8

MODERN MINING

August 2016

MINING News

Groundwater inflow impedes Tschudi production

Weatherly International, listed on AIM,

says that production from its Tschudi cop-

per project in northern Namibia was 3 812

tonnes of copper cathode in the quarter

ended 30 June 2016.

This was a decrease from the previous

quarter, with Weatherly attributing this to

increased groundwater inflow rates being

experienced at levels which exceed those

anticipated in the BFS. As a result, it has

been necessary to design, procure and

commission additional groundwater man-

agement systems and infrastructure whilst

engaging additional Namibian and inter-

national specialist consulting expertise to

assist with this process.

C1 costs for Tschudi for the quarter were

US$4 689 per tonne, increasing due to the

reduced production and actions taken to

manage the groundwater inflow. Weatherly

says that C1 costs for the nine months from

1 October 2015 to 30 June 2016 – since

Tschudi has been in commercial production

– remained below guidance at US$4 199

per tonne.

Production of 17 000 tonnes of copper

cathode is expected to be achieved for the

year ending 30 June 2017 with forecast C1

unit costs expected to be in the range of

US$4 100-4 200 per tonne.

Craig Thomas, CEO of Weatherly, com-

mented: “The Tschudi operations have

been hampered during the quarter by

groundwater inflows significantly higher

than predicted during the feasibility

study. Expertise and equipment have

been procured to resolve the issue and full

production rates are expected to resume

before the end of the 2016 calendar year.”

The leaching behaviour of ore placed

on the heap continues to be as expected

in terms of both leaching rates and acid

consumption. The solvent extraction and

electro-winning plants continue to perform

well, and have demonstrated the ability to

produce at 1 500 tonnes per month when

sufficient copper in solution is available

from the heap.

Asanko Gold Inc, listed on the TSX and

NYSE MKT, has announced production

results for the second quarter 2016 from

Phase 1 of the Asanko Gold Mine (AGM),

located in Ghana.

Commercial production was declared on

April 1, 2016and rampup to steady-statepro-

duction of both the mining and processing

operations was achieved by the end of Q2.

Mining operations continued exclu-

sively in the Nkran pit where bulk mining

of the periphery of the main ore zones was

undertaken to open up access to the main

orebody by the end of Q2. This objective

was achieved in the quarter with 5,8 Mt of

waste removed from the pit and 1,2 Mt of

ore mined at a strip ratio of 4,7:1. As antici-

pated, the bulk mining resulted in higher

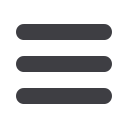

The processing plant at Asanko, seen here, processed 702 318 tonnes of ore at an average grade of 1,69 g/t during the quarter (photo: Asanko).

Asanko Gold Mine delivers a strong quarter

levels of dilution and gold losses than are

expected at steady state, resulting in an

average grade of mined ore of 1,48 g/t gold.

According to Asanko, mining efficien-

cies are showing signs of improvement

as a result of receiving part of a new min-

ing contractor fleet during the quarter to

replace the second-hand fleet that started

the pre-strip in 2015. A Cat 992 FEL, a