UPM Annual Report 2016

UPM Annual Report 2016

16

17

Businesses

Stakeholders

Governance

Accounts

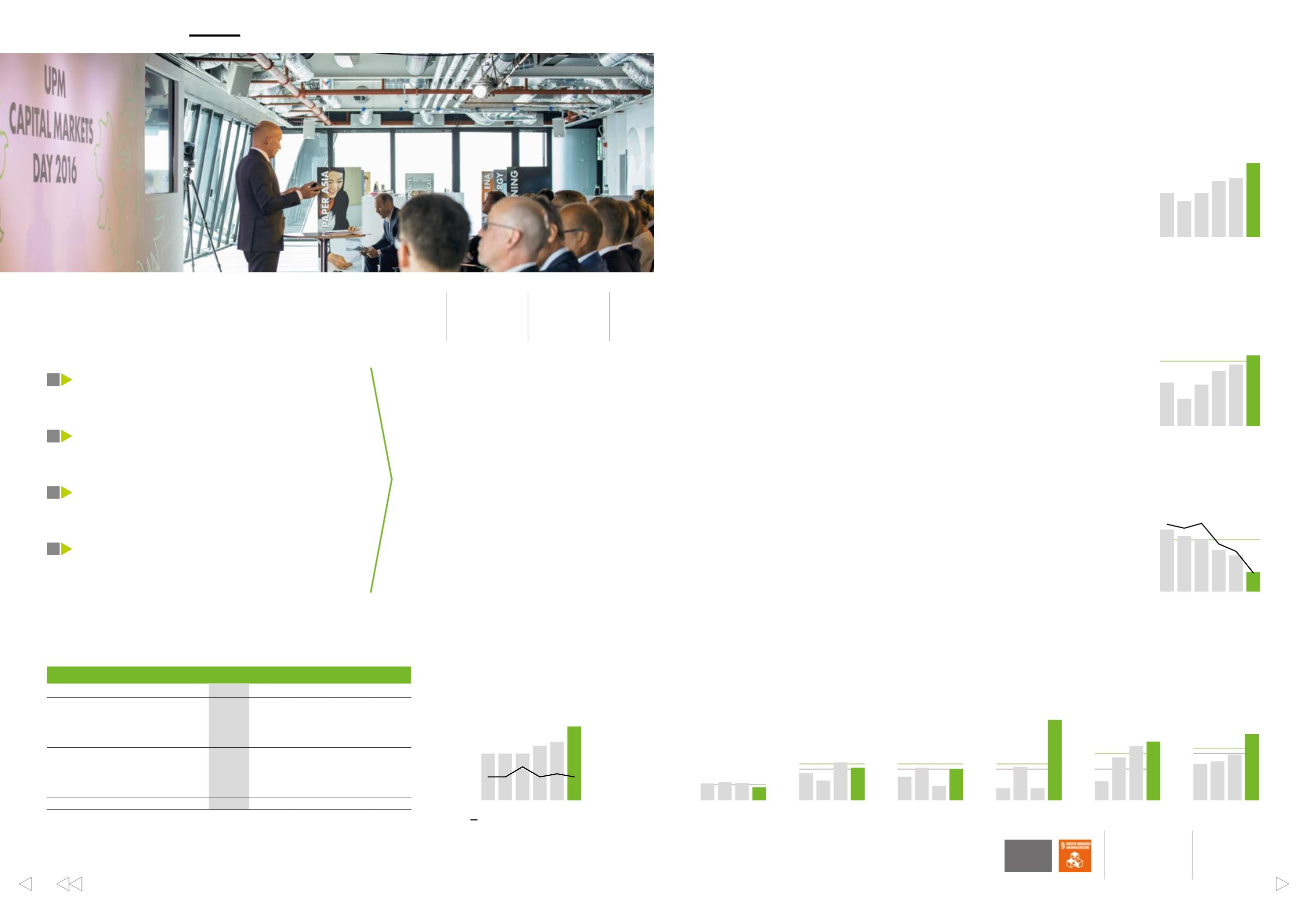

UPM renewed its long-term

financial targets

UPM as an investment

In brief

Strategy

IN THE NEW TARGETS:

•

the business area return targets and

the comparable ROE target have been

increased.

•

comparable EBIT growth has been

introduced as a new group-level target

•

a new financial policy on leverage based

on net debt/EBITDA has been introduced

•

the cash flow-based dividend policy

remains unchanged

Business area long-term return targets

increased

At the business area level, UPM targets top relative

performance in their respective markets compared

with key peers. UPMhas increased the long-term

return targets (below) for five of the six business

areas. The new return targets reflect UPM’s

increased ambition for business performance over

business and investment cycles.

Group earnings growth

On the group level, UPM introduced a new target.

UPM aims to grow its comparable EBIT over the

long term. In 2016, comparable EBIT increased by

25% to EUR 1,143 million (916 million).

UPM aims to grow its businesses with strong

long-term fundamentals. Earnings growth

is prioritised over top-line growth. UPMwill

invest in projects with attractive and sustainable

returns, supported by a clear competitive

advantage. The company also aims to capture

opportunities to develop its business and product

mix and further improve its cost competitiveness.

Efficient capital structure and

return on equity

UPM aims to maintain a strong balance sheet.

Investment grade rating is an important element

in UPM’s financing strategy. UPM’s new financial

policy on leverage is based on net debt/EBITDA

ratio of approximately 2 times or less. In 2016, net

debt/EBITDA was 0.73 times.

The previous maximum gearing limit of 90%

has been discontinued as redundant. At the end

of 2016, gearing ratio was 14%.

UPMhas increased its ROE target, now

aiming for a 10% return on equity. ROE also takes

into account the financing, taxation and capital

structure of the group. In 2016, comparable ROE

was 10.9%.

The previous target was variable: 5 percentage

points over a ten-year risk-free investment such

as the Finnish government’s euro-denominated

bonds. At the end of 2016, the minimum target for

return on equity, as defined above, was 5.3%.

UPM has achieved a clear improvement in the financial performance

since adopting the current business model of six separate businesses

in 2013. With renewed long-term financial targets, UPM aims higher.

5-YEAR SHARE PERFORMANCE AND VALUATION MULTIPLES

2016

2015 2014 2013 2012

Share price at 31 Dec, EUR

23.34

17.23 13.62 12.28 8.81

Comparable EPS, EUR

1)

1.65

1.38 1.20 0.91 0.74

Dividend per share, EUR

0.95

*)

0.75

0.70 0.60 0.60

Operating cash flow per share, EUR

3.16

2.22 2.33 1.39 1.98

Effective dividend yield, %

4.1

4.4

5.1

4.9

6.8

P/E ratio

14.1

10.0 14.2 19.5

neg.

P/BV ratio

2)

1.51

1.16 0.97 0.87 0.62

EV/EBITDA ratio

3

)

8.7

8.4

7.5

8.3

6.0

Market capitalisation, EUR million

12,452

9,192

7,266 6,497 4,633

*)

2016: Board’s proposal

1)

Comparable EPS for 2014-2016; EPS, excl. special items for 2012-2013

2)

P/BV ratio = Share price at 31.12./Equity per share

3)

EV/EBITDA ratio = (Market capitalisation + Net debt)/EBITDA

14 15 16

13

6.9 6.5

6.7

5.0

ROCE %*

)

UPM Energy***

)

*

)

ROCE % = Return of capital employed excluding items affecting comparability.

**

)

Free cash flow after investing activities (investments and/or divestments) and restructuring costs.

***

)

UPM Energy assets valued at fair value.

■

Long-term return target

■

Old target

14 15 16

13

7.6

10.6

14.6

12.6

ROCE %*

)

UPM Biorefining

■

Long-term return target

■

Old target

14 15 16

13

12.6

9.1

5.5

12.1

UPM Specialty Papers

■

Long-term return target

■

Old target

ROCE %*

)

14 15 16

13

12.9

4.6

4.7

31.0

FCF/CE %**

)

UPM Paper ENA

■

Long-term return target

■

Old target

14 15 16

13

16.5

7.3

20.9

22.6

UPM Plywood

ROCE %*

)

■

Long-term return target

■

Old target

14 15 16

13

15.0

14.1

17.6

25.5

UPM Raflatac

ROCE %*

)

■

Long-term return target

■

Old target

12 13 14 15 16

11

Comparable figures for

2014–2016, excluding special

items for earlier years

EURm

Comparable EBIT

1,200

1,000

800

600

400

200

0

Target: EBIT growth

12 13 14 15 16

11

4,500

3,750

3,000

2,250

1,500

750

0

3.0

2.5

2.0

1.5

1.0

0.5

0

■

Net debt

EBITDA (x)

EURm

Net debt and leverage

Policy:

≤

2x

16

12 13 14 15

11

1.0

0.8

0.6

0.4

0.2

0

100

80

60

40

20

0

% of operating cash flow

per share

%

EUR per share

Cash flow-based dividend

0.95

12 13 14 15 16

11

12

10

8

6

4

2

0

%

Comparable ROE

Target: 10%

2016

Comparable

return on equity

10.9%

Business area returns and long-term targets

Strong cash flow

enables focused growth invest

ments, focused M&A, new business development

as well as attractive dividends to UPM shareholders.

An industry-leading balance sheet

mitigates

risks and enables UPM to accelerate its business

portfolio transformation, when the opportunity

and timing are right.

Responsibility is good business:

Good governance,

industry-leading environmental performance,

responsible sourcing and a safe working environment

are important sources of competitive advantage.

Attractive dividend

UPM aims to pay an attractive

dividend, 30-40% of the company’s annual operating

cash flow per share.

UPM is committed to continuous improvement in

its financial, social and environmental performance.

At the business area level, UPM aims for top performance

in its respective markets compared with peers.

UPM invests to expand its businesses with strong long-term

fundamentals for growth and profitability. The company has

clear long-term return targets for its businesses. Earnings

growth is prioritised over top-line growth.

1

PERFORMANCE

3

PORTFOLIO

2

GROWTH

4

INNOVATION

UPM AIMS TO INCREASE LONG-TERM SHAREHOLDER VALUE

UPM’s expertise in renewable and recyclable materials,

low-emission energy and resource efficiency is the key to

developing new, sustainable businesses with high added

value and unique competitive advantage.

Increasing the share of attractive growth businesses

improves the company’s long-term profitability and

boosts the value of the shares.

Dividend proposal

+27%

Share price 2016

+35%

CONTENTS