UPM Annual Report 2016

UPM Annual Report 2016

22

23

In brief

Businesses

Stakeholders

Governance

Accounts

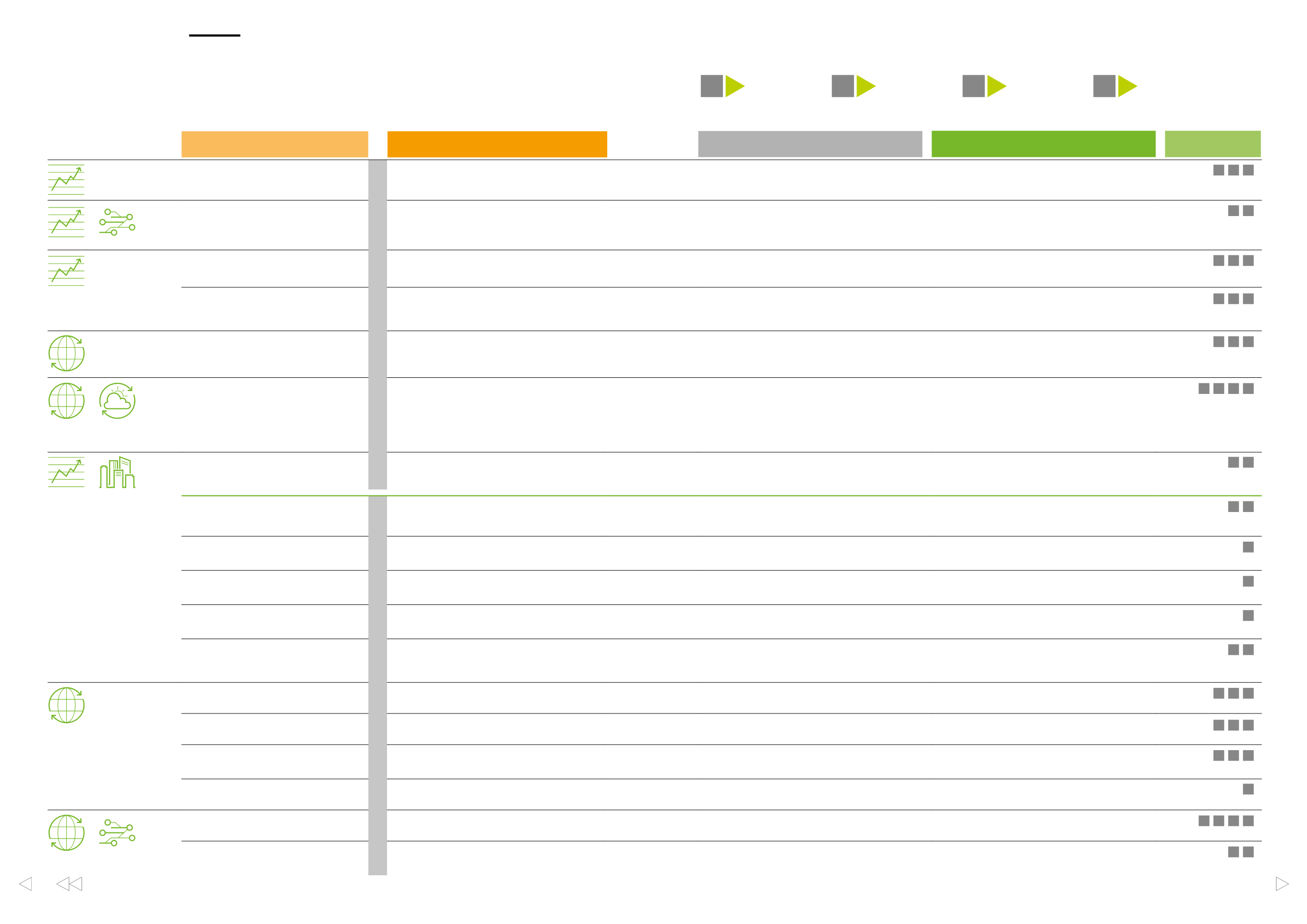

RISK DESCRIPTION

IMPACT

MANAGEMENT

OPPORTUNITY

STRATEGIC FOCUS

AREAS INVOLVED

Global economic cycles

OPERATING ENVIRONMENT

Impacts the demand and sales prices of various UPM products

and main input costs items, as well as currency exchange rates.

