of sales

11.6

9.0

8.8

6.8

5.3

6.8

8.2

3.5

5.4

8.3

Profit before tax

1,080 1,075

667

475 –1,271

417

635

187 –201

292

% of sales

11.0 10.6

6.8

4.7 –12.1

4.1

7.1

2.4 –2.1

2.9

Comparable profit before tax

1,089

849

793

610

471

573

611

107

282

644

% of sales

11.1

8.4

8.0

6.1

4.5

5.7

6.8

1.4

3.0

6.4

Profit for the period

880

916

512

335 –1,122

457

561

169 –180

81

% of sales

9.0

9.0

5.2

3.3 –10.7

4.5

6.3

2.2

–1.9

0.8

Comparable profit for the period

879

734

638

479

390

487

516

58

218

504

% of sales

9.0

7.2

6.5

4.8

3.7

4.8

5.8

0.8

2.3

5.0

Exports from Finland and foreign operations

8,930 9,268 8,923 9,089 9,565 9,252 8,139 7,054 8,515 9,170

Exports from Finland

4,918 4,714 4,340 4,118 4,248 4,313 3,882 3,442 4,371 4,546

Balance sheet

Non-current assets

9,715 10,259 10,269 10,487 11,066 11,412 10,557 10,581 10,375 10,639

Inventories

1,346 1,376 1,356 1,327 1,388 1,429 1,299 1,112 1,354 1,342

Other current assets

2,850 2,558 2,570 2,785 2,489 2,548 1,956 1,912 2,052 1,972

Total assets

13,911 14,193 14,195 14,599 14,943 15,389 13,812 13,605 13,781 13,953

Total equity

8,237 7,944 7,480 7,455 7,461 7,477 7,109 6,602 6,120 6,783

Non-current liabilities

3,364 4,328 4,717 5,019 5,430 5,320 4,922 5,432 5,816 4,753

Current liabilities

2,309 1,921 1,998 2,125 2,052 2,588 1,781 1,571 1,828 2,417

Total equity and liabilities

13,911 14,193 14,195 14,599 14,943 15,389 13,812 13,605 13,781 13,953

Capital employed at year end

10,657 11,010 10,944 11,583 11,603 12,110 11,087 11,066 11,193 11,098

Capital expenditure

325

520

411

362

357 1,179

257

913

551

708

% of sales

3.3

5.1

4.2

3.6

3.4 11.7

2.9 11.8

5.8

7.1

Capital expenditure excluding acquisitions

and shares

325

486

375

329

347

340

252

229

532

683

% of sales

3.3

4.8

3.8

3.3

3.3

3.4

2.8

3.0

5.6

6.8

Cash flow and net debt

Operating cash flow

1,686 1,185 1,241

735 1,040 1,041

982 1,259

628

867

Free cash flow

1,424

750

994

438

968

910

787 1,045

96

442

Net debt

1,131 2,100 2,401 3,040 3,210 3,592 3,286 3,730 4,321 3,973

Key figures

Return on capital employed (ROCE), %

10.5 10.3

6.5

4.8 neg.

4.4

6.6

3.2

0.2

4.3

Comparable ROCE, %

10.6

8.3

7.6

6.0

4.2

5.2

6.4

2.5

4.6

7.4

Return on equity (ROE), %

10.9

11.9

6.9

4.5 neg.

6.3

8.2

2.8 neg.

1.2

Comparable ROE, %

10.9

9.5

8.5

6.4

4.2

6.7

7.5

1.0

3.4

7.4

Gearing ratio, %

14

26

32

41

43

48

46

56

71

59

Net debt to EBITDA

0.73 1.56 1.84 2.62 2.42 2.60 2.45 3.51 3.58 2.57

Equity to assets ratio, %

59.4 56.1 52.7 51.1 50.0 48.6 51.5 48.6 44.5 48.8

Personnel

Personnel at year end

19,310 19,578 20,414 20,950 22,180 23,909 21,869 23,213 24,983 26,352

Deliveries

Pulp (1,000 t)

3,419 3,224 3,287 3,163 3,128 2,992 2,919 1,759 1,982 1,927

Electricity (GWh)

8,782 8,966 8,721 8,925 9,486 8,911 9,426 8,865 10,167 10,349

Papers, total (1,000 t)

9,613 9,771 10,028 10,288 10,871 10,615 9,914 9,021 10,641 11,389

Plywood (1,000 m

3

)

764

740

731

737

679

656

638

567

806

945

Sawn timber (1,000 m

3

)

1,751 1,731 1,609 1,661 1,696 1,683 1,729 1,497 2,132 2,325

1)

EBITDA 2007–2011 includes change in fair value of unrealised cash flow and commodity hedges.

In 2016, UPM has relabeled the previously referenced “excluding special items” non-GAAP financial measures with “comparable” performance measures as published in

» UPM’s stock exchange release on 14 April 2016

. Corresponding 2015 and 2014 measures have been adjusted accordingly.

» Refer Note 10.2

Alternative performance measures, for definitions of key figures.

The definitions of share related indicators are described below: