ACCOUNTS

UPM Annual Report 2016

UPM Annual Report 2016

156

157

In brief

Strategy

Businesses

Stakeholders

Governance

Accounts

CONTENTS

EURm

2016

2015

Prepayments and accrued income

Energy taxes

21

38

Personnel expenses

2

4

Interest income

33

39

Derivative financial instruments

7

4

Income taxes

–

37

Other items

4

2

Carrying value, at 31 December

66

124

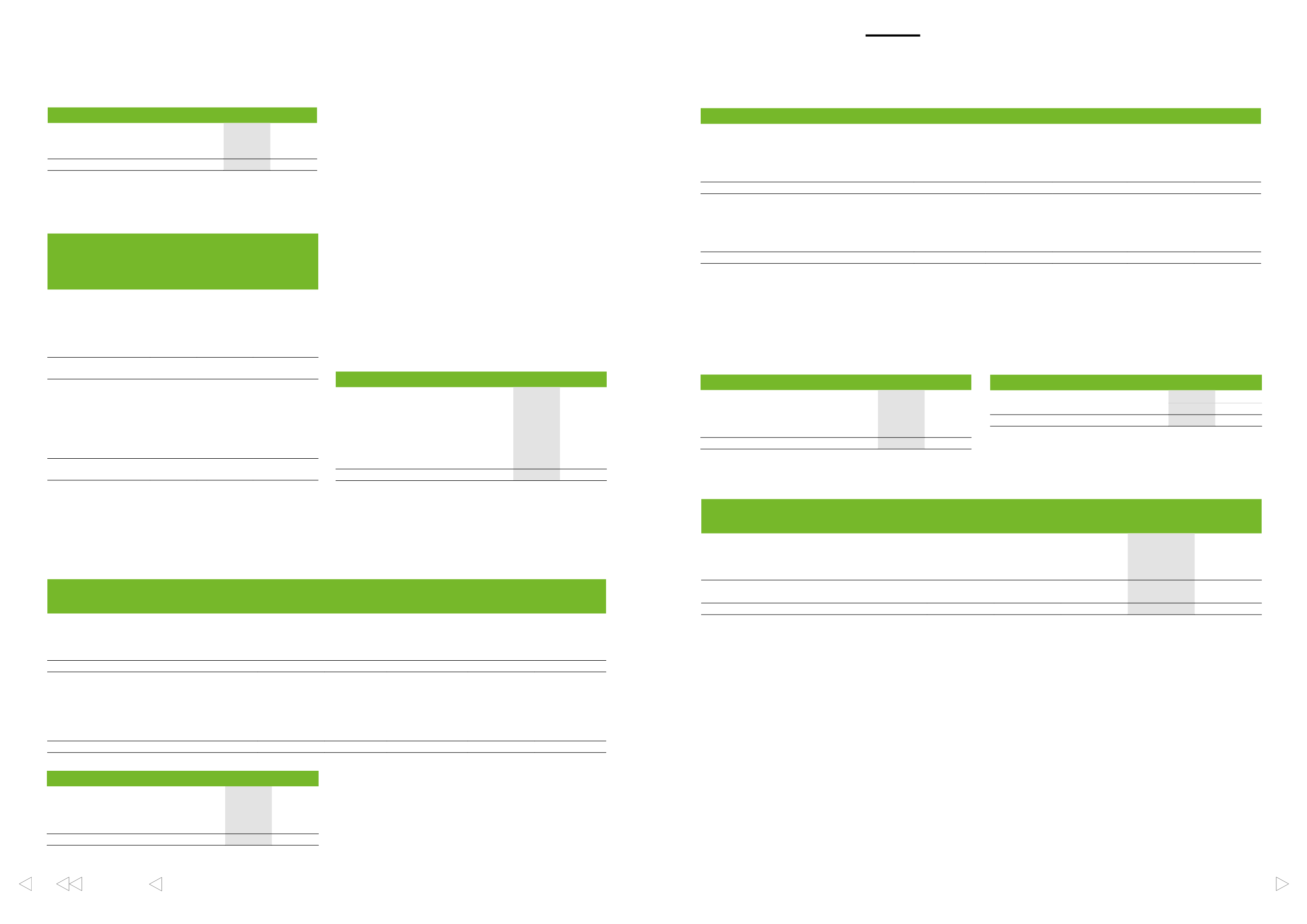

15. Equity

EURm

SHARE CAPITAL

REVALUATION

RESERVE

RESERVE FOR

INVESTED NON-

RESTRICTED EQUITY

RETAINED

EARNINGS

TOTAL

SHAREHOLDER’S

EQUITY

Carrying value, at 1 January 2016

890

427

1,273

2,259

4,849

Profit for period

–

–

–

255

255

Dividend distribution

–

–

–

–400

–400

Changes in revaluations

–

–221

–

–

–221

Carrying value, at 31 December 2016

890

206

1,273

2,115

4,483

Carrying value, at 1 January 2015

890

463

1,273

2,088

4,714

Profit for period

–

–

–

545

545

Dividend distribution

–

–

–

–373

–373

Changes in revaluations

–

–36

–

–

–36

Other changes

–

–

–

–1

–1

Carrying value, at 31 December 2015

890

427

1,273

2,259

4,849

EURm

2016

2015

Distributable funds

Reserve for invested non-restricted equity

1,273

1,273

Retained earnings from previous years

1,860

1,715

Profit for the period

255

545

Total distributable funds at 31 December

3,388

3,533

14. Current receivables

EURm

TOTAL

RECEIVABLES

FROM

GROUP

COMPANIES

RECEIVABLES

FROM

PARTICIPATING

INTEREST

COMPANIES

2016

Trade receivables

437

400

11

Loan receivables

1)

1,495

1,495

–

Prepayments and accrued

income

66

–

–

Other current receivables

42

5

–

Carrying value,

at 31 December

2,040

1,901

12

2015

Trade receivables

228

83

10

Loan receivables

783

783

–

Prepayments and accrued

income

124

2

1

Other current receivables

82

–

–

Carrying value,

at 31 December

1,217

868

11

1)

There were no loans granted to the company’s President and CEO and

members of the Board of Directors at 31 December 2016 and 2015.