UPM’s main earnings sensitivities are presented on page 115.

Industry leading balance sheet. Continuous improvement in

competitiveness, resource efficiency and customer offering.

Business portfolio development.

UPM’s strong balance sheet and focus on competitiveness

mitigate risks and may present strategic opportunities

(incl. M&A) in an economic downturn.

Faster than expected decline in demand

for graphic paper

Increased pressure on UPM’s graphic paper deliveries

and sales prices

Continuous improvement in competitiveness. Focus on more

attractive paper end-use segments. Adjust paper production

capacity to profitable customer demand. Business portfolio

development.

UPM’s large paper production platform provides continuous

optimisation opportunities. Reliable supplier of high quality

products and customer service merits customer loyalty.

Share of UPM businesses in declining markets is decreasing.

Overcapacity in some of UPM’s products

due to changes in demand or supply

Temporarily impacts sales prices and deliveries of the product

in question

Continuous improvement in competitiveness. Disciplined planning

and selection of investments. Business portfolio development.

UPM’s diverse business portfolio, focus on competitiveness and

strong balance sheet mitigate risks and may present strategic

opportunities (incl. M&A) in a cyclical downturn of a business.

Significant moves in currency exchange rates

relevant for UPM

Impacts UPM’s earnings and cash flow directly and

competitiveness indirectly. UPM’s main currency exposures

are presented on page 138.

Continuous hedging of net currency exposure. Hedging the

balance sheet. Continuous improvement in competitiveness.

Disciplined planning and selection of investments. Business

portfolio development.

UPM’s diverse business portfolio and geographical presence,

focus on competitiveness and strong balance sheet mitigate risks

and may present strategic opportunities in changing currency

environment.

International trade barriers,

e.g. antidumping duties

Impacts trade flows and short-term market balances and

may directly or indirectly impact sales prices and deliveries

of UPM’s products.

Monitoring through international trade associations. Continuous

improvement in competitiveness. Disciplined planning and

selection of investments. Business portfolio development.

UPM’s diverse business portfolio and geographical presence

mitigate risks and may present opportunities for optimisation

in case of trade barriers in some products and locations.

Changes in regulation, subsidies, taxation,

e.g. related to climate policies

May distort markets, e.g. for energy or wood raw material.

May change relative competitiveness of energy forms.

May create additional competition for wood raw material.

UPM’s sensitivity to carbon pricing is presented on page 102.

Monitoring for early signals for regulation changes. Communicate

the impacts of such policies on employment and creation of value-

added clearly. Continuous improvement in competitiveness,

materials and energy efficiency. Leading environmental

performance. Innovation and selected investments in value added

renewable products and energy. Business portfolio development.

Sustainable forest management and UPM biodiversity programme.

May drive market growth for sustainable products and energy,

e.g. renewable fuels. Resource efficiency, circular economy and

renewability are increasingly important sources of competitive

advantage. In electricity markets, hydropower is an increasingly

important and competitive form of power generation. Increased

wood growth in northern hemisphere.

Availability and price of major production inputs

like wood, fibre, chemicals and water

Increased cost of raw materials and potential production

interruptions. UPM’s cost structure is presented on page 115

and sensitivity to water prices on page 102.

Continuously improving resource efficiency. Long-term supply

contracts and relying on alternate suppliers. Selected ownership

of forest land and long-term forest management contracts.

UPM’s continuous improvement in resource efficiency and circular

economy mitigate risks and offer competitive advantage.

Continuous improvement in competitiveness

OPERATIONS AND STRATEGY

Weakening relative competitiveness impacts profitability and

increases risks related to the external business environment

(above).

Programmes for savings in variable and fixed costs. Culture

and track record of continuous improvement in productivity

and resource efficiency. Product and service development.

Increasing relative competitiveness improves profitability and

mitigates risks related to the external business environment

(above).

