6

MODERN MINING

August 2016

MINING News

In its interim results for the six months

(H1 2016) and three months (Q2 2016)

ended 30 June 2016, LSE-listed Acacia

Mining, Tanzania’s largest gold producer,

has reported gold production of 412 025

ounces, 12 % higher than in H1 2015. The

AISC for the six-month period was US$941

per ounce sold, which was 17 % lower

than in the equivalent period last year. Q2

gold production was 221 815 ounces, 19 %

higher than in Q2 2015.

“We are pleased that, through continu-

ing optimisation, our assets are starting to

deliver performance which reflects their

potential and as a result increased our

net cash position by US$47 million in the

second quarter,” comments Brad Gordon,

Acacia’s CEO. “Strong production of

221 815 ounces aided a further reduction

in All-in Sustaining Cost (AISC) to US$926

per ounce, even after US$72 per ounce of

cost due to the impact of the strong share

price on the valuation of future share-

based payments to employees.

“The transition to underground min-

ing at North Mara continues to deliver

ahead of expectations with high grades at

Gokona supporting production of 100 016

ounces in the quarter. Bulyanhulu again

produced above plan, delivering 78 643

ounces, although a planned two-week

shaft closure for maintenance in August

and a move back towards reserve grade

will reduce output in Q3.”

Looking ahead, Gordon says Acacia is

now expecting to deliver at or above the

upper end of full year production guidance

of 750-780 000 ounces, and at the lower

end of AISC guidance of US$950-980 per

ounce.

The North Mara mine produced

100 016 ounces in Q2 2016, 50 % higher

than in Q2 2015 and 34 % higher than Q1

2016, driven by higher grade ore than plan

from the Gokona Underground resulting

from positive grade reconciliations and

the processing of higher grade open-pit

material. Total open-pit tonnes mined

increased by 23 % fromQ2 2015, driven by

waste stripping in the Nyabirama pit. Cash

cost per ounce sold of US$382 was 37 %

lower than in Q2 2015, mainly driven by

the higher production base, higher capi-

talised development costs due to waste

stripping at the Nyabirama pit and lower

labour costs due to reductions in head

count, partly offset by higher sales related

costs as a result of higher sales volumes.

Bulyanhulu produced 78 643 ounces,

10 % higher than for the same period

in Q2 2015 and in line with Q1 2016.

Ounces produced from underground

mining amounted to 70 307 ounces, a

17 % improvement on Q2 2015 due to an

increase in throughput and grade, while

production from the reprocessing of tail-

ings amounted to 8 336 ounces. During

the quarter, 236 000 tonnes of ore were

hoisted while 251 000 tonnes of run-of-

mine ore were processed, 10 % higher than

in Q2 2015 while grade increased by 5 %

to 9,6 g/t.

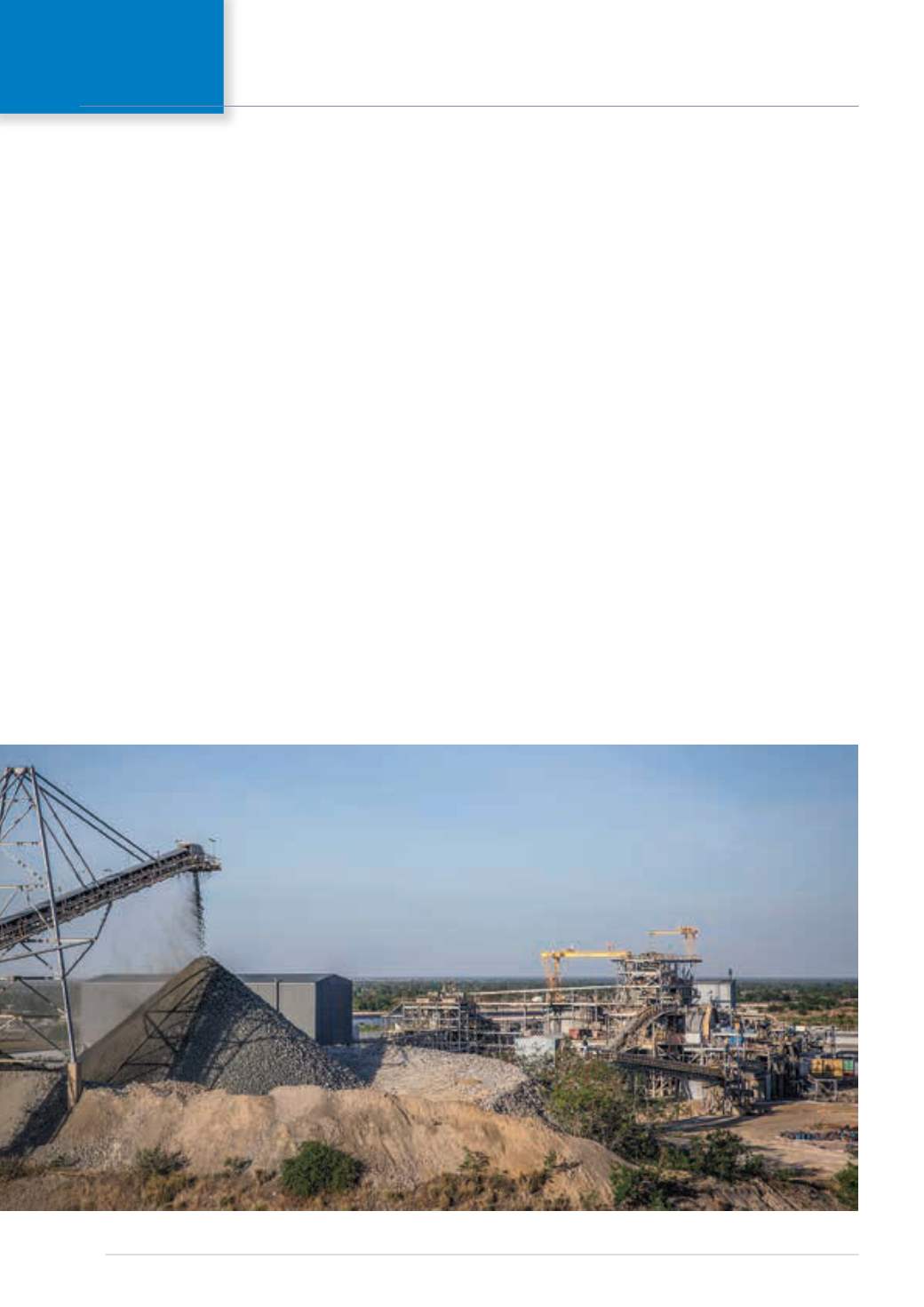

At Buzwagi, gold production for the

quarter of 43 156 ounces was 10 % lower

than Q2 2015, but 16 % ahead of Q1 2016.

Total tonnes mined decreased by 18 %

from Q2 2015 while ore tonnes mined

were in line with the prior year. Cash cost

per ounce sold of US$948 was 2 % higher

than Q2 2015. This was mainly due to the

lower production base, partly offset by

a fall in energy and fuel costs driven by

lower global fuel prices and reduced diesel

usage, lower general and administrative

expenses as a result of lower freight costs

and lower labour costs driven by head-

count reductions.

Acacia’s Tanzanian gold mines performing strongly

Acacia’s Buzwagi mine is an open-pit operation commissioned in 2009. It produced 43 156 ounces in Q2 2016 (photo: Acacia Mining).