13. Inventories

EURm

2016

2015

Raw materials and consumables

132

203

Finished products and goods

22

80

Advance payments

19

31

Carrying value, at 31 December

174

314

17.

Non-current liabilities

EURm

2016

2015

Bonds

593

991

Loans from financial institutions

568

911

Pension loans

68

135

Other non-current liabilities

170

161

Carrying value, at 31 December

1,399

2,198

EURm

2016

2015

Bonds

356

421

Other non-current liabilities

170

160

Total

526

581

FIXED RATE PERIOD

INTEREST RATE,

% CURRENCY

NOMINAL

VALUE ISSUED,

MILLION

CARRYING

VALUE, 2016

EURm

CARRYING

VALUE, 2015

EURm

1997–2027

7.450

USD

375

356

344

2000–2016

3.550

JPY

10,000

–

76

2002–2017

6.625

GBP

250

292

341

2003–2018

5.500

USD

250

237

230

Carrying value, at 31 December

885

991

Current portion

292

–

Non-current portion

593

991

16. Provisions

EURm

RESTRUCTURING TERMINATION ENVIRONMENTAL

OTHER

1)

TOTAL

Provisions at 1 January 2016

15

13

12

20

60

Provisions made during the year

–

1

–

154

155

Provisions utilised during the year

–2

–2

–

–3

–7

Unused provisions reversed

–

–

–

–1

–2

Changes due to restructurings

–10

–6

–2

–17

–35

Carrying value

, at 31 December 2016

3

5

9

153

170

Provisions at 1 January 2015

17

17

13

21

68

Provisions made during the year

–

3

–

3

6

Provisions utilised during the year

–2

–6

–1

–3

–12

Unused provisions reversed

–

–1

–

–1

–2

Carrying value

, at 31 December 2015

15

13

12

20

60

1)

Other provisions are attributable to onerous contracts and fair value losses of financial derivatives. At the end of 2016 the fair value loss in other provisions

of EUR 11 million was attributable to one group internal cross currency swap with nominal value of EUR 104 million and maturity in 2027.

Changes in provisions are recognised in in personnel or other operating expenses, in sales, materials or financial items.

Maturity in 2022 or later (in 2021 or later)

Bonds