Selection and execution of investment projects

Material cost overruns. Inopportune timing.

Return on investment does not meet targets.

Disciplined selection, planning, project management and

follow-up processes. Investing in projects with attractive returns

and sustainable competitive advantage.

Carefully selected and implemented growth projects improve

UPM’s profitability and ROCE. UPM’s financial targets are

presented on page 17.

OL3 nuclear plant project completion and start-up

Loss of profit and cost overruns. Inopportune timing.

Return on investment does not meet targets.

Ensuring that contractual obligations are met by both parties.

Arbitration proceedings have been initiated by both parties.

The investment provides a competitive, safe and CO

2

emission-free electricity supply for the long term.

Selection and execution of M&A

Cost of acquisition proves high and/or targets for strategic

fit and integration are not met. Return on investment does not

meet targets. Damage to reputation.

Disciplined acquisition preparation to ensure the strategic fit,

right valuation and effective integration. Environmental and social

impact assessments. Stakeholder engagement.

UPM’s strong balance sheet and cash flow enable value-

enhancing M&A when timing and opportunity are right.

Societal value creation.

Developing and commercialising innovations

and new businesses

Return on investment does not meet targets.

Lost opportunity.

Disciplined selection, development and commercialisation of

processes for innovations. Collaboration and partnerships in

R&D and commercialisation. Business model development.

Existing products and services redesigned to bring more value.

New value-added products to replace oil-based materials may

be a significant source of value creation and growth for UPM.

Compliance risks; competition law, anti-corruption,

human rights, securities regulation

Damage to reputation. Loss of business. Fines and damages.

May impact the value of the company.

Governance, compliance procedures, UPM Code of Conduct,

UPM Supplier and Third Party Code, audits, whistleblowing

channel, trainings.

Good governance mitigates risks and promotes best practices.

High responsibility standards and transparency are a

differentiating factor and create long term value.

Supply chain and third party reputation risks

Damage to reputation. Loss of business. Loss of competitive

position. May impact the value of the company.

UPM Code of Conduct, UPM Supplier and Third Party Code,

supplier audits, certification.

Good governance and responsible sourcing practices mitigate

risks and provide competitive advantage.

Environmental risks; a leak or spill due

to malfunction or human error

Damage to reputation. Sanctions. Direct costs to clean up

and repair potential damages to production plant. Loss of

production.

Best available techniques (BAT). Maintenance, internal control

and reports. Certified environmental management systems

(ISO 14001, EMAS).

Industry-leading environmental performance provides competitive

advantage, including efficiency gains.

Physical damage to the employees or property

Harm to employees and damage to reputation.

Damage to assets or loss of production.

One Safety system (p. 45). Loss prevention activities and systems.

Emergency and business continuity procedures.

Leading health and safety performance strengthens the brand

as an employer, as well as improving engagement, efficiency

and productivity.

Ability to retain and recruit skilled personnel

Business planning and execution impaired, affecting long-term

profitability

Competence development. Incentive schemes. Workplace safety.

Acting on employee engagement and management effectiveness.

Engaged high-performing people enable the implementation

of the Biofore strategy, as well as commercial success.

Availability and security of information systems

Interruptions in critical information systems cause a major

interruption to UPM’s business. Damage to reputation.

Loss of business.

Technical, physical and process improvements to mitigate

availability and security risks.

Sophisticated IT systems enable efficient operations, optimised

performance as well as new customer services and data security.

Strategy

Risks and

opportunities

The operating environment exposes UPM to a number of risks and opportunities.

Many of them arise from general economic activity and global megatrends

(see previous page). Execution of strategies exposes UPM and its business areas,

functions and production plants to a number of risks and opportunities.

PERFORMANCE

1

GROWTH

2

PORTFOLIO

3

INNOVATION

4

3 2 1

3 2 1

3 1

3 2 1

3 2 1

4 3 2 1

3 1

2

2

3

4 1

4 1

3 2 1

3 2 1

3 2 1

1

4 3 2 1

4 1

INFLUENCING TRENDS

CONTENTS