10

MODERN MINING

August 2016

MINING News

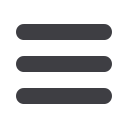

AIM-quoted Firestone Diamonds reports

that construction of its Liqhobong mine in

Lesotho was 85 % complete as at the end

of June 2016, ahead of the revised target of

81 %, with the plant 18 % commissioned,

also ahead of target. The project’s zero lost

time injury record has been maintained,

with approximately 2,6 million man hours

now having been worked.

Initial production is now expected in

early Q4 2016. The revised capital budget

of R2,1 billion remains within the original

project budget of US$185,4 million.

The remaining 15 % of the project

relates to the continued completion of

the final equipment installation together

with the installation of the electrical and

control cabling.

Liqhobong has fully harvested its water

requirements for its first year of produc-

tion, with in excess of 400 000 m

3

of water

on site.

Currently Firestone’s total workforce at

Liqhobong stands at 779, which includes

both employees and contractors. The oper-

ational staffing of the mine is progressing

well with all senior positions filled and the

remaining required positions to be com-

pleted prior to the start of production

ramp-up.

Once initial production has started,

Firestone anticipates that the ramp up pro-

Construction work on the main plant terrace at Liqhobong (photo: Firestone Diamonds).

Liqhobong diamond mine speeds towards completion

cess to full nameplate capacity – 3,6 Mt/a

or 500 t/h to recover up to 1 million carats

per annum – will take at least six months.

During commissioning, ore from mixed

low grade stockpiles and diluted ore from

the main pit will be processed through the

plant. The variability of this ore will influ-

ence the recovery of run of mine carats.

Firestone expects to treat between

1,8 and 2,0 Mt of ore during the financial

year ending June 2017. Within this period,

it is estimated that between 380 000

and 450 000 carats will be produced at

Liqhobong. Costs are projected to be in

the region of US$12 to US$14 per tonne

processed.

Comments Stuart Brown, Firestone’s

CEO: “I am pleased to report that construc-

tion activities at the Liqhobong diamond

mine have continued to progress well over

the last quarter. As at the end of June, con-

struction was ahead of schedule and initial

production is now expected in early Q4

2016. The company remains fully financed

throughout its ramp-up period and expects

to host its first diamond sale in January 2017.

“The excitement and momentum is

building nicely and we are looking for-

ward to the recovery of our first carats in

Q4 2016.”

Acacia accelerates buy-in to Kenyan project

LSE-listed Acacia Mining – which oper-

ates three gold mines in Tanzania – says it

is continuing to enhance and expand its

exploration portfolio through an agree-

ment to accelerate the earn-in on the West

Kenya Joint Venture licences in Kenya.

Acacia has agreed to increase its owner-

ship from 51 % to 100 % in the two licences

covering the majority of the West Kenya

project area from a subsidiary of Lonmin

plc for a consideration of US$5 million.

Following the completion of the agree-

ment, Acacia has full exposure to what it

describes as “an exciting and highly pro-

spective land package” in Kenya, including

its most advanced project, the Liranda

Corridor.

Acacia reports that it continues to

intersect high grade gold zones at the

Bushiangala and Acacia prospects along the

Liranda Corridor where drilling is indicating

the potential for a new gold camp.