UPM Annual Report 2016

UPM Annual Report 2016

166

167

In brief

Strategy

Businesses

Stakeholders

Governance

ACCOUNTS

CONTENTS

11 12 13 14 15 16

07

10 09 08

12,000

10,000

8,000

6,000

4,000

2,000

0

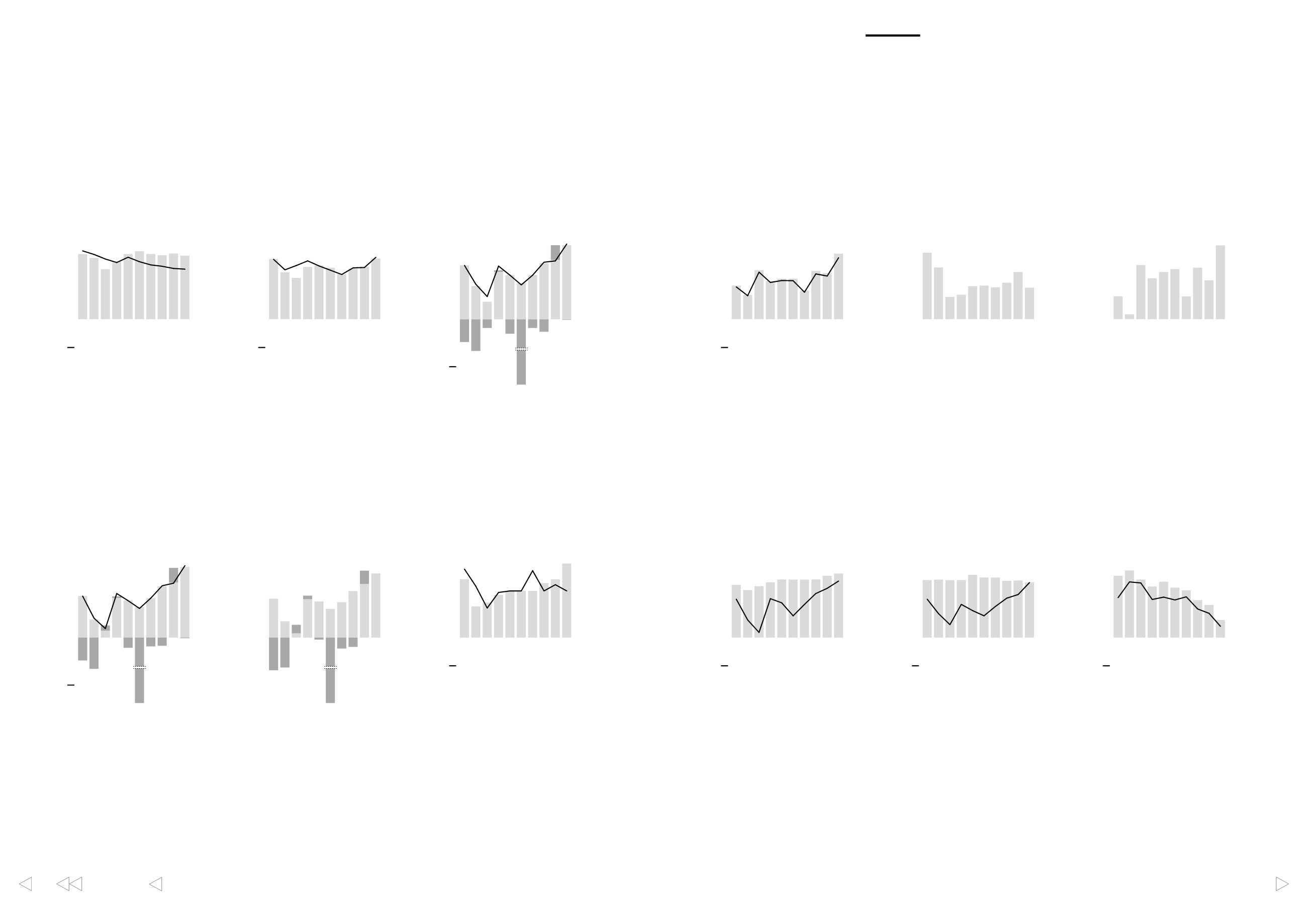

Sales and personnel

■

Sales

Personnel

30,000

25,000

20,000

15,000

10,000

5,000

0

employees

EURm

11 12 13 14 15 16

07

10 09 08

2,000

1,600

1,200

800

400

0

Comparable EBITDA

■

Comparable EBITDA

% of sales

20

16

12

8

4

0

%

EURm

11 12 13 14 15 16

07

10 09 08

2,000

1,500

1,000

500

0

Operating cash flow

■

Operating cash flow

Per share

4

3

2

1

0

EUR

EURm

11 12 13 14 15 16

07

10 09 08

10,000

8,000

6,000

4,000

2,000

0

Equity and ROE

■

Equity

Comparable ROE

15

12

9

6

3

0

%

EURm

11 12 13 14 15 16

07

10 09 08

15,000

12,000

9,000

6,000

3,000

0

Capital employed and ROCE

■

Capital employed

Comparable ROCE

15

12

9

6

3

0

%

EURm

11 12 13 14 15 16

07

10 09 08

5,000

4,000

3,000

2,000

1,000

0

Net debt

and net debt to EBITDA

■

Net debt

Net debt to EBITDA

5

4

3

2

1

0

EUR

EURm

11 12 13 14 15 16

07

10 09 08

Capital expenditure

excluding acquisitions and shares

EURm

800

600

400

200

0

11 12 13 14 15 16

07

10 09 08

1,500

1,200

900

600

300

0

Free cash flow

EURm

11 12 13 14 15 16

07

10 09 08

1,200

1,000

800

600

400

200

0

Operating profit

■

Comparable EBIT

% of sales

■

Items affecting comparability

12

10

8

6

4

2

0

%

EURm

11 12 13 14 15 16

07

10 09 08

1,200

1,000

800

600

400

200

0

Profit before tax

■

Comparable profit before tax

% of sales

■

Items affecting comparability

12

10

8

6

4

2

0

%

EURm

11 12 13 14 15 16

07

10 09 08

2.0

1.5

1.0

0.5

0

Earnings per share

■

Comparable EPS

■

Effect of items affecting comparability

EUR

11 12 13 14 15 16

07

10 09 08

1.0

0.8

0.6

0.4

0.2

0

Dividend per share

■

Dividend per share

Dividend to operating cash flow

50

40

30

20

10

0

%

EUR

In 2016 UPM has relabeled the previously referenced “excluding special items” non-GAAP financial measures with “comparable” performance measures.

Corresponding 2014 and 2015 group measures have been revised accordingly.

Financial information 2007–2016

Accounts